Apartments for USDT and registered capital in XRP: how businesses are integrating digital assets

Cryptocurrencies as a means of payment are developing at a rapid pace. In terms of speed of adoption, they seem to outpace even the internet in the late 1990s. In some countries it’s become routine to scan a QR code at the checkout and pay stablecoins for purchases. ForkLog examined the statistics and spoke with businesses of various sizes to explain how the technology is faring.

“Crypto Adoption” in numbers

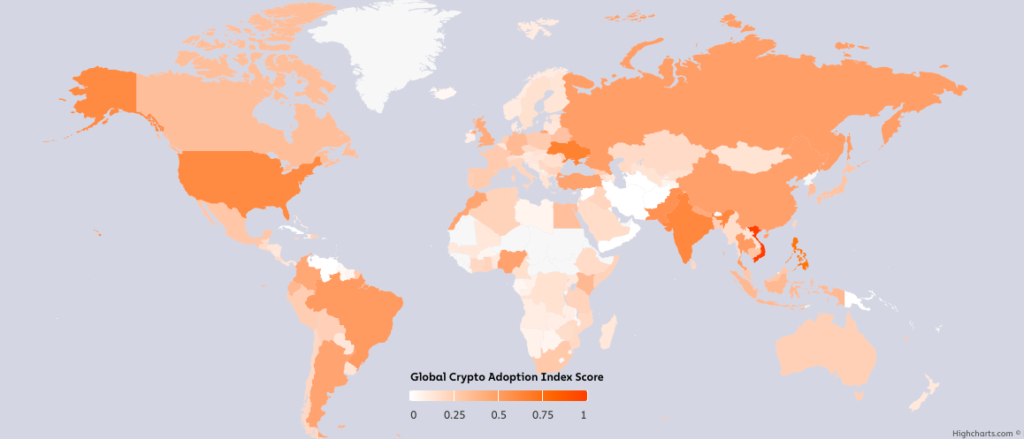

For a better understanding of the global situation, refer to Chainalysis‘s 2022 Global Crypto Adoption Index report. Its authors created their own “crypto adoption” index and calculated it for 146 countries.

The index comprises several sub-indices:

- volume of trading on centralized crypto exchanges;

- retail trading on centralized exchanges;

- volume of P2P trades;

- volume of trading in the DeFi segment;

- volume of retail trades in the DeFi segment.

According to the data, the top five, in order, were Vietnam, the Philippines, Ukraine, India and the United States. Russia ranked ninth.

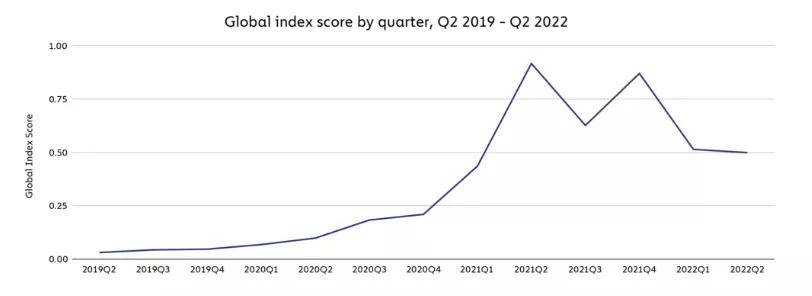

The global crypto adoption index shows that from 2019 to 2021 the measure jumped from near-zero values to peaks around 0.9. Since then, the value has fluctuated and by mid-2022 remained at local lows.

Experts link the shaky indicators to the onset of the bear market. However, in their view, many players show resilience to crisis situations.

“Users in low- and middle-income countries often rely on digital assets for remittances, preserving their savings during fiat volatility and meeting other financial needs unique to their economies. These countries are also more inclined to rely on Bitcoin and stablecoins than others,” Chainalysis emphasized.

At the same time, most new users who pour capital into cryptocurrency during upswings remain when prices fall. This allows the ecosystem to grow steadily across different market cycles, the researchers noted.

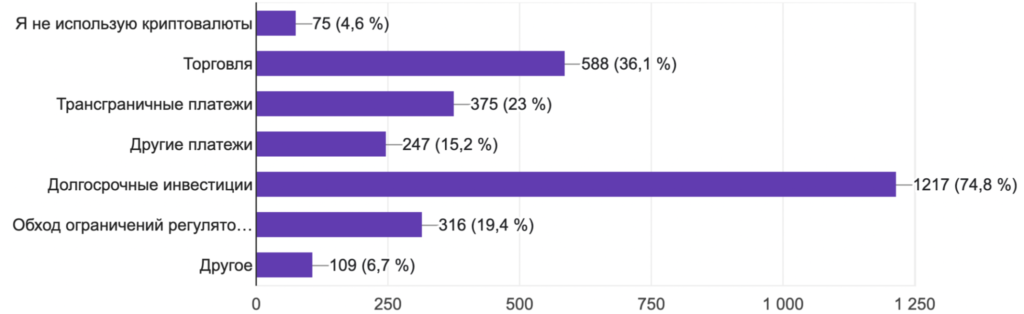

More local data — about ForkLog readers — are presented in our annual survey, in which more than 1,600 people participated.

