Fed’s Printing Press Fueled Bitcoin’s Move, Says Arthur Hayes

Analysts flagged key levels ahead of the Fed meeting

BitMEX founder Arthur Hayes suggested the first cryptocurrency could break out of its range if the Fed backstops Japan’s bond market.

He posits the Federal Reserve could step into Japan’s crisis: a weakening yen alongside rising government-bond (JGB) yields.

The situation threatens US interests: investors could dump Treasuries to buy higher-yielding JGBs.

“Will a collapse of the yen and JGB markets trigger any money printing by the Bank of Japan or the Fed? The answer is yes. Discussion of the Japanese financial system is important because for bitcoin to break out of its sideways move, it needs a healthy dose of money printing,” Hayes believes.

In his view, the US central bank could create dollar reserves via banks such as JPMorgan, sell the currency for yen to support the exchange rate and buy

JGBs to lower their yields. This would expand the Fed’s balance sheet and act as “a necessary injection for the dirty fiat system”.

Fed meeting

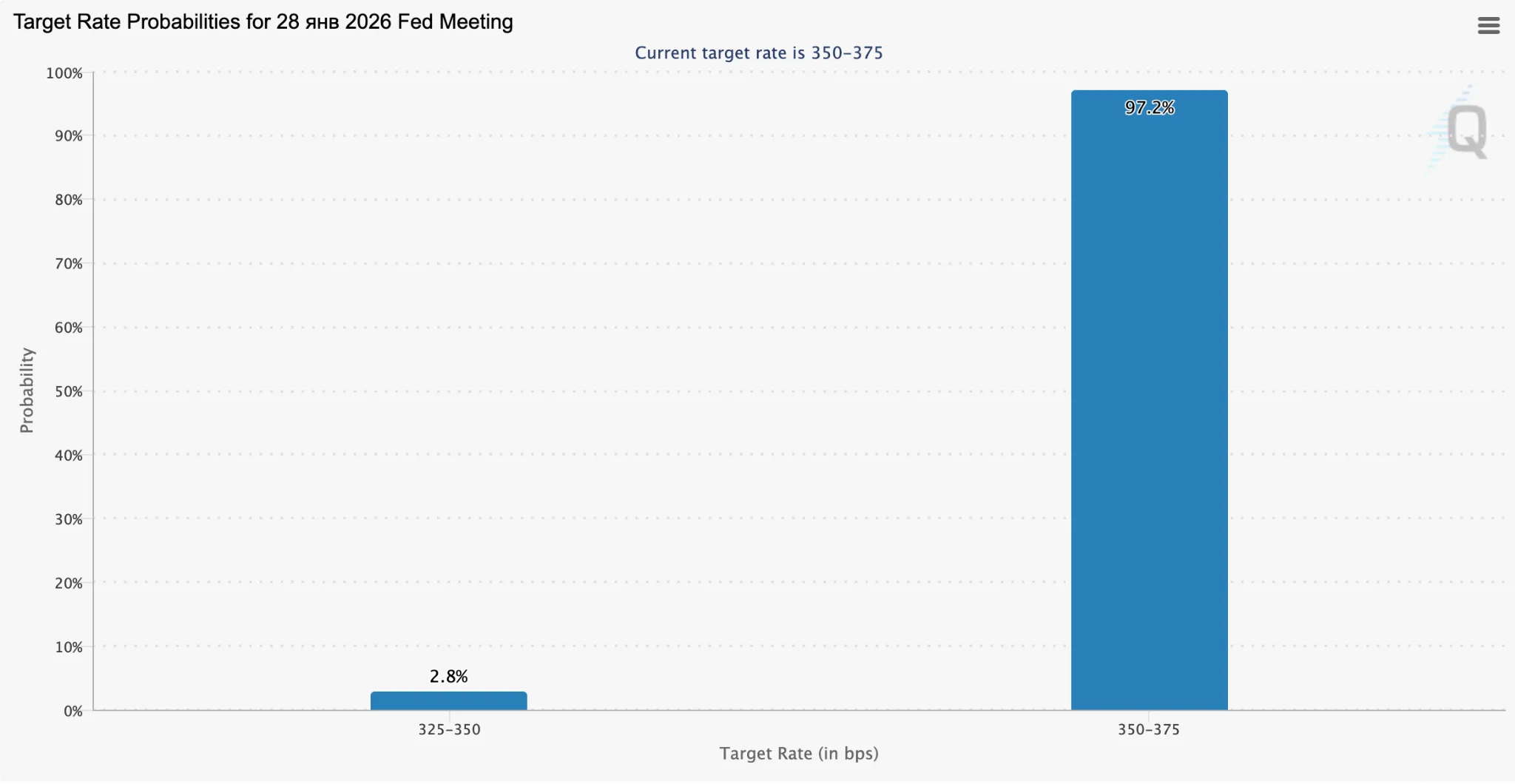

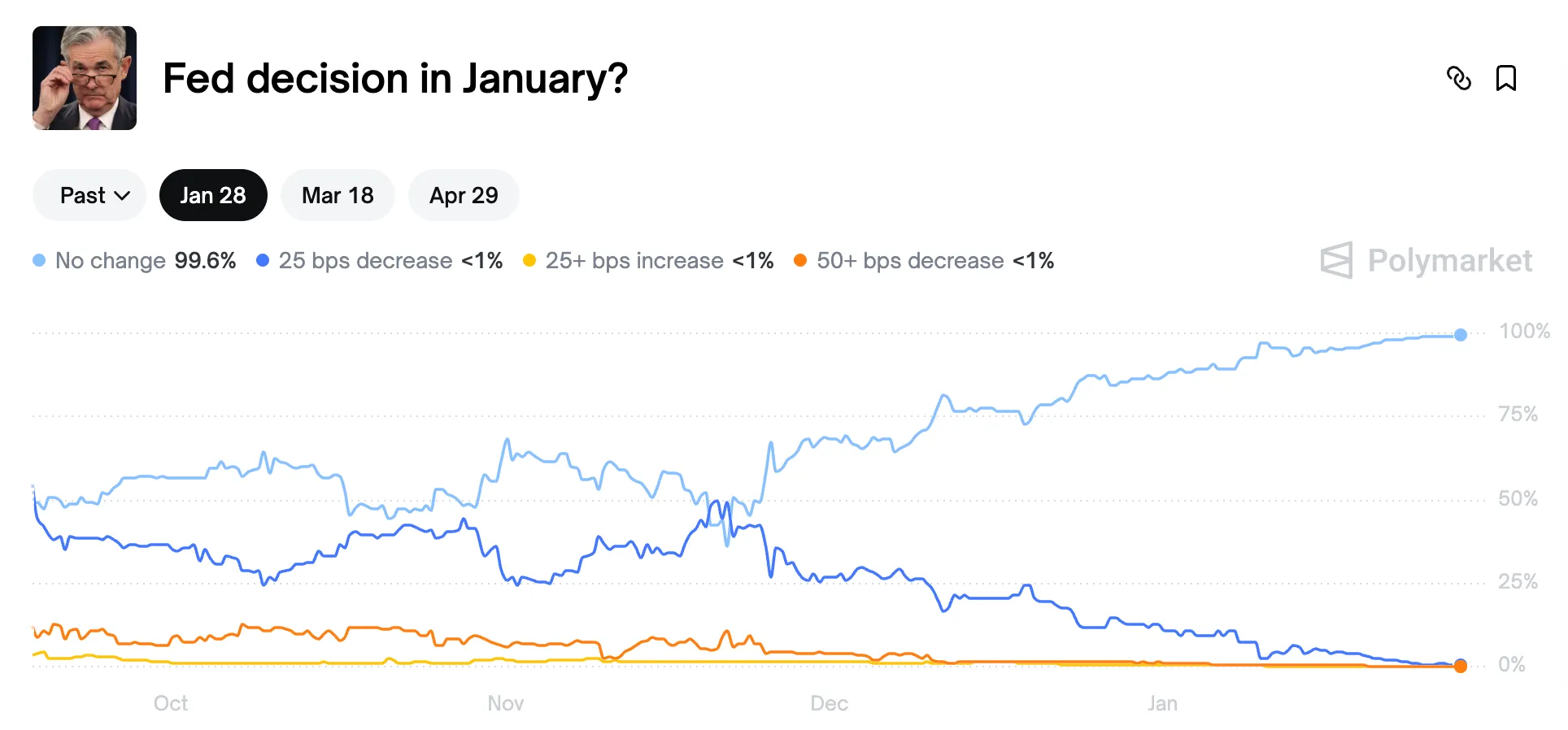

On January 28, the FOMC will decide on the policy rate. An overwhelming majority of investors expect it to stay unchanged, at 3.5%–3.75%.

Prediction markets tell a similar story. Polymarket users put the odds of a cut or a hike at under 1%.

Traders reckon the market has already priced in the potential drag from an unchanged rate. QCP analysts suggested only short-term volatility in the case of a “hawkish pause”.

