April 2021 in figures: Bitcoin dominance dips below 50%, Dogecoin in the top five, USDT on Tron among the leaders

Key highlights

- Bitcoin hit a new high around $65,000. Ethereum, Cardano, and Dogecoin also set price records.

- Exchanges recorded record trading volumes. Aggregate spot-market turnover reached $2 trillion.

- Excessive leverage in the Bitcoin futures market triggered a correction and a series of liquidations totaling $10 billion.

- The value of funds in Ethereum-based apps rose by 51%.

- Daily transactions on Binance Smart Chain outpaced Ethereum sixfold.

- In the DEX segment a new favourite emerged — PancakeSwap on Binance Smart Chain. It has surpassed Uniswap in turnover.

- NFT hype is cooling. Celebrities still sell their tokens for substantial sums.

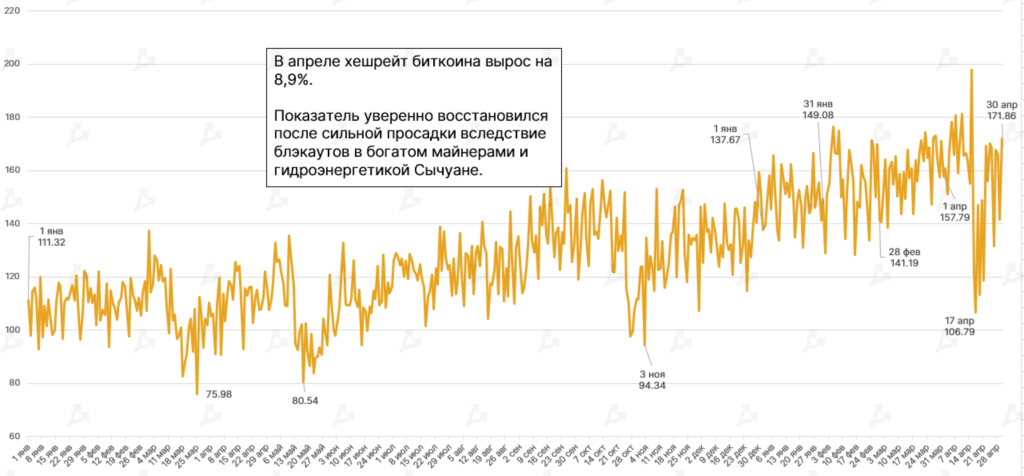

- Bitcoin hash rate temporarily suffered due to outages in China.

