As the Fed meeting nears, bearish sentiment weighs on crypto funds

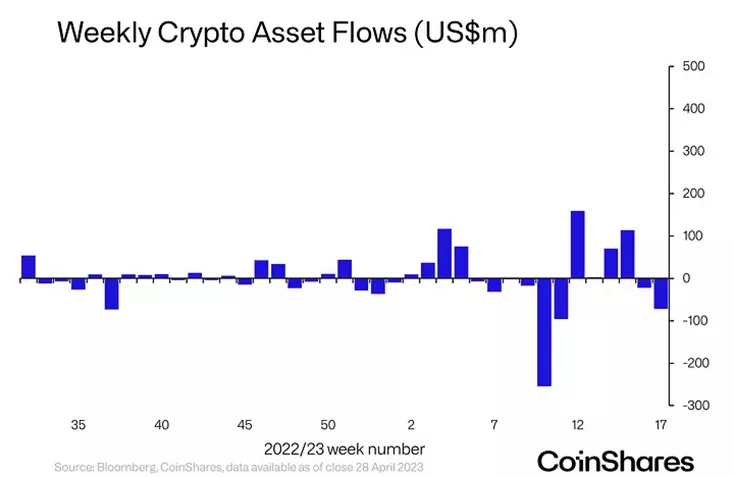

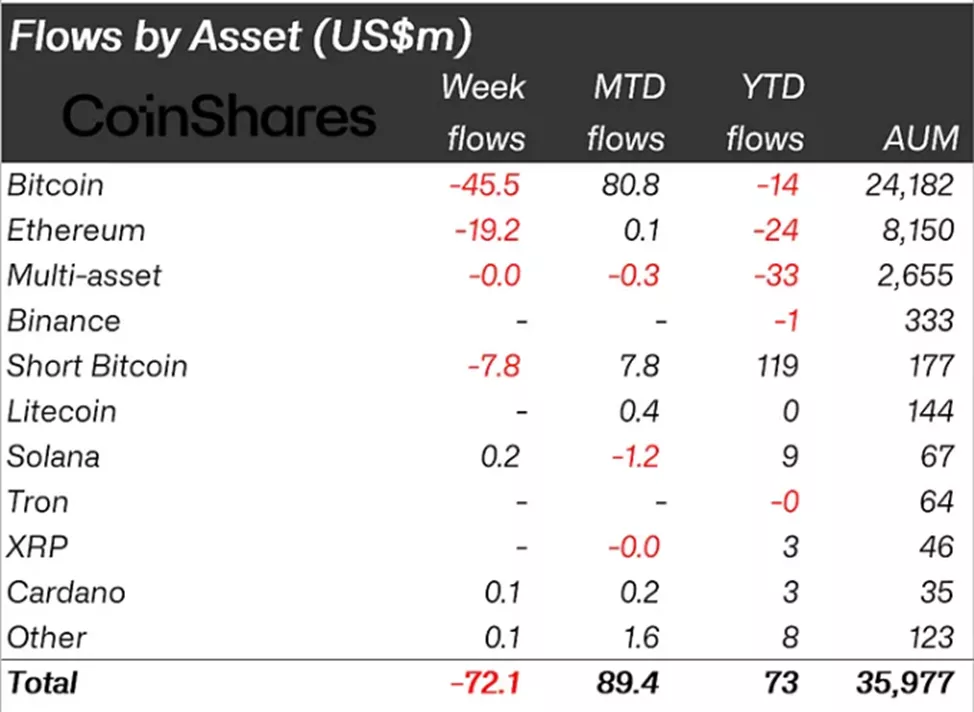

Net outflows from cryptocurrency investment products from 22 to 28 April amounted to $72.1m, compared with $30.4m a week earlier. This assessment was provided by CoinShares analysts.

Analysts attributed the dynamics to the upcoming May 3 meeting of the Fed, where a 0.25 percentage point rate increase is expected.

Outflows from Bitcoin products amounted to $46m (last week $53.1m).

From the instruments that permit shorting the first cryptocurrency, investors pulled the largest $7.8m since September 2022. In the previous reporting period there was an inflow of $1.5m.

Ethereum ETFs recorded an outflow of $19m, the largest since The Merge in September 2022. A week earlier there was an inflow of $17m.

In other altcoins, positive momentum prevailed. Products based on Solana, Algorand and Polygon attracted $0.2m, $0.17m and $0.14m, respectively.

Analysts at Glassnode cited orders to sell «new investors» near the $30,000 mark as a key factor in halting Bitcoin’s rally.

Earlier, Galaxy Digital CEO Mike Novogratz predicted Bitcoin would reach the $40,000 level after the Fed began to cut the key rate.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!