Back to paper

Why governments want to go back to cash

Sweden’s authorities are urging citizens to use cash again, citing international tensions and the possibility of direct confrontation with Russia. Meanwhile, on the other side of the world, Australians are rapidly embracing cryptocurrencies.

ForkLog examines how attitudes to payment methods are shifting across regions—and where digital assets fit in.

Tap your card

Seven years ago Swedish economist Cecilia Skingsley, formerly deputy governor of the Riksbank, predicted that by 2025 the country would be virtually cashless. Her forecast has largely come true: as The Guardian notes, only one in ten purchases in the Nordic countries is now made with banknotes and coins.

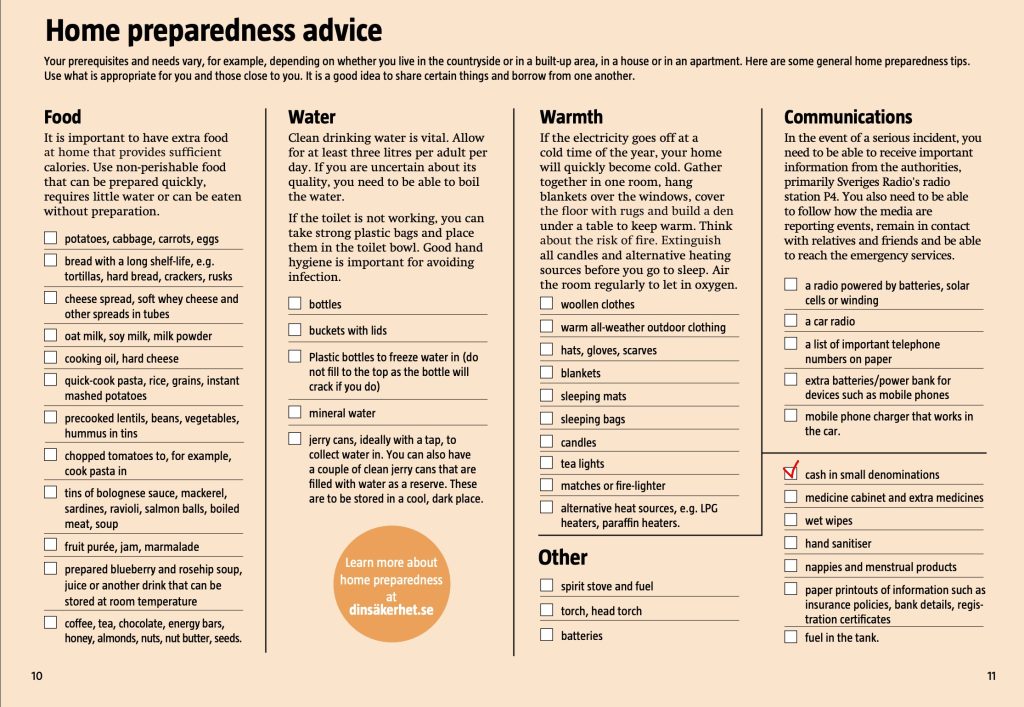

Reporter Miranda Bryant wrote that this worries Riksbank officials because of heightened risks of cyberattacks and communications breakdowns. The authorities even distributed en masse a Ministry of Defence brochure, “If Crisis or War Comes”, urging households to keep cash in various denominations alongside basic food, water supplies and hygiene products.

The return to cash prompted concern from Ethereum co-founder Vitalik Buterin. He suggested the second-largest cryptocurrency as a reserve asset in unstable times, stressing its decentralised nature.

Few are willing to forgo the obvious convenience of electronic payments for the sake of safety, however. According to Statista, the total value of transactions in 2025 will reach $20.09 trillion. The largest slice is payments via mobile POS terminals—$12.56 trillion. Over the next five years analysts expect further growth averaging 13.63% annually. China is the largest market for electronic transfers.

