Analysts report continued ‘hangover’ among Bitcoin investors.

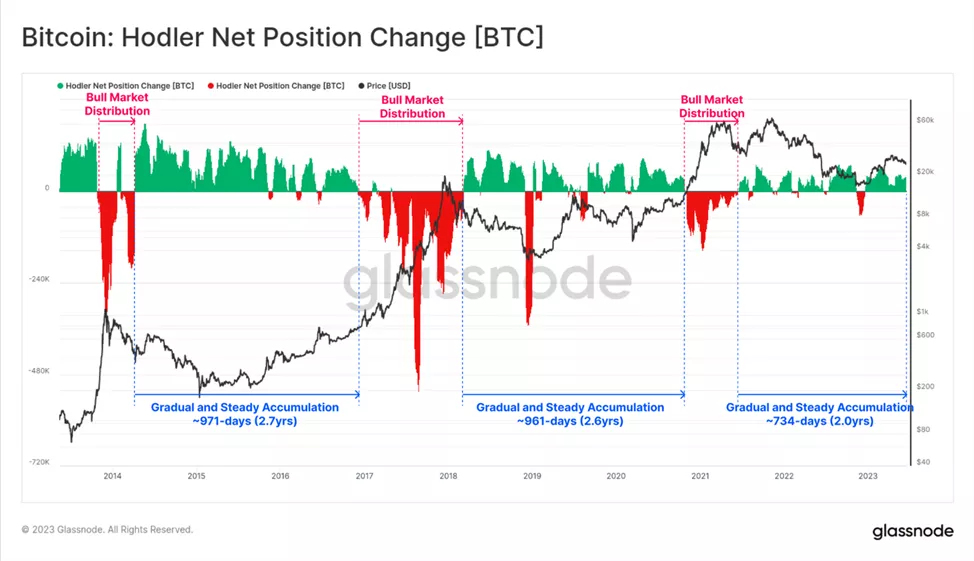

By most measures of market activity, the excitement among Bitcoin investors gives way to apathy. In anticipation of halving, hodlers continue to accumulate coins, according to Glassnode.

#Bitcoin is quiet, volumes are down, and it is pretty clear we are in the hangover apathy phase.

But look under the surface.

What are the highest conviction holders doing?

What are the fundamental supply dynamics?

Latest analysis hot off the press.https://t.co/Y4sfE2W63e

— _Checkɱate ?⚡?☢️?️ (@_Checkmatey_) June 19, 2023

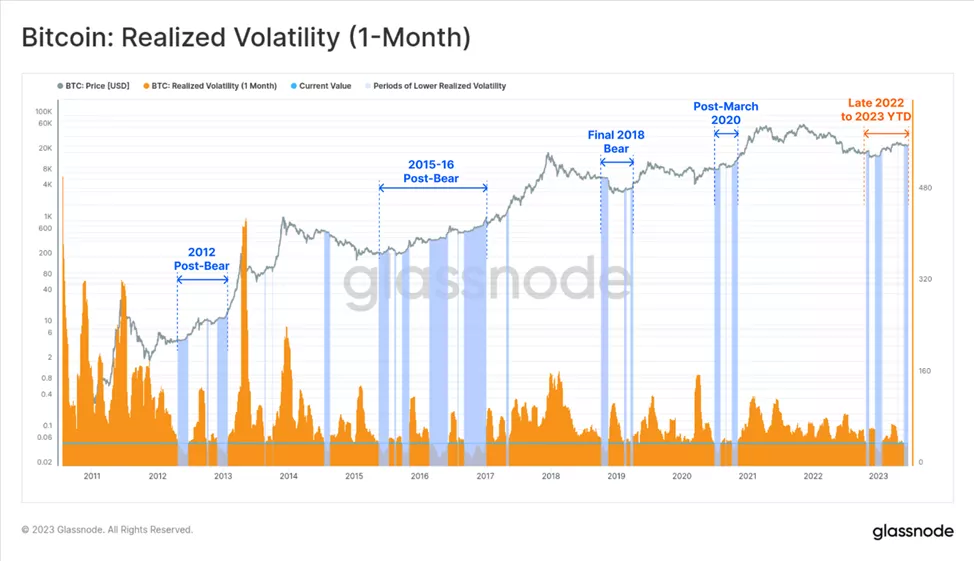

The situation is well characterized by the drop in realized volatility on a monthly basis to the lows of the 2021 bull phase.

