Analysts set out conditions for Ethereum to reach $4,000

ETH must clear $3,800–$3,900 to aim for fresh highs, analysts say.

The price of the second-largest cryptocurrency has recovered to about $3,500. The asset must clear the $3,800–$3,900 area to pursue new highs, according to analyst Michaël van de Poppe.

Technically speaking, $ETH is in accumulation land.

It needs to bereak the $3,800-3,900 area and then we’re off towards new ATHs.

Overall, it’s still 20-30% to go before we’re back to the levels before October 10th.

Things take time. pic.twitter.com/rl4UxB9kL2

— Michaël van de Poppe (@CryptoMichNL) November 11, 2025

Investor Ted Pillows noted that Ethereum tried to hold above $3,700 but ultimately slipped. If the coin can reclaim that level, the next target is the $4,000–$4,100 area.

$ETH failed to reclaim the $3,700 level and is now going down.

There’s some strong support for Ethereum around $3,400 which could get retested.

In case ETH is able to reclaim the $3,700 level, it’ll tap the $4,000-$4,100 liquidity zone. pic.twitter.com/R2TmxklLvD

— Ted (@TedPillows) November 11, 2025

Trader Crypto-ROD pointed to the same level.

Analyst Jelle said the asset’s next move depends on bulls, who “need to step in” for Ethereum.

Bulls really need to step in for $ETH as well.

Lose current area too and we have a disgusting deviation on our hands.

The sooner we get back above 4k, the better. pic.twitter.com/XQ3iRupumE

— Jelle (@CryptoJelleNL) November 11, 2025

“If we lose the current area as well, we will get an extremely unpleasant deviation. The sooner we get back above $4,000, the better,” he wrote.

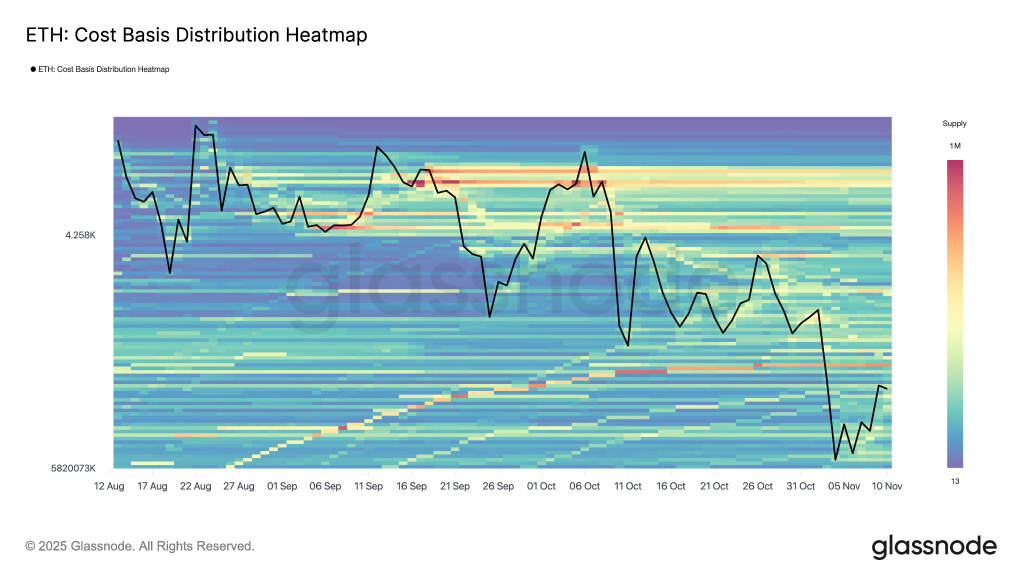

Investors currently hold about 4.2 million ETH bought at an average cost between $3,600 and $3,815. Those levels have formed a potential resistance zone. If market participants sell near breakeven, it could slow Ethereum’s upward momentum.

At the time of writing, the second-largest cryptocurrency trades around $3,550, down 1.4% over the past 24 hours.

A potential catalyst

Ethereum balances on the largest crypto exchange, Binance, have fallen to their lowest since last May, noted CryptoQuant contributor Arab_Chain.

Ethereum Exchange Supply on Binance Falls to Its Lowest Level Since Last May

“Overall, current indicators reflect a transitional phase in the Ethereum market, where investors appear to be accumulating and holding.” – By @ArabxChain

Read more ⤵️https://t.co/zwIkpf5Yh1 pic.twitter.com/vNLCJQyuIl

— CryptoQuant.com (@cryptoquant_com) November 11, 2025

The ratio of the asset’s available supply on the platform has reached 0.0327, extending a downtrend that began mid-year. Peaks were seen in June–July, followed by a sharp contraction in November.

Falling exchange balances of Ethereum are traditionally viewed as a medium-term bullish signal: fewer coins available to sell reduces market pressure.

The move coincided with a pullback from the August–September highs at $4,500–$5,000 to around $3,500. According to Arab_Chain, this indicates a shift from profit-taking to accumulation.

“If the current trend of declining Ethereum supply on Binance continues, we may see a reduction in liquidity available for sale. This would support potential price stabilization and a possible return to an uptrend as risk appetite improves,” the expert stressed.

However, he warned that persistently weak demand and lower on-chain activity could usher in a sideways market or a short-term drop.

Leon Waidmann, head of research at Onchain Foundation, added that about 10% of Ethereum’s total supply remains on exchanges.

Ethereum is now more scarce on centralized exchanges than Bitcoin! 🔥

Only ~10% of ETH’s total supply remains on exchanges — compared to ~14% for BTC.

This is a massive structural shift showing how much ETH has moved into staking, DeFi, and long-term custody.

Less ETH on… pic.twitter.com/DAyTCjJLzh

— Leon Waidmann 🔥 (@LeonWaidmann) November 11, 2025

“This is a massive structural shift showing how much ETH has moved into staking, DeFi and long-term custody. […] Such scarcity creates fundamental support for price growth in the long term,” the analyst said.

Earlier, the expert ShayanMarkets pointed out the return of whales to the Ethereum market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!