Author of ‘The Bitcoin Standard’ Dismisses Institutional Threat to Bitcoin

- BlackRock and Strategy pose no threat to the first cryptocurrency’s protocol, as they have fiduciary duties to their investors.

- Since November 2024, bitcoin balances on exchanges have dropped by approximately 425,000 BTC, with around 350,000 BTC attributed to corporate purchases.

Even if a single company acquires a substantial amount of digital gold, it will not harm its protocol, stated economist and author of “The Bitcoin Standard,” Saifedean Ammous.

The world has moved closer to a bitcoin standard over the last few months.

I sat down with @saifedean to understand what is happening, why bitcoin will eat gold & the US dollar, and why he thinks everyone is underestimating what is happening right in front of our eyes.

This was… pic.twitter.com/UcaCPGTm68

— Anthony Pompliano ? (@APompliano) April 24, 2025

“If [Strategy’s founder] Michael Saylor ends up with 10 million BTC (48% of the total supply), what will he do? Most likely, he’ll just use them to buy even more of the first cryptocurrency. I don’t see how this threatens the protocol,” the expert stated.

In Ammous’s view, in this hypothetical scenario, Saylor “won’t wake up one day and say, ‘Let’s try to hard fork to get another 5 million BTC.'”

The economist emphasized that pursuing such a plan would simply reduce the value of the existing 10 million BTC.

According to Ammous, companies like BlackRock and Strategy are not the actual owners of the digital gold they manage, as the coins belong to investors.

“Organizations are fulfilling their fiduciary duties,” the expert explained.

In case of misconduct, shareholders will withdraw their funds and find alternative ways to access the first cryptocurrency.

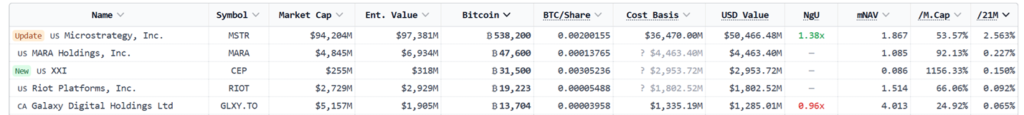

According to BitcoinTreasuries, Strategy holds 538,200 BTC (2.56% of the supply) valued at $50.47 billion.

IBIT’s share from BlackRock is 2.78%. The largest BTC-ETF issuer holds 582,664 BTC ($54.63 billion).

Corporate Influence

Bitcoin balances on crypto exchanges have fallen to 2.6 million BTC — the lowest since November 2018, according to Fidelity Digital Assets.

We have seen #bitcoin supply on exchanges dropping due to public company purchases—something we anticipate accelerating in the near future. Here are some of the current trends unfolding: ⬇️ ?

— Fidelity Digital Assets (@DigitalAssets) April 24, 2025

Experts attribute this trend to increased purchases by public companies following the U.S. presidential elections in November 2024. Analysts believe this trend will intensify.

Strategy leads in activity with 285,980 BTC — 81% of the total figure.

The organization’s latest purchase occurred on April 21. On that day, Strategy acquired 6,556 BTC at an average price of $84,785, totaling $555.8 million.

$MSTR has acquired 6,556 BTC for ~$555.8 million at ~$84,785 per bitcoin and has achieved BTC Yield of 12.1% YTD 2025. As of 4/20/2025, @Strategy holds 538,200 $BTC acquired for ~$36.47 billion at ~$67,766 per bitcoin. https://t.co/YxUq6mHzca

— Michael Saylor (@saylor) April 21, 2025

Previously, the corporation announced plans to raise up to $21 billion in MSTR and $21 billion in STRK over the next three years to accumulate more coins as part of its “21/21 plan”.

In April, TD Cowen assessed the impact of the company’s purchases on the bitcoin price.

As reported, the firm Twenty One Capital, established by Cantor Fitzgerald, aims to challenge Strategy. The organization’s charter fund will consist of 42,000 BTC (~$3.9 billion).

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!