Bernstein Affirms Resilience of USDC Issuer

Circle shares fell 12.2% despite strong Q3 report; Bernstein sees investor fears as unfounded.

Shares of Circle, the issuer, fell by 12.2% despite a strong third-quarter report. Analysts at Bernstein consider investors’ concerns unfounded, reports The Block.

The company’s revenue amounted to $740 million, and adjusted EBITDA was $166 million. These figures are 5% and 26% above analysts’ forecasts, respectively. Income from reserves increased by 12% to $711 million.

Bernstein attributed the decline in shares to concerns about potential interest rate cuts and competition. Experts deemed these fears “misplaced” and found no reason to alter the long-term forecast.

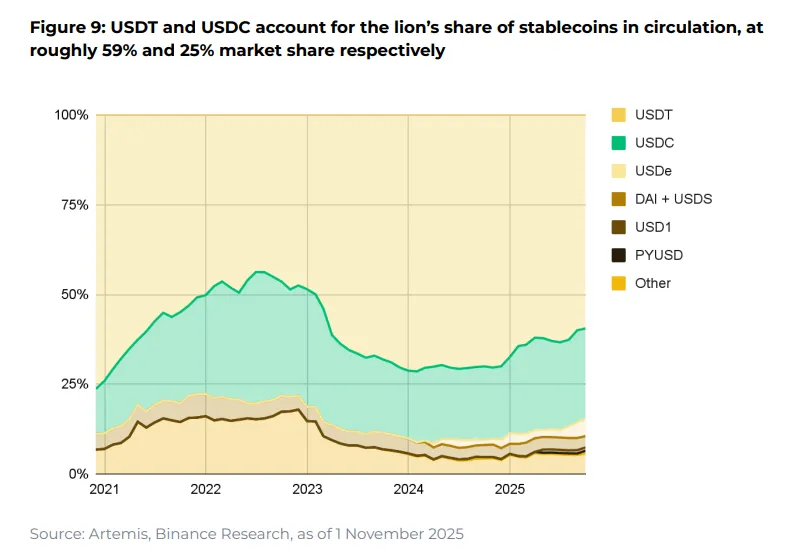

They noted a 20% increase in the supply of USDC over the quarter, reaching $73.7 billion. The market share of the stablecoin reached 29%.

In the report, the company stated that it is “exploring the possibility” of issuing a native token for the Arc network, which would coexist with USDC.

Analysts acknowledged the threat from competitors like Stripe but consider liquidity to be USDC’s main advantage. They noted that even PayPal and Ripple faced challenges when launching their own “stablecoins.”

Bernstein maintained an Outperform rating for Circle’s shares with a target price of $230. This suggests a potential increase of 167% from the closing price on November 12 ($86.3).

B2B Payments in Stablecoins

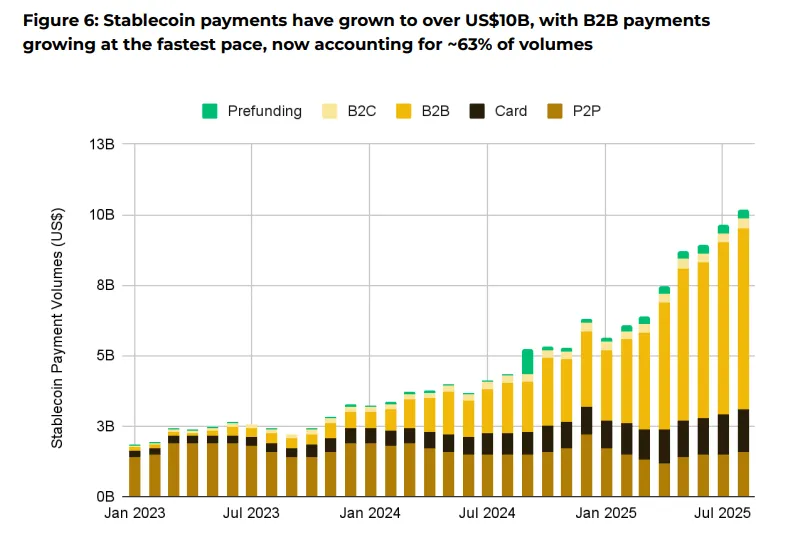

The volume of B2B payments in “stablecoins” has increased more than 50 times since January 2023, reaching $6.4 billion by August 2025. Fiat-pegged tokens are transforming from a trading tool into infrastructure for global business, according to a report by Binance Research.

According to data from the analytics company Artemis, the total volume of stablecoin payments since the beginning of 2023 has increased 5.4 times, exceeding $10 billion. The B2B segment accounts for about 63% of this amount.

Findings are confirmed by a survey from Ernst and Young in September 2025: 62% of respondents used this asset class for cross-border settlements with suppliers, and 53% for receiving payments from business partners.

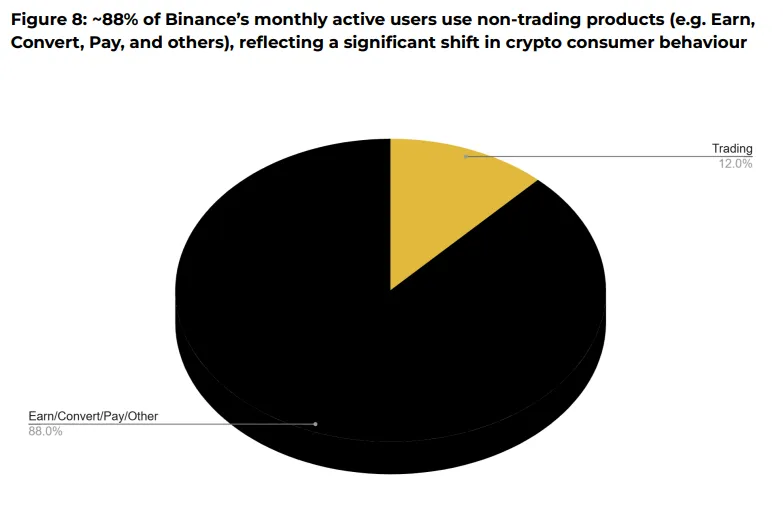

The trend towards utilitarian use is reflected in user behavior. According to Binance, 88% of the exchange’s monthly active clients use non-trading products such as Earn, Pay, and Convert. Only 12% are actively engaged in trading.

The market for centralized stablecoins remains concentrated. Tether (USDT) and Circle (USDC) account for 84% of the total supply.

Analysts at Binance Research noted that fiat-pegged assets are transitioning from niche trading instruments to elements of basic financial infrastructure.

The growth of B2B payments, changes in user behavior, and the emergence of clear regulations lay the foundation for further integration of “stablecoins” into global commerce.

In October, Bernstein experts forecasted nearly a threefold increase in USDC supply over two years.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!