Arcane Research analysts see slim odds for spot Bitcoin ETF launch

The market does not expect SEC approval of a spot ETF based on the first cryptocurrency. According to Arcane Research analysts, this follows from the GBTC discount to its NAV.

The Weekly Update — Week 42

🔹Record-breaking launch of BTC futures ETFs

🔹The GBTC discount has never been bigger – the market does not expect acceptance of a spot ETF

🔹#Bitcoin miners’ sustainable power mix is almost 3x higher than the world averagehttps://t.co/PLmRYx1nnn— Arcane Research (@ArcaneResearch) October 26, 2021

Grayscalesent a Form 19b-4 to the SEC to convert the Bitcoin Trust into a spot ETF under the ticker BTC. The decision followed the debut of trading of the first futures-based ETF tied to the first cryptocurrency.

The trust is Grayscale’s largest. As of October 25, its assets under management stood at $40.46 billion. The company’s total assets under management (AUM) were estimated at $55.5 billion.

10/25/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $55.5 billion$BTC $BAT $BCH $LINK $MANA $ETH $ETC $FIL $ZEN $LTC $LPT $XLM $ZEC $UNI $AAVE $COMP $CRV $MKR $SUSHI $SNX $YFI $UMA $BNT $ADA $SOL pic.twitter.com/Xp3UdDbTxD

— Grayscale (@Grayscale) October 25, 2021

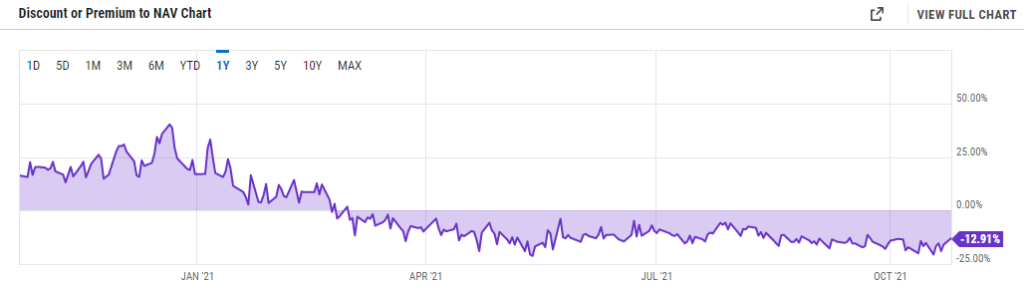

Is the market expecting the SEC to approve GBTC as the first spot Bitcoin ETF in the United States? We are looking at the trust’s discount as the market’s assessment of such a scenario. If this happens, Grayscale will launch a buyback programme, many traders will start playing for a compression of the spread. For now, such a development seems unlikely. — analysts wrote.

The GBTC discount has persisted since February 23. By October 25 it had narrowed to 12.91%.

In May 2021, Digital Currency Group, Barry Silbert’s parent company of Grayscale Investments, announced an increase in the GBTC buyback limit from $250 million to $750 million.

Recently, US Global Investors, Miller Opportunity Trust, Morgan Stanley and Wealthfront have reported purchases of GBTC shares.

Subscribe to the ForkLog channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!