Analysts explained that such events usually occur during a prolonged sideways movement, when the market gets back on its feet after a prolonged bear trend.

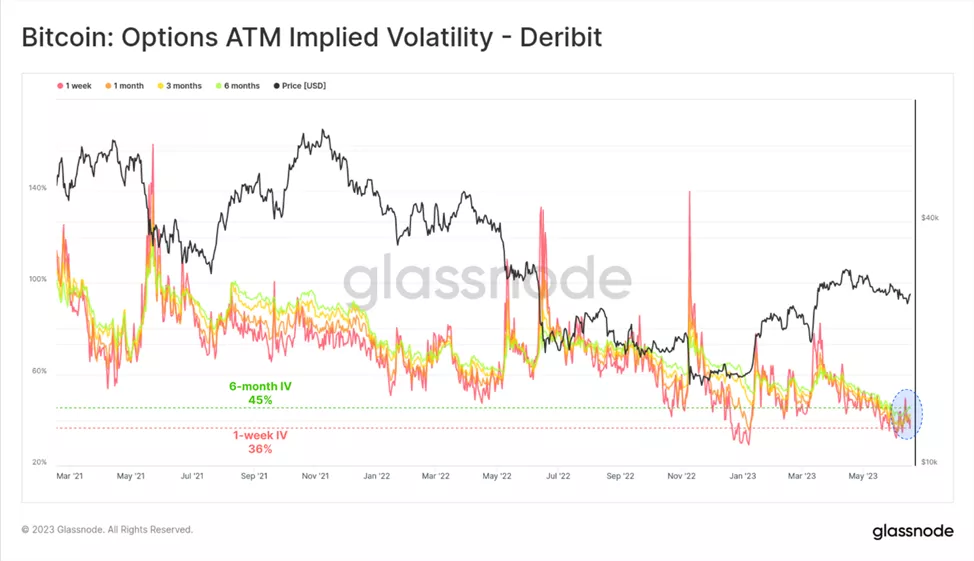

A similar picture is seen in the futures market, where daily trading volume has dried up to $20.9 billion. Implied volatility of Bitcoin options with various expiries has fallen to levels near cyclical lows.