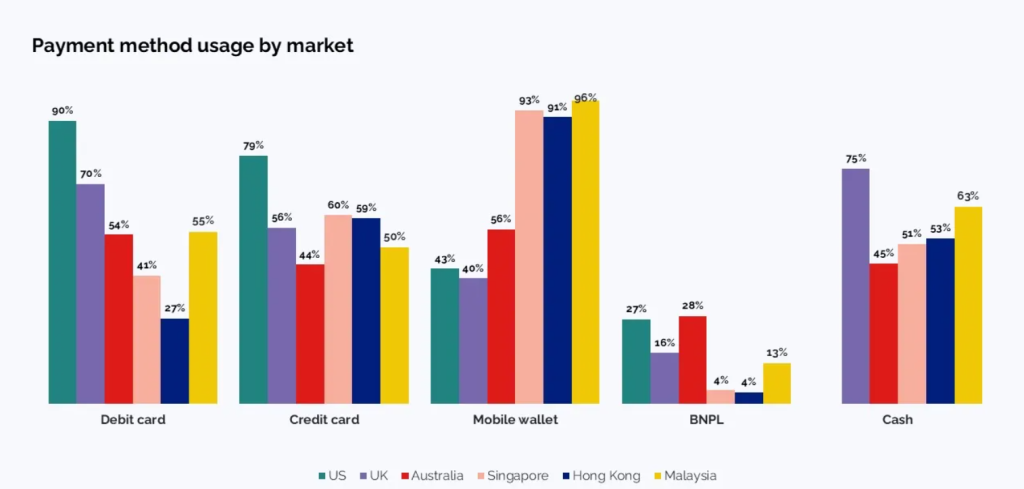

According to RFI Global’s study “How the world pays in 2025”, Buy Now, Pay Later (BNPL) has become a global trend. The scheme is displacing traditional banking mechanisms thanks to quick, simple quasi-loans, which has already drawn the attention of regulators in many countries.

The pandemic accelerated the retreat from cash wherever possible. The move to remote work reshaped payroll. For small firms paying “off the books”, passing on cheques and envelopes became harder. Large companies hiring remote staff globally ran into steep fees on traditional SWIFT transfers. As a result, Western Union and MoneyGram started ceding ground to fintech platforms like Payoneer, Wise and Revolut, which charge much less.

In parallel with the growth of cashless fiat transactions, more pioneers opted for the crypto alternative. According to Rise, 25% of companies now pay staff in digital assets, up from just 15% in 2023.

Over the past year the share of employees in the blockchain industry who are paid mainly in stablecoins has tripled—from 3% to 9.6%. The main assets are USDC with a 63% share and USDT with 28.6%.

Globally, crypto payment systems are on the rise.