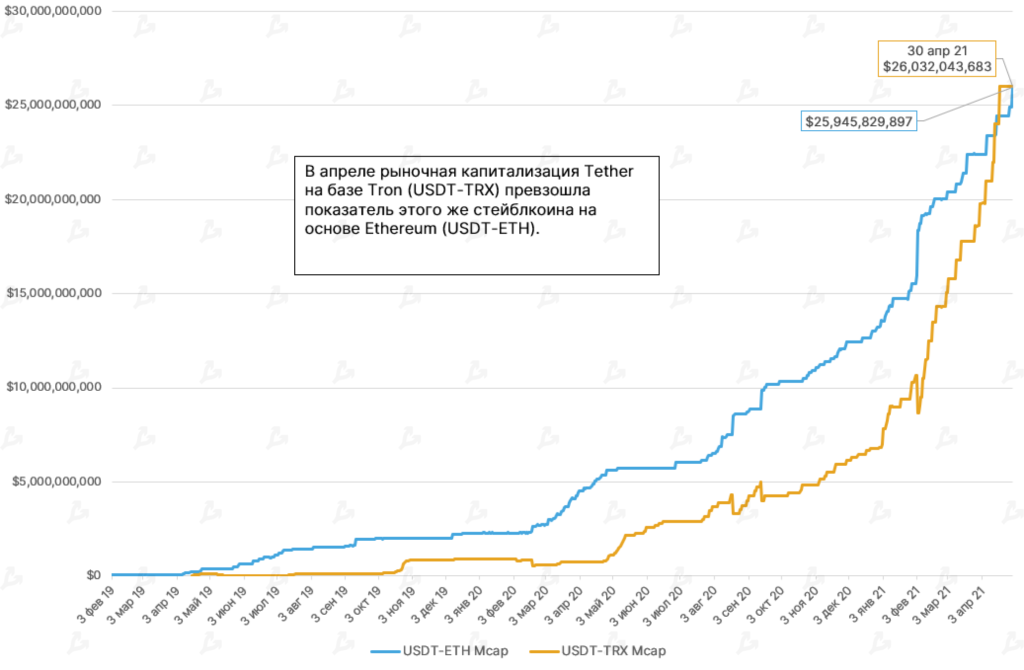

- Total capitalization of stablecoins exceeded $80 billion. USDT on Tron overtook its Ethereum-based counterpart.

- Coinbase debuted on Nasdaq in the largest direct listing in history.

- Average venture deal size in the sector rose by 120%.

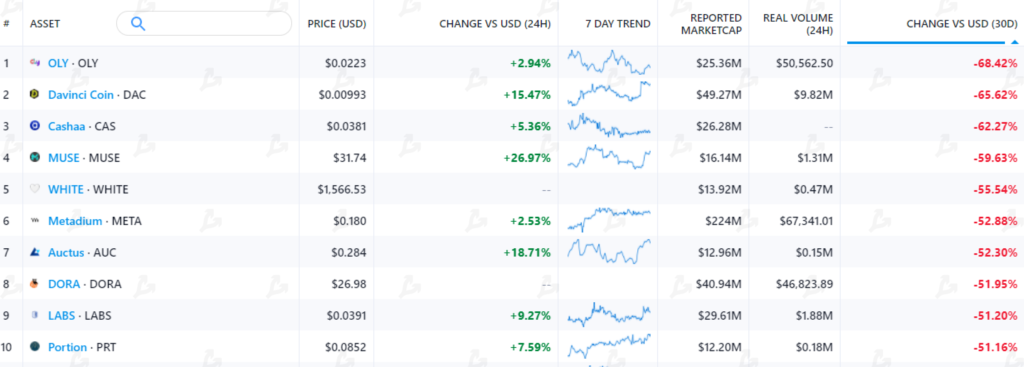

Leading asset dynamics

April will be remembered for Bitcoin’s new all-time high — on April 14 the price reached $64,875 on Bitstamp. At one point, the crypto market capitalization exceeded $2.3 trillion.

Over the next two weeks the price corrected to $47,000, triggering the largest ever series of liquidations in Bitcoin futures. By month-end Bitcoin fell 1.7%.

A similar dynamic was observed for Ethereum, the second-largest cryptocurrency by market cap, whose price updated a mid-month high. Yet by the end of April it stood at $2,800. The April rise amounted to 44%.

In April, Binance Coin (BNB) posted the largest rise among leading assets, jumping 106% with a high of $638.

New records were set by other leading cryptos:

- Cardano (ADA) — $1.55 (+13% for April);

- Polkadot (DOT) — $48.3 (-2.5%);

- Uniswap (UNI) — $43.8 (+44%);

- Chainlink (LINK) — $44.4 (+29%).

Against Bitcoin’s dominance below 50%, many altcoins rose. For example, XRP hit a three-year high, approaching $2.

The hype around Dogecoin Day propelled the meme coin DOGE to the fifth position by overall project market cap. On 16 April the coin hit a high of $0.45. At the start of April it traded around $0.05. In the month, Dogecoin rose by nearly 500%. Among liquid altcoins, CRO from Crypto.com rose 718%.

