Arcane Research notes resilient finances among public miners.

Public mining companies are going through difficult times due to the drop in Bitcoin price, higher electricity tariffs, and mining difficulties. But none of them have gone bankrupt, according to experts at Arcane Research.

Analysts cited the “enormous” cash and cryptocurrency reserves accumulated by miners by the start of the summer as the main reason for their financial resilience.

The companies liquidated significant volumes of their Bitcoins in June and July to cover equipment purchases and other expenses. However, most remain in good financial shape, Arcane Research noted.

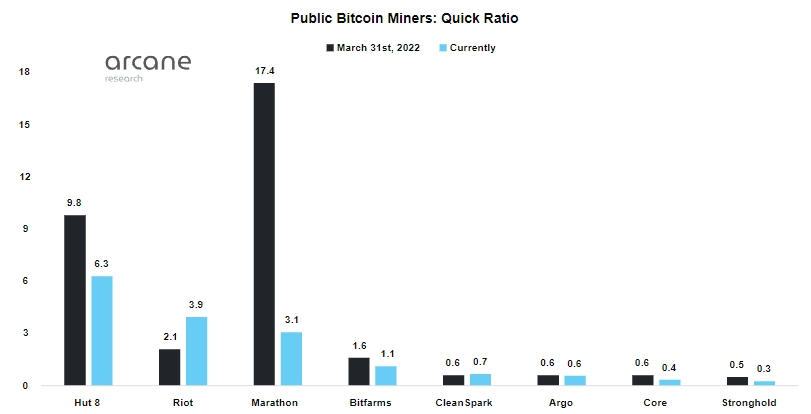

Analysts compared miners’ quick liquidity ratios as of March 31 and to date. The metric is the ratio of liquid assets (fiat money, their equivalents and cryptocurrencies) to working capital.

The summer drawdown of reserves predictably reduced the ratio for six of the eight companies studied. Marathon showed the largest drop.

The financial position of the latter, as with the others, remains resilient, experts say. In their view, the exception is Stronghold. The firm has a quick ratio of only 0.3, and it has negative working capital.

“The companies will have difficulty staying afloat unless a Bitcoin price rebound saves them,” Arcane Research analysts concluded.

Earlier, Capriole Investments founder Charles Edwards concluded that the period of capitulation of Bitcoin miners had passed.

Read ForkLog Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!