Arthur Hayes on the Decline of Tokens Post-CEX Listing

Former BitMEX CEO Arthur Hayes, in a new PvP essay, described the current cryptocurrency market cycle as “player versus player,” where ordinary investors suffer losses due to the high FDV of new tokens, while venture firms and crypto exchanges profit.

The expert’s team sought to address several questions:

- Is it worth paying exchanges for a listing to increase a token’s chances of a pump?

- Are the valuations of new projects too high?

To this end, analysts compiled a representative sample of 103 protocols whose tokens were listed on CEX this year.

Hayes emphasized that creating a useful product or service with a growing number of paying customers is the “secret sauce” for a successful Web3 project. Listing on centralized platforms is not decisive, he added.

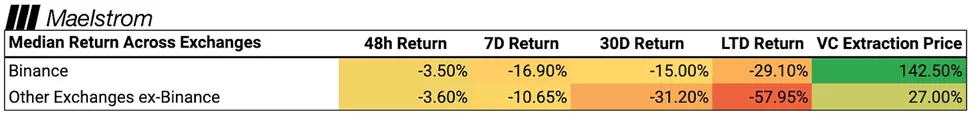

According to the illustration, adding a token to the list of tradable instruments on CEX did not yield returns. Only venture investors benefited, as the median price rose by 31% compared to the FDV of the last private round (last column).

The table also indicates no guarantee of price growth with a Binance listing. The former BitMEX CEO noted that it only makes sense if the platform itself decides to take this step due to the project’s popularity and its community. In this scenario, teams would need to transfer or sell part of the tokens to the exchange.

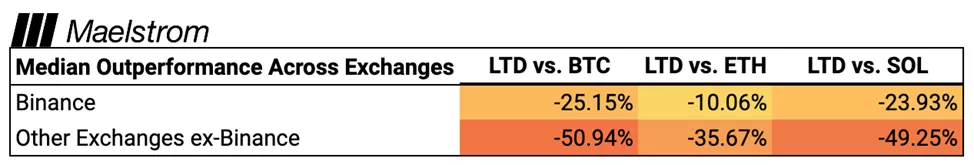

Analysts also compared asset dynamics relative to changes in the value of Bitcoin, Ethereum, and Solana, yielding unsatisfactory results.

Based on the second table, Hayes concluded that projects need to reduce their initial valuations by 40-50% to become attractive.

The expert blames venture investors for the current situation, as they persuade founders to conduct private rounds with ever-increasing FDV, aiming to recoup their investments in illiquid early-stage projects.

High FDV allows venture firms to show large unrealized profits and attract funds for the next fund, Hayes noted.

After listing, reality sets in—the market shows that teams have not created a product or service for which a sufficient number of users will pay real money, justifying their “ludicrously high FDV.”

Therefore, venture funds push founders to delay token launches and continue private rounds. As a result, when the project hits the exchange, it “falls like a stone.”

In this scenario, venture investors mostly do not lose out, as the collapsed FDV still exceeds the amounts they paid, Hayes explained.

According to the expert, exchanges are also interested in inflated diluted valuations. Firstly, trading fees are charged as a percentage of the token’s nominal value. Secondly, high FDV and low availability lead to the transfer of undistributed assets to platforms. The median percentage in the sample was 18.6%.

The former BitMEX CEO also highlighted excessive listing costs as a problem. They can reach 16% of the token supply and $5 million in BNB for Binance and up to $2,000,000 on other platforms.

As a solution, he sees either founders refusing to pay fees and focusing on attracting more users or reducing exchange appetites.

“The worse the project, the higher the fee. […] If it has few users, it needs a CEX to dump its ‘dog crap’ on the market. If there is a suitable product and a healthy growing ecosystem, exchange listing is not so necessary. The community will support the token price wherever it is placed,” the expert commented.

In conclusion, Hayes urged founders to allow investors to get rich. To achieve this, he recommended initially conducting a private seed round to create a product for a very limited audience. Only then should they list with a small FDV. A low price will help form a loyal and engaged community.

Instead of CEX, the former CEO suggested considering listing on DEX. This way, additional costs can be avoided. With interested product users, price growth will not be long in coming, the expert assured.

“I want the projects we support at Maelstrom to stop worrying about which CEX will take them and start thinking about their ‘damn’ number of DAU,” he concluded.

Back in September, Binance announced the launch of a pre-market where real tokens, not derivatives, will be traded.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!