19.8% of respondents are connected with the blockchain and cryptocurrency sector. The majority (33.7%) first bought or received digital assets in 2017–2019. About 31% did so in 2020–2021, and another 13.9% in 2022.

Readers mainly use cryptocurrencies for long-term investments, and more than a third engage in trading.

The most popular assets were Bitcoin and Ethereum, with Binance Coin (BNB) in third place.

29.5% of respondents own NFT, but most (56%) do not own non-fungible tokens and do not plan to buy them. In 2022, about 35% invested in the DeFi sector, 7.2% participated in the governance of DAO.

Cryptocurrencies and business

Before turning to real-world examples of how businesses interact with digital assets, it is worth outlining the advantages and drawbacks of this direction.

First, note their inherent online format. Many fiat transactions are digital, but they are based on physical cash. Businesses that accept cryptocurrency are less likely to make mistakes in settlement and save themselves from unnecessary paperwork.

Secondly, this provides access to new liquidity and capital. A business could potentially obtain loans in digital assets with fewer restrictions and lower interest rates than in fiat.

Additionally, cryptocurrencies give companies new payment options for their customers, ensuring greater privacy. Moreover, this approach can significantly reduce transaction fees for both the firm and buyers.

“Using cryptocurrencies has helped us move away from the constraints of traditional financial systems, such as high fees and slow bank transfers. It has allowed us to conduct transactions with partners and customers on a global scale without unnecessary complications,” said Ivan Mueller, Marketing Director at the Dexsport betting platform.

He added that the firm saw digital assets as a tool to attract customers, as many are interested in new technologies and alternative ways of financial interaction. Dexsport now supports seven blockchains.

Another advantage of cryptocurrencies for business is transparency and verifiability of transactions. On-chain data available on the ledger simplify the preparation of financial statements and tracking of incoming funds.

However, questions of security and regulation remain on the agenda. Only recently, and not in all jurisdictions, have relevant laws begun to appear. Thus, in May 2023 the European Council unanimously approved the draft regulation for the crypto-asset market (MiCA).

Some firms have to spend on lawyers and blockchain-security experts to ensure compliance and safeguard assets.

The founder of boqpod, Ilya Suslin, said they became the first company in Switzerland with registered capital in the Ripple (XRP) token. Because of this specificity, financial institutions refused to open a bank account for the firm.

According to Suslin, at one point they had to pay for training for the law firm that conducted the audit to prove XRP reserves.

The assets of boqpod are stored in its own cold wallets.

“Our own code is always better than Ledger. After all, we work in information security, and for us it’s important to keep a finger on the pulse,” said the company head.

98% of the project’s clients use cryptocurrencies for payments. They mainly send stablecoins via centralized exchanges. But as the preferred cryptocurrency, Suslin highlighted Monero (XMR), which, like boqpod itself, is oriented toward privacy

Meanwhile, an anonymous Dubai real estate agent spoke about widespread crypto payments in the UAE.

According to the interviewee, his real estate firm has been using digital assets for more than three years. The process is straightforward: by agreement, the client sends cryptocurrency to the agency’s partners’ wallet — mainly USDT and, in rare cases, Bitcoin.

Usually, operations are conducted on centralized exchanges, sometimes with the involvement of a third party. The company withdraws funds through exchangers.

The agent noted that in the UAE there are many clients who pay in cryptocurrency — around 30–40%. Most are citizens of CIS countries, the EU, and the USA, occasionally there are residents of China and India.

“Many of our clients are cryptocurrency enthusiasts. It’s clear they seek a safe way to store their money. Digital assets can offer outsized returns, but there is also the risk of losing investments. In that sense, real estate is a conservative instrument that helps preserve money. Therefore, many crypto investors strive to buy homes and apartments,” explained the company representative.

Smaller businesses are actively using digital assets as well. The Russian service for selling phone numbers Simsms integrated cryptocurrency into the business in 2015 to provide “more convenient payment methods.”

Representative Nikolai Tuz said they accept a wide range of assets, including LTC, BNB, USDT, DASH, DOGE, XRP, TRX, AXS, HT, DAI, USDT, DESU, ADA, USDC and SOL. This variety is provided to them by the aggregator 0xprocessing.

About 15–20% of the service’s clients prefer to use cryptocurrencies as payment. Withdrawals are carried out via P2P trades.

“We are seeing rising interest in using crypto payments in Russia. Businesses and clients are increasingly interested in this payment method, and we expect the trend to develop. Government authorities are also expressing interest in regulating this area, which could contribute to a more stable digital environment,” Simsms forecasted.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!