Analysts Spot Signs of Recovery in Bitcoin’s Spot Market

Glassnode says bitcoin’s spot market is healing as volumes rise and sellers retreat.

Glassnode analysts report an improving backdrop in the spot market for the leading cryptocurrency. Trading volumes are rising and selling pressure is easing.

$BTC has pulled back from recent highs of $98K, slipping back into the low-$90Ks. Momentum has cooled but remains above neutral, pointing to consolidation rather than trend deterioration.

Read more in this week’s Market Pulse👇https://t.co/SqtQrQ3D8C pic.twitter.com/Z5ONm7bXM2

— glassnode (@glassnode) January 19, 2026

The firm recorded a “modest” pickup in trading activity. The imbalance between buys and sells pierced the upper statistical band. That signals a shrinking supply of coins, even as demand remains “fragile and uneven.”

Specialists reckon the market is consolidating and gradually reconfiguring. Underlying conditions are improving despite traders’ continued defensiveness.

OKX’s Singapore CEO Gracy Lin said the market has already “digested” the late-2025 profit-taking. Long-term holders are not selling every bounce, and institutions are buying dips via ETF.

Amid headlines about tariffs and record gold prices, investors are increasingly using bitcoin to hedge portfolios rather than for short-term speculation, Lin added.

Swissblock compared the current set-up with 2022. Declining network activity and liquidity resemble the prior cycle’s conditions.

Network growth has hit lows not seen since 2022, while liquidity continues to drain. Back in 2022, similar network levels triggered a $BTC consolidation phase as network growth began to recover, even while liquidity remained weak and bottoming out.

History shows that the… pic.twitter.com/24sC3aoyAD

— Swissblock (@swissblock__) January 19, 2026

According to the analysts, history shows that a recovery in these metrics has previously set off large bull rallies.

At the time of writing, the price of the leading cryptocurrency is $91,142.

A 2% daily decline triggered $335 million in liquidations.

Losses and a slide in sentiment

CryptoQuant’s head of research, Julio Moreno, noted a key shift in investor behaviour. For the first time since October 2023, bitcoin holders are realizing net losses on a 30-day basis (a trend in place since late December).

Bitcoin holders realizing losses, for a 30-day period since, late December for the first time since October 2023. pic.twitter.com/OGsPYm8714

— Julio Moreno (@jjcmoreno) January 20, 2026

Researcher Axel Adler Jr. recorded a drop in the sentiment index from an extreme 80% to 44.9%. Earlier, around the local high at $97,000, the gauge was in overheated territory.

A move below the neutral 50% mark signals waning risk appetite. In his view, a return above that level is needed to stabilise prices. A further slide toward 20% would increase the likelihood of a deep correction.

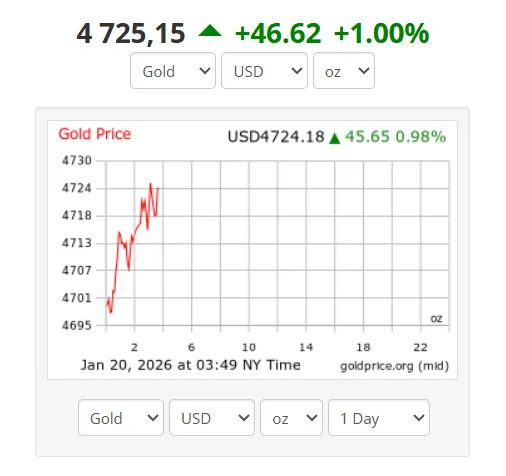

Gold hits fresh records

Amid pressure on digital assets, gold crossed $4,700 per ounce for the first time. US futures on the metal also set new records.

Silver reached a new all-time high of $95.

The rally in precious metals was spurred by worsening global sentiment after US President Donald Trump threatened to impose new tariffs against European allies if Denmark refused to sell Greenland.

According to Bitfinex, the bitcoin-to-gold ratio has fallen by more than 50% from its peak.

Gold just made an ATH of $4700/oz

This means the $BTC/Gold ratio is down 52% from ATHs.

Last time we were here, BTC went on to outperform gold.

Worth watching this cross as 2026 liquidity builds. pic.twitter.com/2K1zpGh4F2

— Bitfinex (@bitfinex) January 20, 2026

“The last time at similar levels, the leading cryptocurrency subsequently outperformed the precious metal. It is worth watching this cross as 2026 liquidity builds,” the analysts wrote.

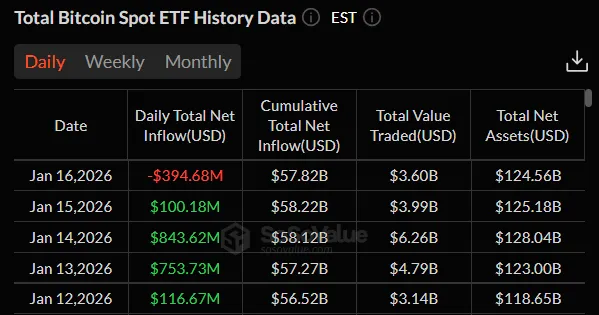

ETF outflows and risk-off

US spot bitcoin ETFs ended a four-day streak of $1.8 billion in inflows, recording $394.68 million of net outflows on January 19.

Valr CEO Farzam Ehsani linked this to the market shifting into “risk reduction” mode. In his words, Mr Trump’s aggressive trade rhetoric and the threat of tariff wars have historically created “a strong headwind” for cryptocurrencies and other risk assets.

Earlier, the analyst known as Darkfost noted an improvement in the “visible demand” for the leading cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!