Attention is now on the wording of Fed chair Jerome Powell.

“All eyes are on Powell’s press conference and his words about the Fed’s plans for the coming months. If we hear any hints of a cut in March, bitcoin will go to the Moon,” — says crypto investor Kiran Gadakh.

Bitcoin’s key levels

Ahead of the meeting, bitcoin returned to $90,000 — up 2.3% over the past 24 hours.

Some link the recovery of the bellwether to a weaker dollar, whose index fell to 95.5 yesterday — a four-year low.

“This reduced the opportunity cost of holding risk assets and supported bitcoin’s rise. The pressure eased after the coin entered the $86,000–$87,000 area and held there, where a dense cluster of leveraged position liquidations was triggered, which reduced excess leverage and stabilized the short-term market structure,” — noted analysts at the crypto exchange CoinSwitch.

They described the move in digital gold as “a lull and consolidation,” rather than readiness for a push higher.

Analyst Daan Crypto Trades marked $84,000 as key support in the event of a pullback on the Fed decision or macro data. This level aligns with the 0.382 Fibonacci retracement drawn from the 2022 low ($15,500) to local highs.

$BTC Technically the .382 Fibonacci retracement retest has still held up to this point.

This is a pattern that has repeated throughout the entire cycle so far. Where each major drawdown has held on to that .382 Fib Retracement measured from the bear market bottom to the local… pic.twitter.com/xokyJzRNSl