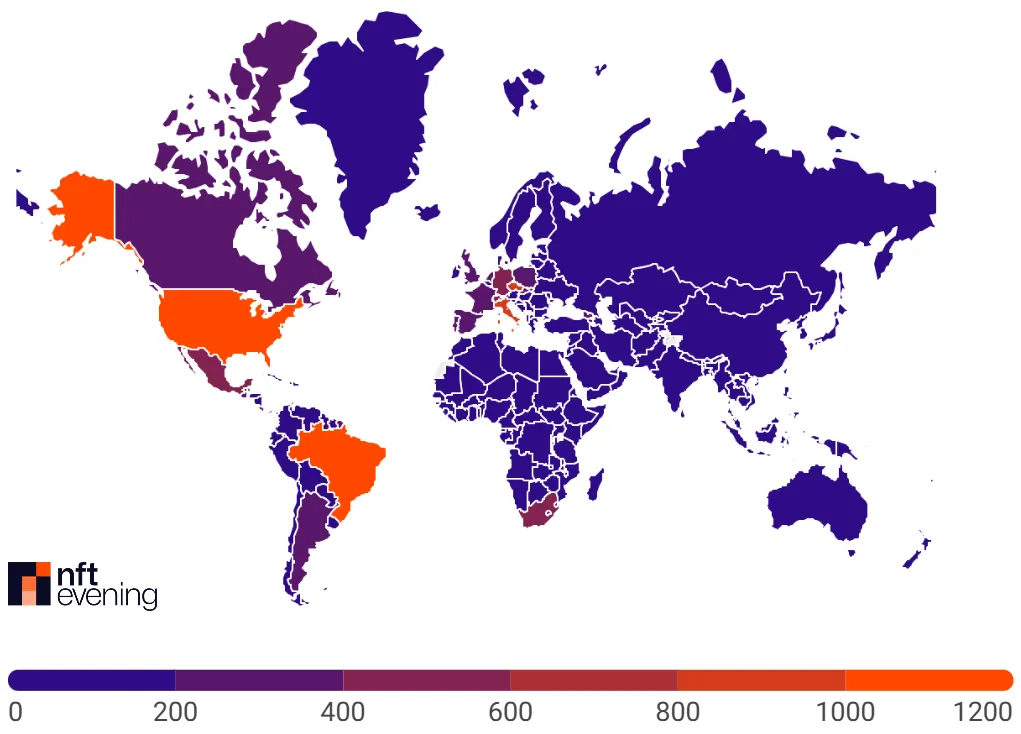

According to a March report by NFTevening, 12,834 companies, merchants and service providers worldwide accepted crypto payments in 2024—50% more than a year earlier.

After adding digital-asset payments, 88% of companies reported higher revenue, and 76% did not immediately convert it to fiat. Brazil tops the list with 1,292 businesses accepting “blockchain money”, followed by the United States, Czechia and Italy. Across the European Union, 5,677 firms accepted digital assets last year—a record.