Market sentiment, correlations, user activity

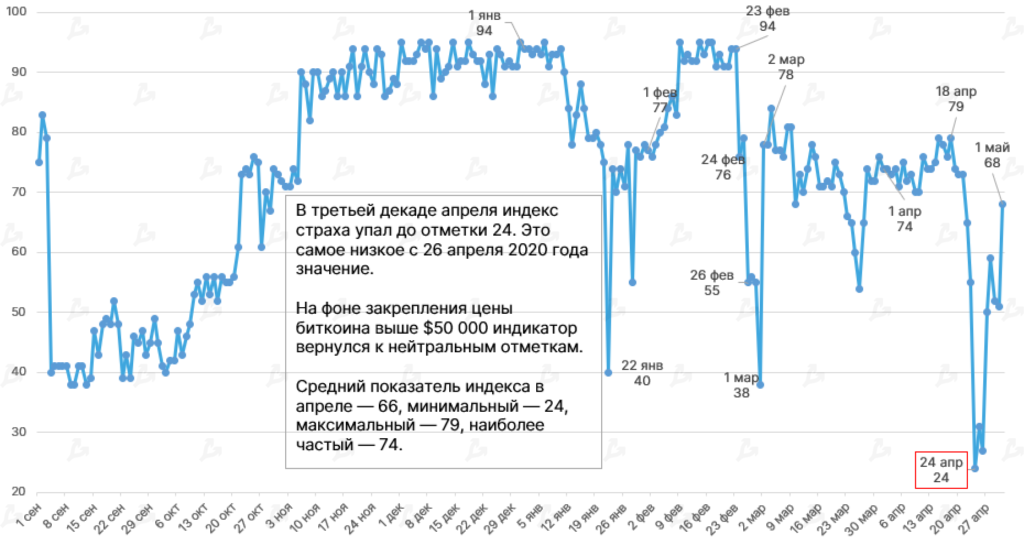

As Bitcoin slipped below $50,000, the Fear and Greed Index dropped to 24, the lowest in a year. With the price recovery, it returned to neutral levels.

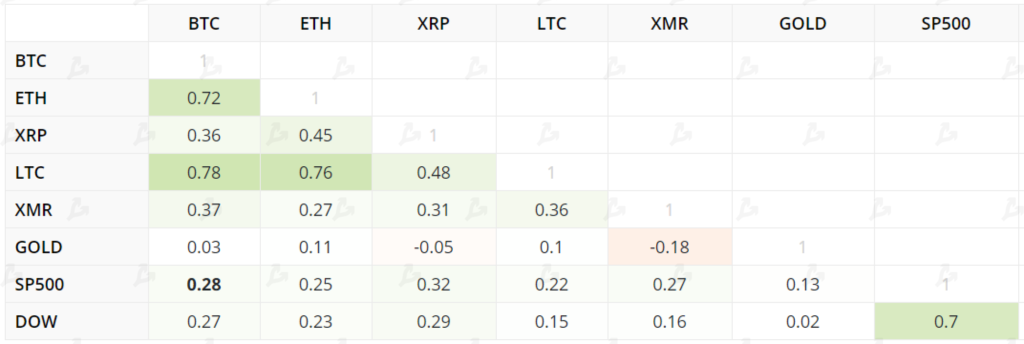

Bitcoin’s correlation with Ethereum and Litecoin softened slightly. The statistical link between “digital gold” and the S&P 500 remains high (0.26), and with gold it is essentially negligible (0.01). Over the past month, the figures changed little.