— Daan Crypto Trades (@DaanCrypto) January 27, 2026

“From a technical perspective, this level is a significant reference point, but to preserve a healthy market structure a confident price reaction is needed soon,” the expert noted.

Joao Wedson, founder and CEO of Alphractal, believes that “bitcoin cannot lose $81,000 under any circumstances.”

In his view, a break of this mark could trigger “a capitulation process similar to 2022,” with the next major support then “around $65,500”.

Bitcoin cannot lose $81K under any circumstances, according to on-chain analysis.

If this level breaks, a capitulation process similar to 2022 may unfold.

The next major support would sit around $65,500.

Hard to believe for many — but this same disbelief about how far price… pic.twitter.com/IcGLelt2pP

— Joao Wedson (@joao_wedson) January 27, 2026

The key resistance zone is $90,000–$94,000, where the 50- and 100-day moving averages run. Clearing this cluster is needed to resume the uptrend.

Outlook

MEXC Research’s chief analyst Sean Yang expects a swift recovery. Historically, bitcoin and Ethereum average February gains of 14% and 27%, respectively.

“If history repeats, both assets may see a moderate recovery in the coming month, as extended technical indicators signal oversold conditions,” he told ForkLog.

He cautioned, however, that the market has lately broken with traditional trends — clear signs are emerging of changes to the classic four-year cycle.

