Analysts Point to Signs of Continued Bitcoin Rally

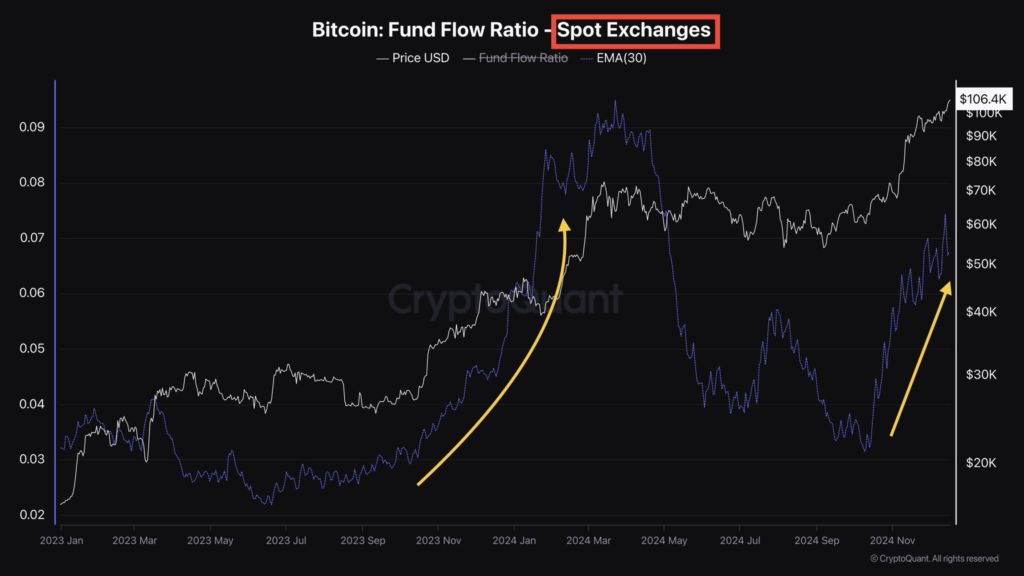

The price of Bitcoin is expected to continue its ascent, driven by momentum from the spot market, where buyer pressure is gaining strength. This conclusion was reached by a CryptoQuant author known as Avocado_onchain.

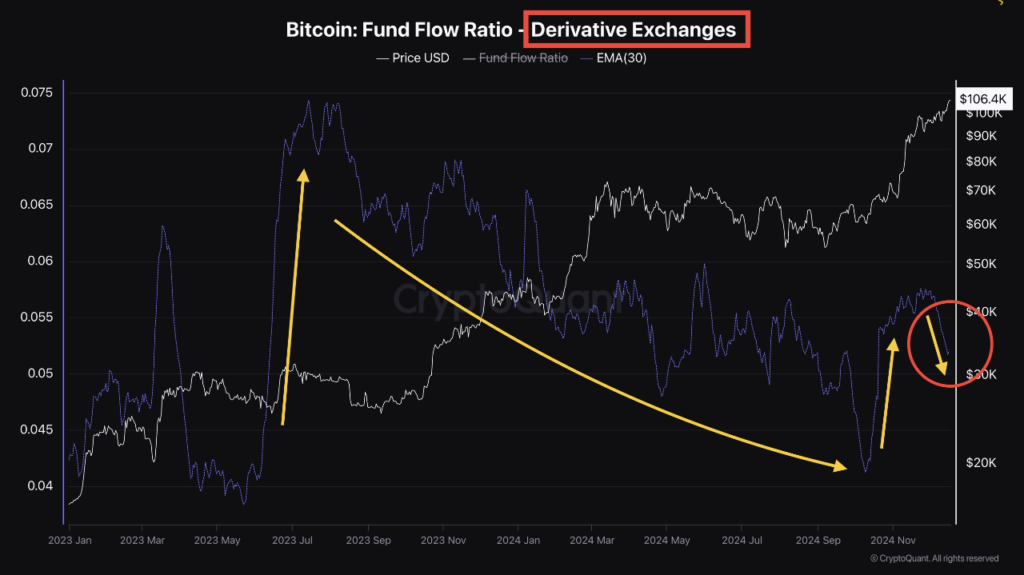

The previous bullish cycle of the cryptocurrency, which began in the first half of 2023, was initially fueled by the futures market. The subsequent surge in spot activity further stimulated growth, noted the analyst.

Since March 2024, both segments experienced a multi-month period of declining activity, but from October, trading volumes began to rise simultaneously. This led Bitcoin to reach new highs.

“While activity in the futures market has decreased, demand in the spot market continues to grow. This indicates that speculative excess in derivatives is cooling, while buyer pressure in the spot market is gaining strength,” the expert continued.

He further expects the futures segment to repeat cycles of overheating/liquidation, which will stimulate the growth of digital gold’s price. This price movement, in turn, will attract fresh capital to the spot market.

“Analyzing the funding rate (30 EMA), there are no visible signs of late-cycle overheating. This suggests that Bitcoin’s upward trajectory is likely to continue with significant room for further growth,” the analyst emphasized.

A crypto trader with the pseudonym Mister Crypto also believes that Bitcoin’s funding rates are “not overheated yet.” In his view, the rates will continue to rise towards 1%.

The #Bitcoin funding rates are still not overheated at all.

We will push higher as long as they will not reach 1%. pic.twitter.com/WK3C47HVdS

— Mister Crypto (@misterrcrypto) December 17, 2024

Analyst Rekt Capital is confident that Bitcoin’s parabolic growth phase is just beginning. Historically, such periods have lasted about 300 days, and currently, only 41 days have passed, he believes.

#BTC has only just begun its Parabolic Phase in the cycle

Historically, this phase has lasted on average ~300 days

Bitcoin is only on Day 41 of its Parabolic Phase$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) December 17, 2024

CryptoQuant analyst Burak Kesmeci expressed a similar opinion.

Bitcoin’de bu boğa rallisinin zirvesini (107K) gördük mü?

Cevabım çok net şekilde, HAYIR!

1⃣Önce Veri

Bir çok döngüsel analize dayalı on-chain veri bize henüz tepeyi görmediğimizi işaret ediyor.

Bir kaç tane örnek vermek gerekirse MVRV, Pi Cycle Top, Golden Ratio ve NUPL…… pic.twitter.com/cH3gOVO5cH

— Burak Kesmeci (@burak_kesmeci) December 17, 2024

“Have we seen the peak of this Bitcoin bull rally? My answer is unequivocally, NO!” he stated.

According to him, the Pi Cycle Top indicator suggests we are in the early stages. Prices have increased by “only” 50% relative to the previous peak, and Kesmeci expects further growth of another 29%. This implies the cryptocurrency will reach $129,000.

The analyst noted that a significant factor was breaking the psychological barrier of $100,000, which is now “behind us.”

At the time of writing, digital gold has corrected from the historical high reached the day before at levels above $108,000. The asset is trading around $104,100, having decreased by 2.4% over the day.

Earlier, Bitfinex specialists predicted the peak of Bitcoin’s bull market in the third to fourth quarters of 2025 with a target price of $200,000. Bitwise also mentioned this level.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!