Still cash-heavy countries

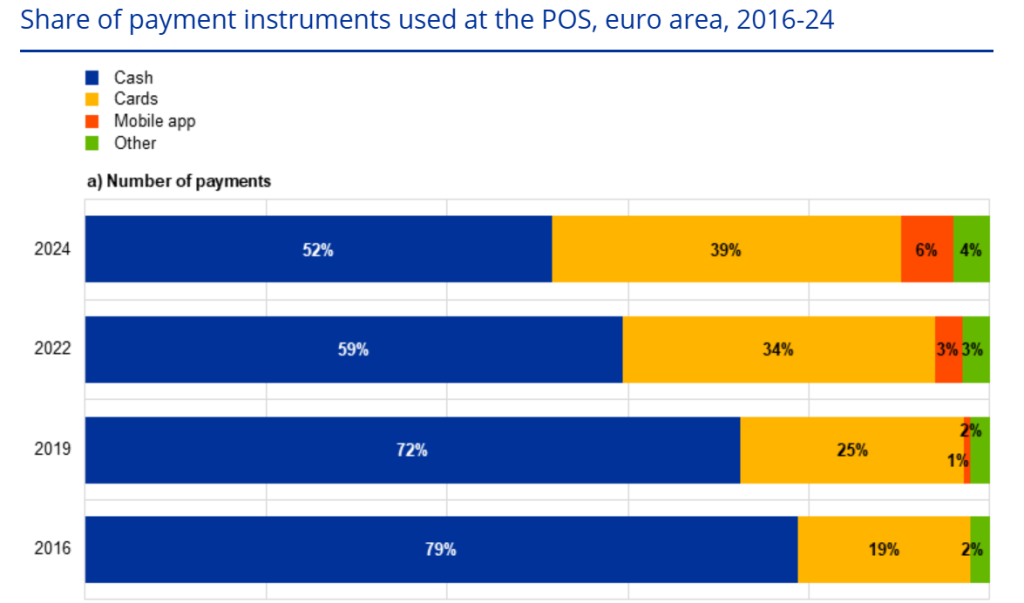

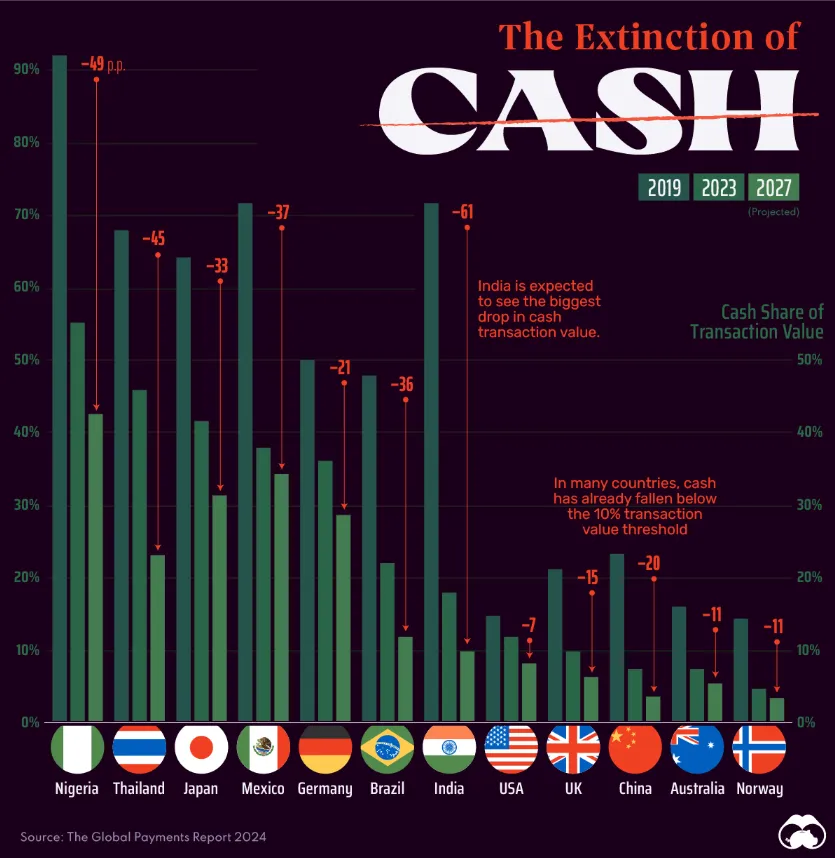

The highest use of cash today is seen in parts of Asia (Thailand, the Philippines, Japan), as well as Nigeria and Colombia. In the European Union, cash remains a popular means of payment: in 2024 its share was 52%. Residents of Slovenia, Malta, Austria, Italy and Germany are the keenest users.

Launched in 2020, the European Payments Initiative aims to create a unified service for cards, mobile payments and P2P transfers. It is expected to go live within the next two years. A digital euro is planned by 2028.

The picture is different in developing countries, where access to banking is limited and local currencies steadily lose value to hyperinflation. Alongside banknotes, people are increasingly using cryptocurrencies, which partly offset a rapidly widening technology gap.

Nigeria is one such country. In 2023 it joined India, Mexico and Brazil at the top of the league for the decline in cash transactions. In August 2025 the African state ranked sixth for digital-asset adoption.

Cryptocurrencies are making steady inroads where they are genuinely needed to solve everyday problems. There are also examples in the rich world where digital assets are edging towards mass adoption.