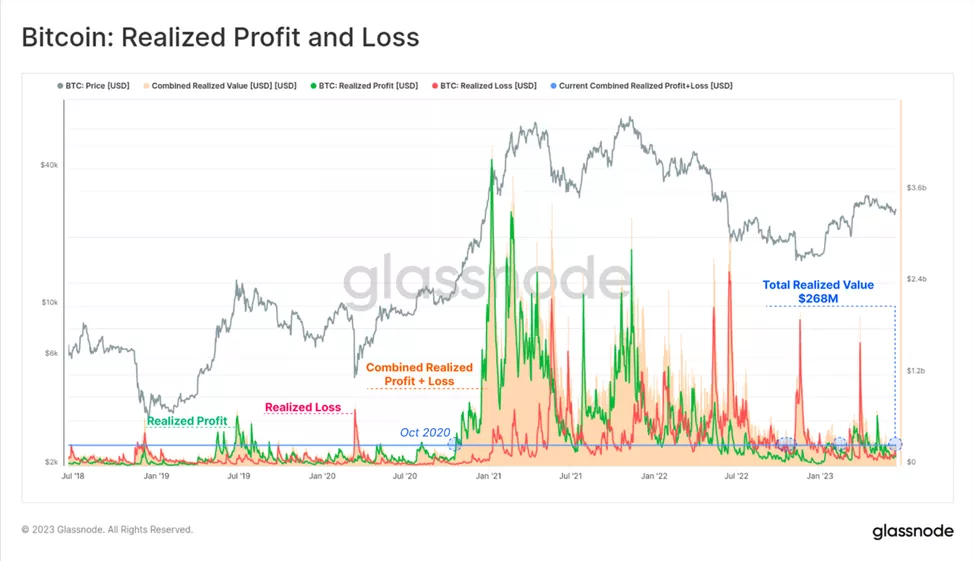

On-chain indicators confirm the prevailing trend. The aggregate volume of realized profits and losses has fallen to levels seen in 2020, when digital gold was valued at $10 000.

«This shows how quiet the capital flows into and out of this asset class have been today», the experts noted.

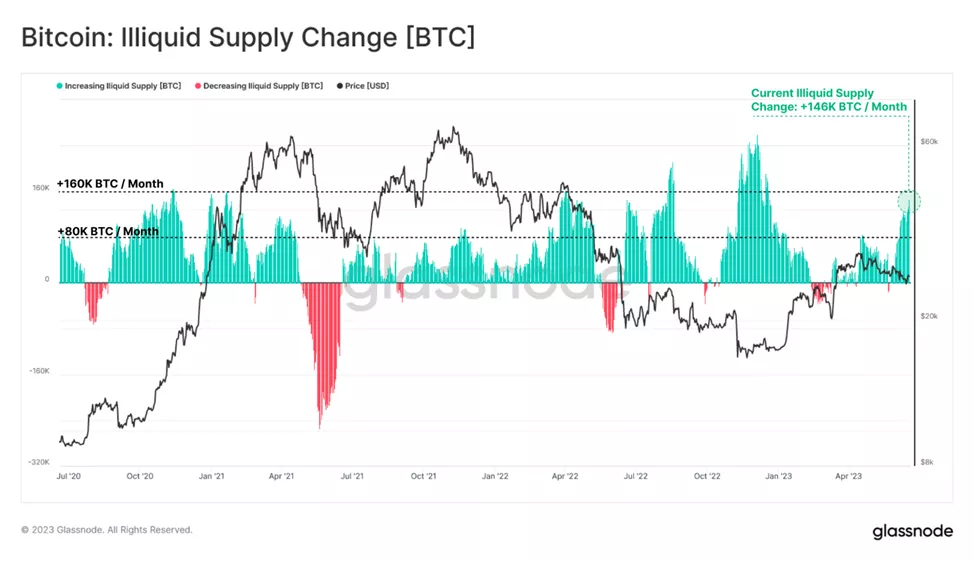

Monthly pace of hodlers accumulating coins reached 42 200 BTC. Analysts noted that this regime started a little over two years ago and, if previous cycles repeat, could last another 6 to 12 months.