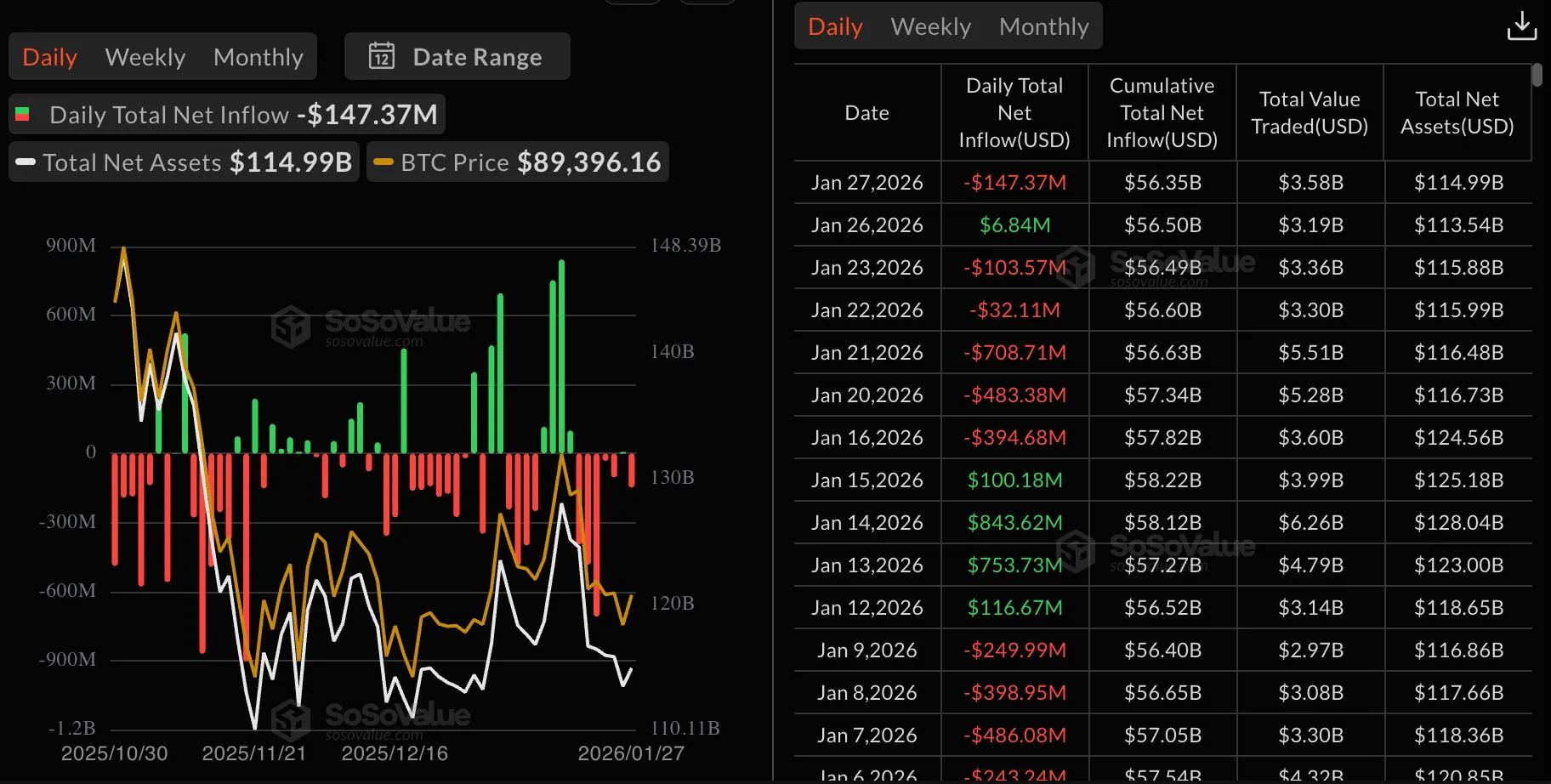

Yang tied the prospects for gains to inflows of institutional capital but noted their current instability.

Max Khnatyshyn, Toobit’s head of operations for the CIS, voiced a similar view. Additional drivers of growth, he said, are progress on regulation and global adoption of bitcoin.

“For Ethereum, the key growth factor remains active use of the mainnet and layer‑2 solutions,” he stressed.

Earlier, CryptoQuant’s head of research Julio Moreno called the $86,600 mark a decisive threshold for ETF holders.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!