Andreessen Horowitz unveils new ‘State of Crypto’ index

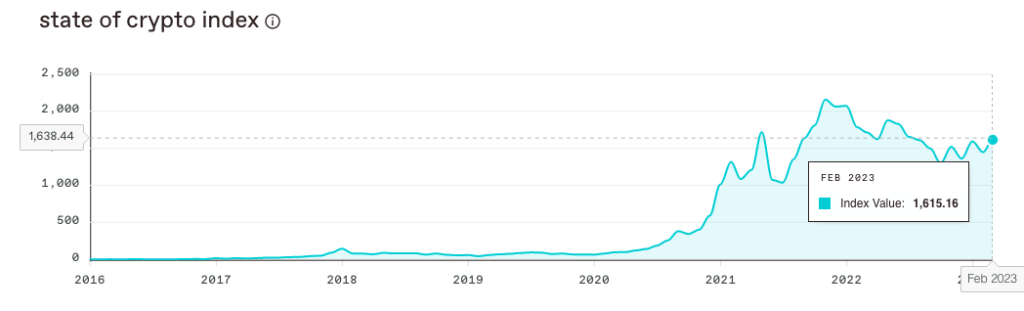

The Web3 division of venture-capital firm Andreessen Horowitz (a16z) has unveiled a new index — ‘State of Crypto’.

You can explore the State of Crypto index yourself!

It’s interactive, so tweak the parameters, create different views, and share them with us ↓https://t.co/LDCLKZPLIj

— a16z crypto (@a16zcrypto) April 11, 2023

The company released the new metric together with the eponymous report. The index itself accounts for several so-called adoption-and-innovation parameters, including the number of active developers, mentions of cryptocurrency in academic research, and volumes on decentralized trading platforms.

According to the chart, while Bitcoin’s price fell 55% from its 2021 peak, the a16z index fell 25%.

Over the past year, the number of active developers fell by about 25%, and the number of transactions on blockchains by 10%, from 1.3 billion to 1.17 billion.

“Speculative cycles operate differently from commodity cycles. If there is a production cycle and technological progress, you should be able to see the data underlying this plane,” said the company’s CTO, Eddy Lazzarin.

He also pointed to a ‘radical acceleration’ in deploying scaling solutions for Ethereum and zero-knowledge protocols.

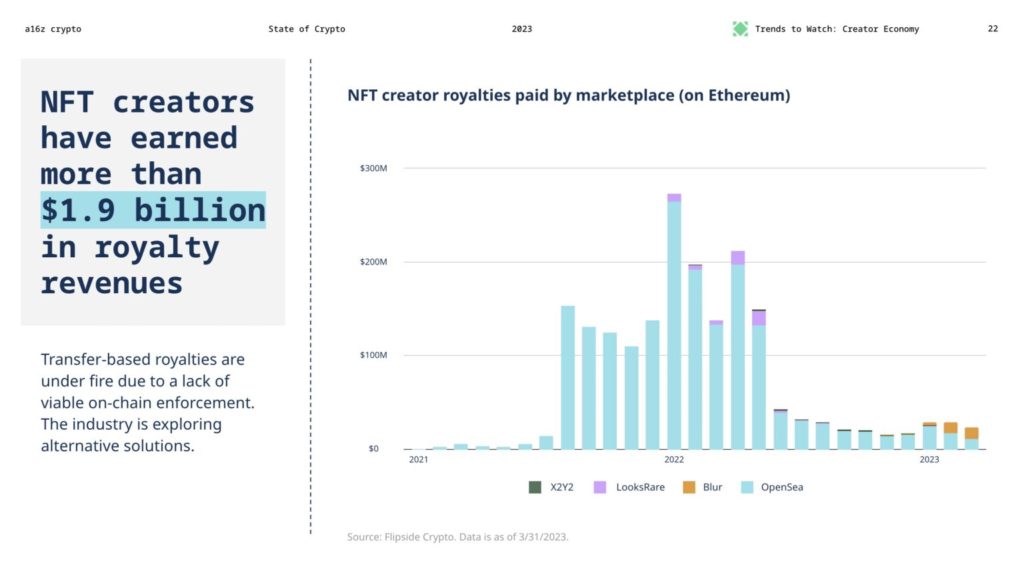

The study also notes a revival of the non-fungible token sector thanks to the development of DeFi apps and Web3 games. Over the past two years NFT marketplaces paid authors royalties totaling $1.9 billion.

In late March, the fear-and-greed index reached 68, the highest reading in 18 months.

In April, Bitcoin dominance rose to levels seen in mid-2021. Bitcoin’s share of total market capitalization exceeded 45%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!