Are NFTs Securities?

The hype surrounding non-fungible tokens (NFTs) has faded, but the technology endures.

The concept allows property rights to be secured over digital and physical assets, and some companies are seeking to apply it—particularly for tokenising real-world objects.

NFTs are not only used in business. For example, in 2022 a British court approved service of court documents in the form of non-fungible tokens. The practice was later adopted in other jurisdictions.

At the same time, the question remains: if tokenisation of contractual relationships and real-world obligations has occurred, are NFTs investment objects? After all, in such a case these tokens would fall under the regulations governing securities trading, would impose liability on issuers and become subject to regulators such as the SEC.

For ForkLog, Yulia Privalova, head of the legal department at DRC, explains whether buying a non-fungible token can be considered an investment.

What is the Howey test?

To determine whether NFTs fall under the definition of a security, the so-called Howey test is used (Howey Test).

This test was developed by the US Supreme Court in 1946 during the case SEC v. W.J. Howey Co. Participants had to determine whether the contract for the sale of land with subsequent leasing was an investment contract (a security).

During the proceedings it was found that buyers never planned to live or work on the land they purchased. Instead, they entered into agreements to earn income from citrus groves planted by Howey Co.—that is, they expected to profit from their investments.

Howey test as applied to NFTs

American lawyers have adapted the Howey test to crypto-market projects. To determine whether an NFT constitutes a security, the asset should be measured against a set of criteria.

Investment of money. This condition is almost always met, since NFTs are typically purchased for a defined consideration.

A joint venture with a reasonable expectation of profit. This point is more applicable to fractional NFTs, as the value of each share in such a token depends entirely on the value of the other parts and the whole asset.

With regard to the expectation of profit, the US Supreme Court expressed its view in United Housing Foundation, Inc. v. Forman:

«… when the purchaser is motivated by the desire to use or consume the purchased good, securities laws do not apply».

Thus, the manner in which NFTs are used is a key factor.

Profit must be generated by the efforts of a certain third party. This criterion is more applicable to NFT collections. Marketing the entire set of tokens by marketers, producers, and agents affects the value of each asset individually.

Case law

There is currently much debate on this issue and a multitude of ambiguous court rulings.

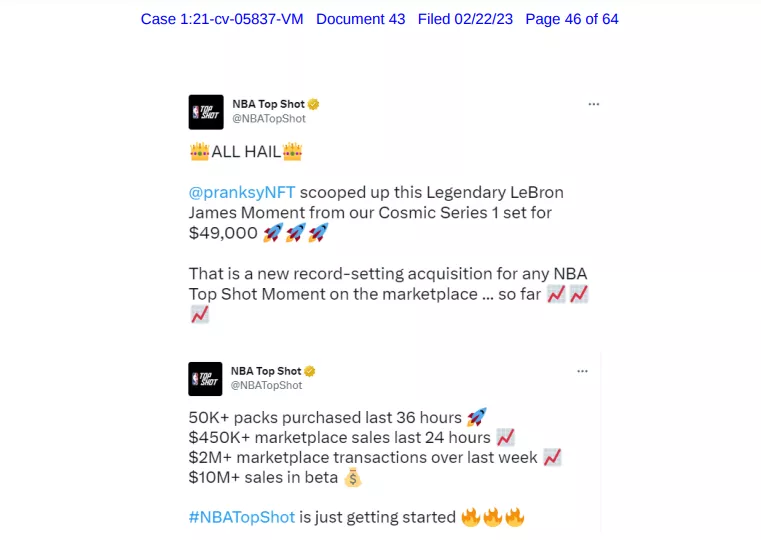

For example, in February 2023 the Federal district court for the Southern District of New York ruled that Dapper Labs, via its NBA Top Shots Twitter account, gave “investment advice” through emoji posts, and the tokens of the NBA Top Shots NFT collection were unregistered securities.

The court papers state:

«… although the word “profit” is not included in any of the tweets, the emoji “rocket”, “stock charts” and “money bags” objectively signify one thing — financial return on investments».

Which NFTs can be considered securities?

DRC argues that for proper classification, NFTs should distinguish between digital art and tokenised real-world objects.

If NFTs are treated as works of art, they may appreciate in value and yield profits like equities. At the same time, if the deal contemplates the transfer of rights to the work and the seller does not mention any potential for asset appreciation, it is unlikely to be a security.

However fractional NFTs, and tokens that promise certain returns such as royalties, profits or dividends, will be treated as securities.

***

The versatility of non-fungible tokens offers a wide range of applications. These assets can be used to tokenise almost anything—from airline tickets to court notices.

The NFT sector is still too young to have generated a large number of precedents or to have established clear regulation.

Therefore, for the proper classification of a given NFT, DRC’s specialists recommend that project teams consult qualified lawyers at the earliest stage of development. They say this will help safeguard the product and make it more attractive to investors.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!