Australia: high adoption

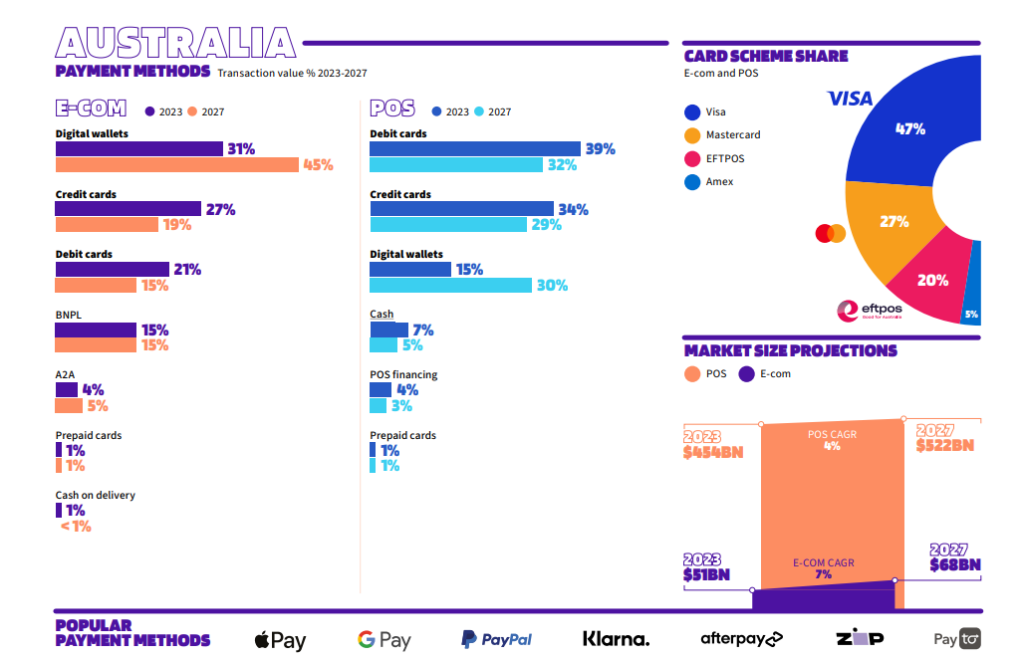

As of 2023, cash turnover in Australia fell to a record low of about 7%. If in 2015 more than 80% of residents used cash at least once a month, by 2025 that figure had dropped to 45%.

ATMs are gradually disappearing from the streets as demand wanes—worrying cash advocates. Australians are among the most progressive adopters of modern payment tools: BNPL accounts for 15% of payments.

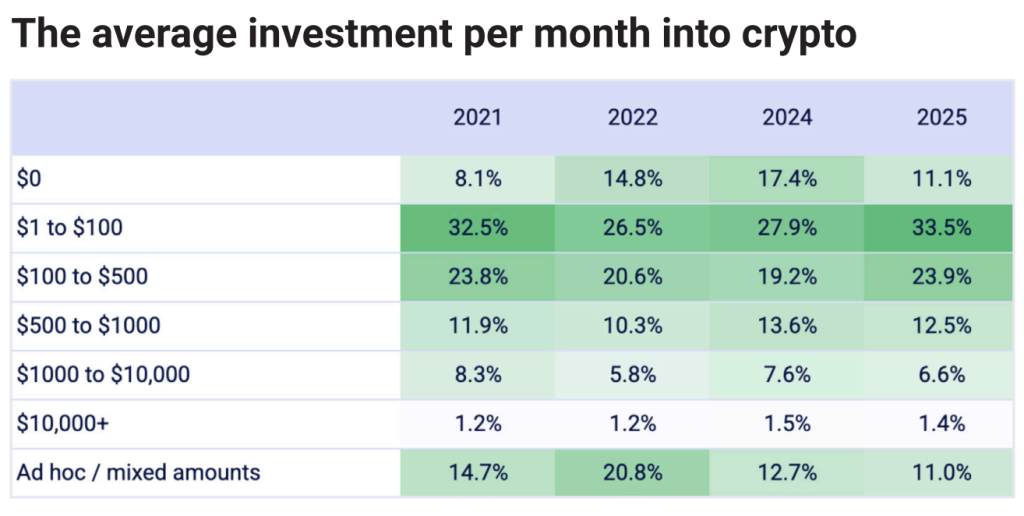

Australians are also on good terms with cryptocurrencies. According to Independent Reserve, awareness is high—over 95% have heard of at least one digital asset. As of 2025, about 31–32.5% of the adult population own or have owned digital assets, up from 28.8% in 2021. Bitcoin remains the most popular cryptocurrency.