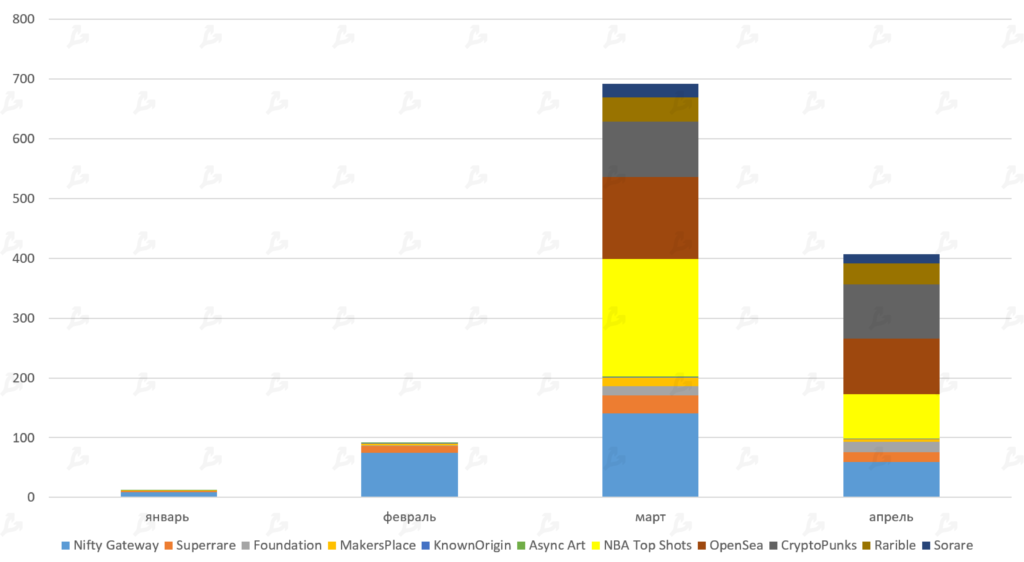

NFT

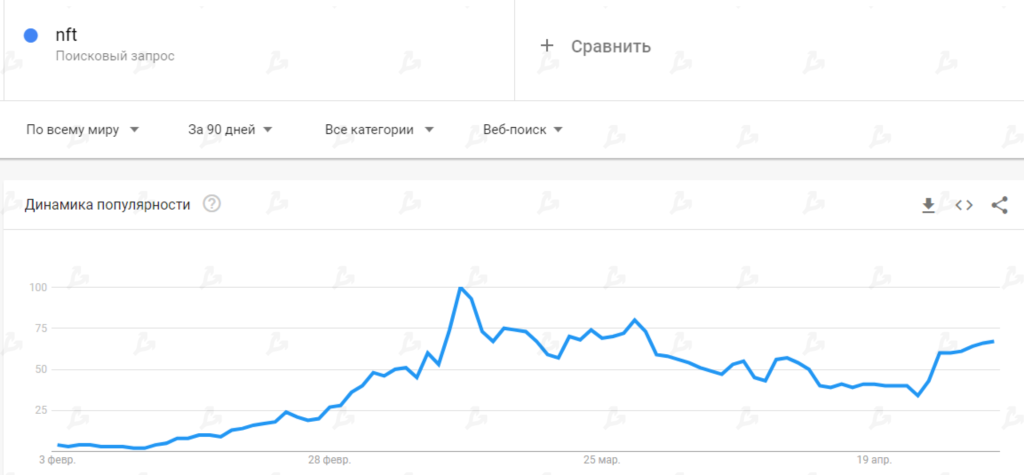

The NFT hype appears to be fading. In April, NFT market volumes on leading marketplaces fell by 40%. Google search interest declined as well. In terms of platforms, OpenSea led with $93.3 million in activity, followed by CryptoPunks at $90.1 million, while NBA Top Shots generated $73.5 million.

The launch of a Binance NFT marketplace was announced for June. “If you don’t understand NFT yet, we hosted a five-hour conference to help you catch up. The recording is on ForkLog’s YouTube channel.”