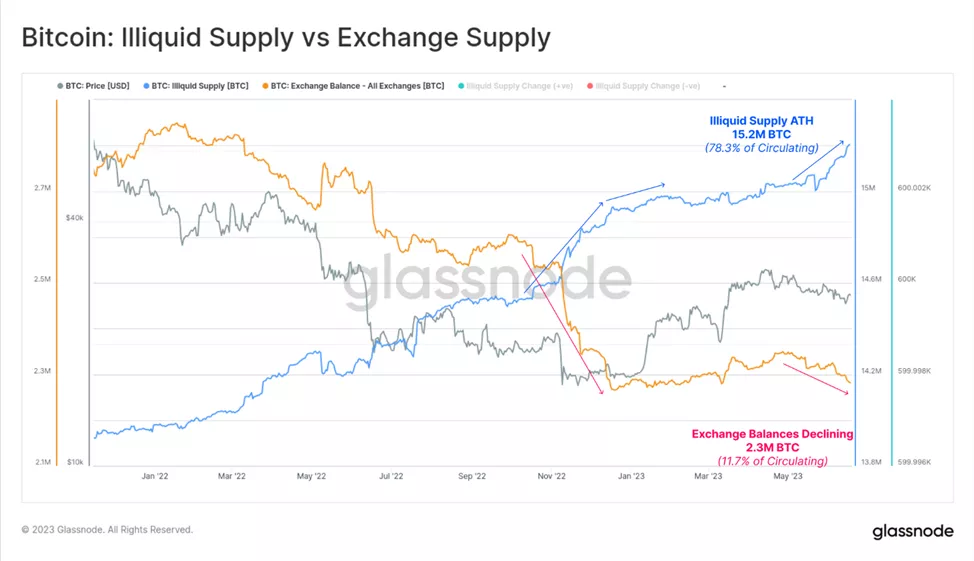

The previous observation is confirmed by the divergence between exchange balances trends and the volume of coins stored in illiquid wallets (with an actual lack of spending history).

The latest figure reached a new level of 15.2 million BTC (78.3% of supply), the first fell to a minimum since January 2018 (2.3 million BTC, 11.7% of supply).

Monthly pace of hodlers accumulating coins reached 146 000 BTC.

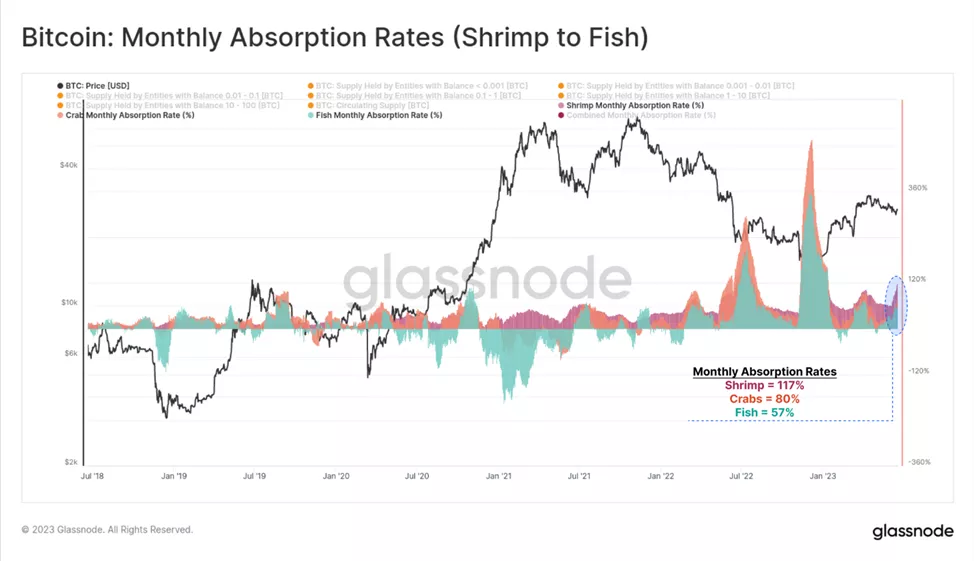

More granular picture is provided by the composition of accumulation across different investor categories. High activity in accumulation mode is shown by “shrimp,” “crabs” and “fish” (balances up to 100 BTC). Over the last month, these market participants collectively topped up wallets 2.54x faster than coins mined by miners.

