Aster Compensates Traders After XPL Contract Glitch

The exact amount of reimbursed funds remains unknown.

The decentralised exchange Aster has completed compensating users who lost funds due to an error in the perpetual contract of the XPL token from the stablecoin project Plasma.

We are aware of abnormal price movements on the XPL perpetual trading pair. Rest assured, all user funds are SAFU. We are conducting a full review and will compensate any affected users for losses.

— Aster (@Aster_DEX) September 25, 2025

On September 25, the coin’s price on the platform surged to $4, while on other exchanges it was around $1.3. According to Abhishek Pawa, founder of the Web3 agency AP Collective, the issue arose from an incorrectly configured index manually set by the Aster team at $1.

> Aster’s XPL perp had the index hard-coded to $1.

> The mark price was capped at ~$1.22 off that broken index.

> They lifted the cap while the config was still wrong.

> Price on Aster spiked to ~$4 (wick) while other venues stayed near ~$1.3.

> Chart even stalled/stuck briefly… pic.twitter.com/Yn5LOforS4— Abhi | AP Collective (@0xAbhiP) September 25, 2025

“The settlement price, based on the incorrect index, was artificially capped at ~$1.22. The limit was removed before the index setting was corrected. As a result, the price soared to ~$4,” he explained.

Representatives of the DEX promptly rectified the error and promised to compensate affected traders. Compensation was distributed within three hours, followed by a second round of payments to cover trading and liquidation fees. The exact amount of reimbursed funds remains unknown.

The incident occurred amid the launch of Plasma’s mainnet and the debut of its native token XPL. At the time of writing, the asset is trading at $1.17, having dropped nearly 24% in the past 24 hours.

“Hyperliquid Killer”

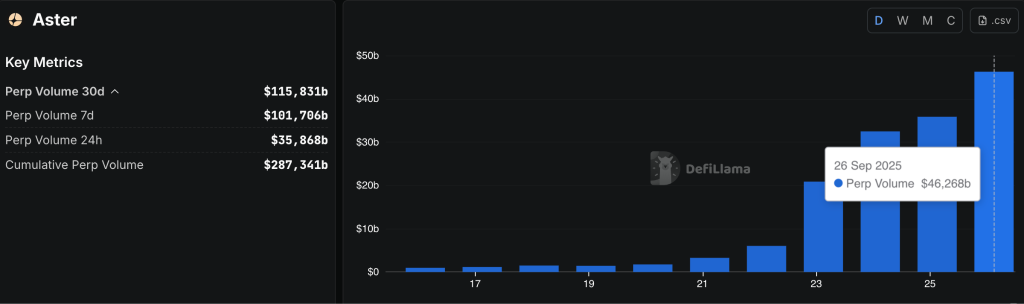

Aster continues to outpace Hyperliquid in daily futures trading volume. Over the past 24 hours, the platform’s volume exceeded $46 billion compared to $17 billion for its competitor.

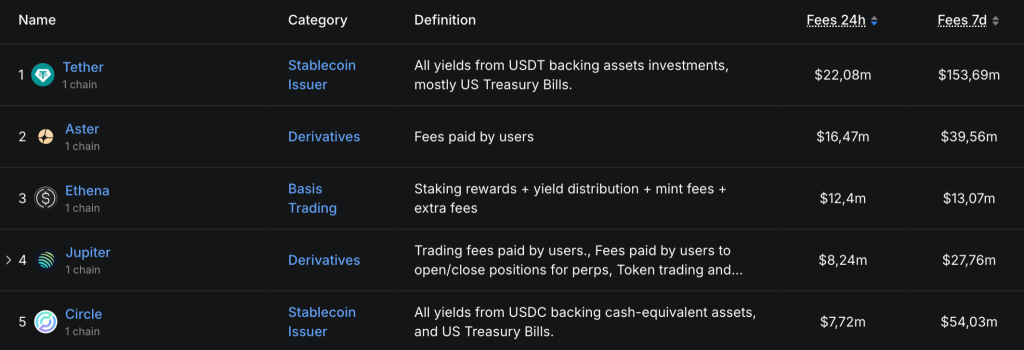

The DEX on the BNB Chain has also surpassed Hyperliquid in fees. The newly launched exchange even managed to outpace Circle, the company behind the USDC stablecoin.

TVL for Aster has already reached $2.2 billion. In this metric, the platform still trails Hyperliquid, which stands at $5.9 billion. However, analysts have suggested that the situation could change soon.

Previously, the community suspected Binance founder Changpeng Zhao of being involved in the launch of the new decentralised exchange.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!