Stablecoins

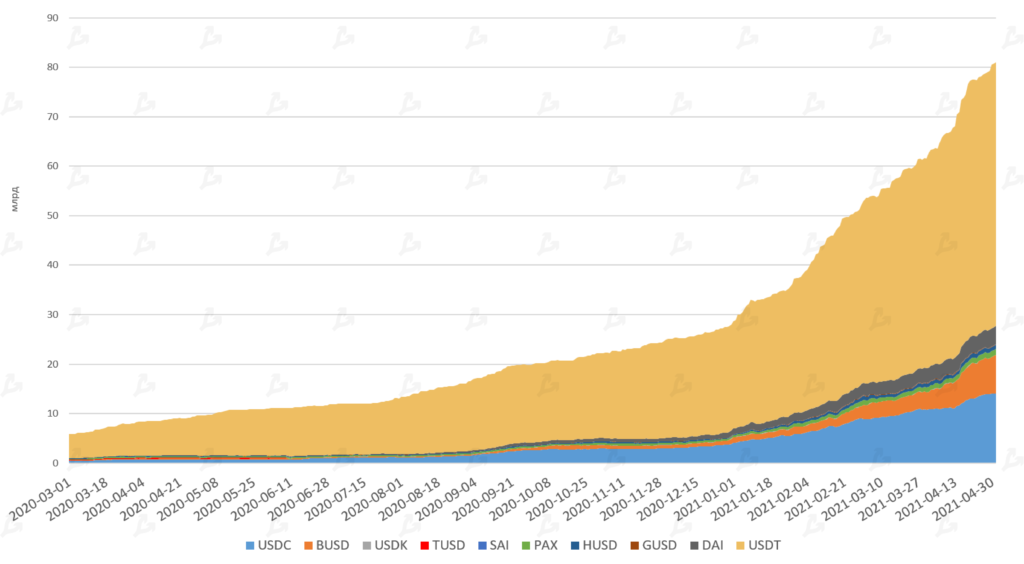

Total stablecoin capitalization in April exceeded $80 billion. Tether’s share in the segment rose to $53 billion. USDC started the year at $4 billion and now exceeds $14 billion. BUSD from Binance surpassed $7 billion.

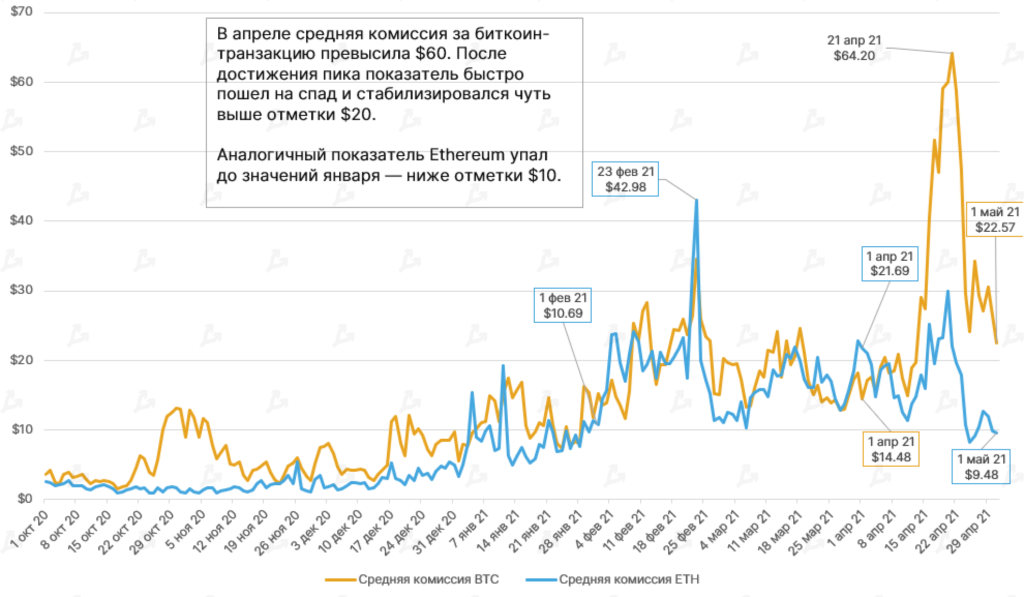

Total USDT on Tron (USDT-TRX) surpassed the Ethereum-based USDT (USDT-ETH). The increase in USDT-TRX supply likely reflects rising demand to minimise costs and speed up transfers.