Analysts Identify Signs of a Healthy Bitcoin Rally

The twice-observed price pullback of the leading cryptocurrency since 2024, following a surge in trading volume and funding rates, reflects a healthy bull market, according to a report by CryptoQuant.

Currently, the approach of prices to the ATH is not accompanied by increased speculation among bulls in derivatives and trading volumes on spot platforms, which does not indicate a weakening of the upward momentum, experts assert.

In their view, unlike the two previous episodes, the market now “remains light and cautious.”

“Buyer sentiment remains favorable for further growth, indicating that it is not yet time to consider cashing out. On-chain signals and market data are very constructive,” the review states.

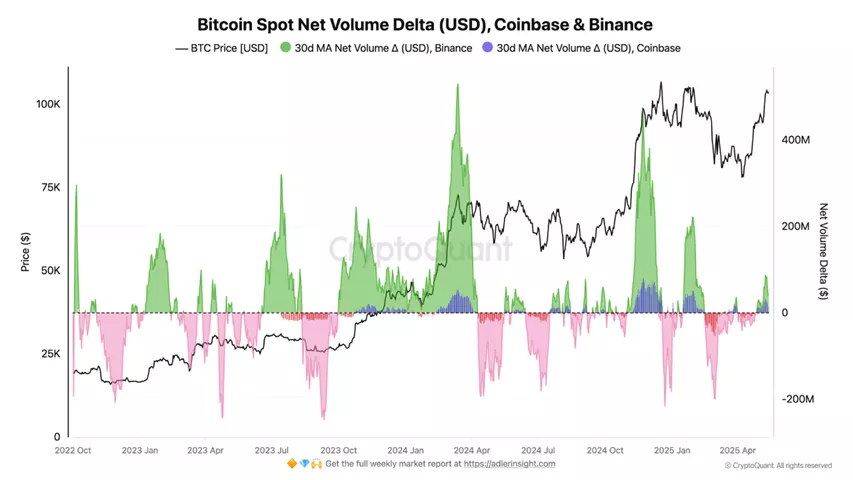

Positive Delta

Specialists specifically noted that the delta of spot trading volume on Binance has turned positive. In other words, buying activity has increased while selling pressure has weakened — and this is happening against the backdrop of surpassing the $100,000 mark.

Is a Spring Unwinding Soon?

CryptoQuant also pointed to a favorable technical picture. On the daily chart, price compression is observed — the third time in the current bull run. Experts explained that a similar situation preceded the 2018 rally.

On the daily timeframe, compression is building up again — the third instance in this bull cycle. A similar pattern of three compressions preceded the 2018 rally. Very soon, we’ll see just how tightly the spring has been coiled this time. pic.twitter.com/wy6KAJQ560

— Axel ?? Adler Jr (@AxelAdlerJr) May 20, 2025

Ethereum Overheating

In the second-largest cryptocurrency by market capitalization, conditions have formed for profit-taking. As it approaches the psychological level of $2500, a sharp increase in trading volume associated with the closing of long positions has been recorded.

Ethereum Market Overheats: Potential Short-Term Correction Before Breakout

“Ethereum’s approach to the critical $2.5K resistance level has led to overheating, characterised by a significant surge in trading volume… primarily driven by profit-taking.” – By @ShayanBTC7 pic.twitter.com/CYLPGAdU9Y

— CryptoQuant.com (@cryptoquant_com) May 20, 2025

Analysts expect the asset’s consolidation phase to continue until a new wave of demand forms, leading to a breakout above the specified level.

Back on May 9, Ethereum prices momentarily rose by 18.8%, reaching levels above $2300. The driver could have been the activation of the Pectra hard fork.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!