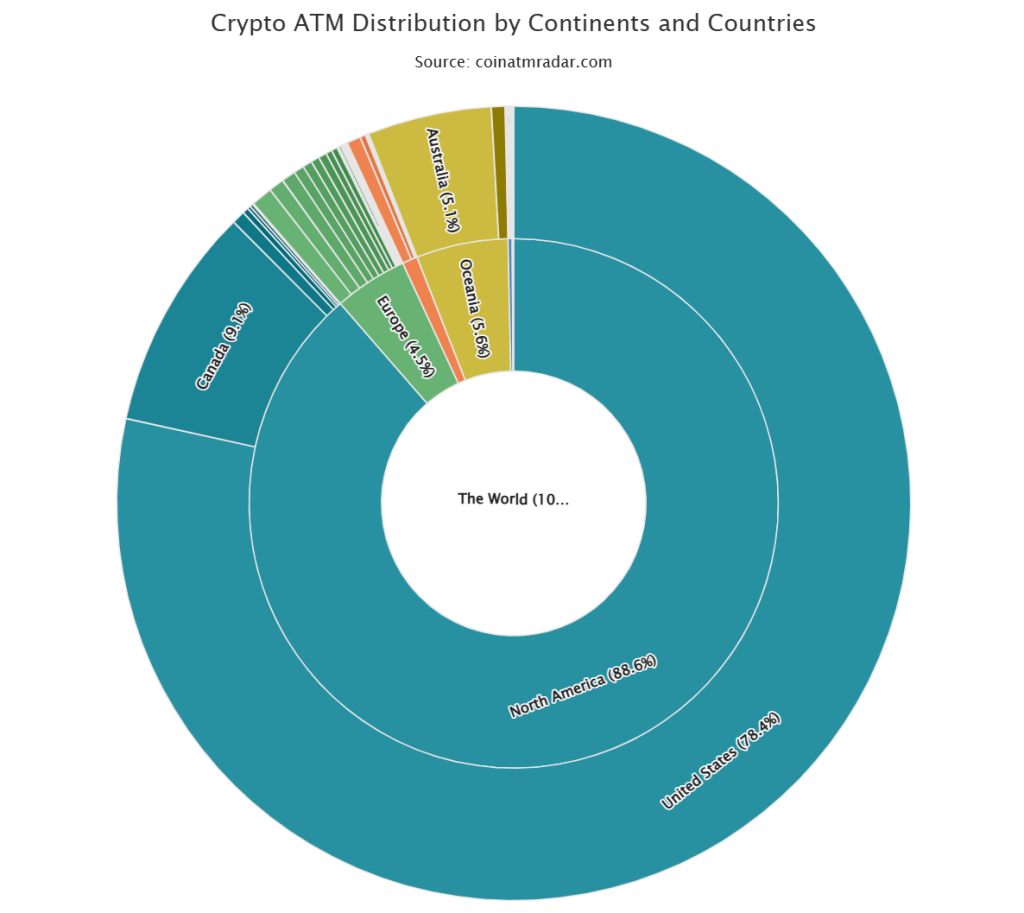

Australia also ranks third worldwide by number of crypto ATMs. At the time of writing, the country has 1,990 such machines.

Cryptocurrencies are penetrating Australia’s financial system, notably through self-managed superannuation funds. Exchanges Coinbase and OKX are launching products aimed at them.

Even so, Australians periodically run into regulatory headaches. While cryptocurrencies are legal, about 20% of investors reported banks blocking or delaying their transactions.

The United States also shows steady progress. According to Security.org, in 2025 roughly 28% of American adults own cryptocurrencies, and among Generation Z the share is as high as 51%.

Payment approved

As the financial system evolves, money is taking on more forms, responding to the needs of different regions. On the one hand, the rise of fintechs, neobanks and mobile solutions lets providers tailor systems to age, geography and even religion. On the other, this inevitably fragments the global payments landscape—offering choice yet posing a stability risk as cash reserves shrink.

Cryptocurrencies are carving out a niche in payments from private solutions to state-backed pilots. The fastest expansion is in fast-growing economies of Asia and Latin America. While the ECB prepares a domestic payment solution to reduce Europe’s reliance on the United States, Sweden and its neighbours are rolling out cashless systems—while rebuilding cash buffers.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!