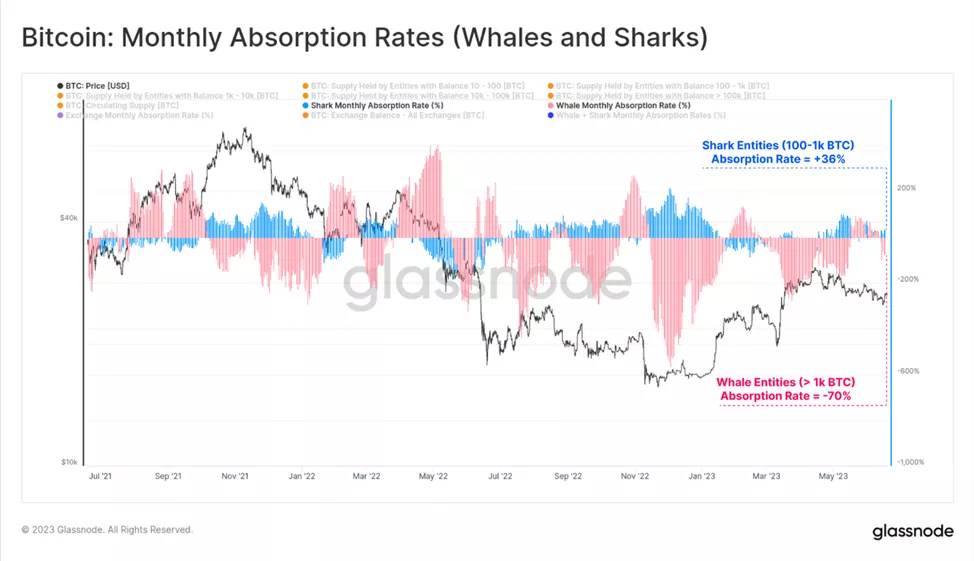

Whales (over 1000 BTC) sold the equivalent of 70% of issued Bitcoin. Purchases by “sharks” (from 100 to 1000 BTC) were estimated at 36% of the increased supply.

«The market appears to be in a period of “calm” accumulation. This suggests weak demand, despite regulatory pressure in recent times», the experts noted.

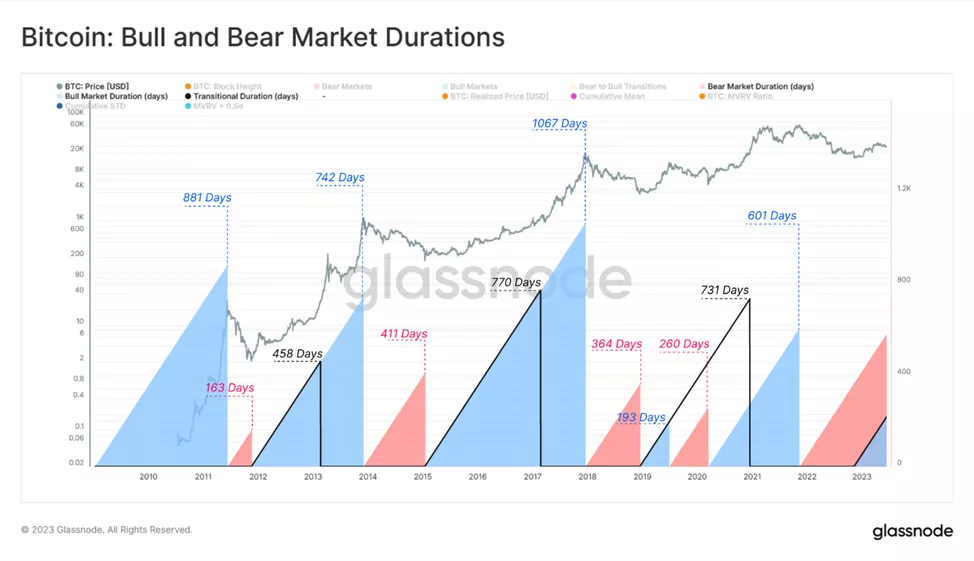

Evaluating the duration of previous accumulation phases, analysts allowed that a return to historical highs could occur in 8-18 months. In total such periods lasted from 459 to 770 days. The “age” of the current one has reached 221 days, they calculated.

CoinShares noted investors’ caution in the crypto market amid uncertainty about the end of the US Federal Reserve’s monetary tightening cycle.

Earlier, former chairman of the CFTC Tim Massad stated, that the future of digital assets depends on the outcomes of the lawsuits SEC against Binance and Coinbase.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!