Bernstein Predicts Miner Stocks to Outperform Bitcoin on Path to $150,000

Shares of mining companies remain the best proxy investments in Bitcoin as the cryptocurrency moves towards the $150,000 target. This view is shared by Bernstein analysts, as reported by The Block.

In a note to clients, Gautam Chhugani and Mahika Sapra highlighted that historically, miner stocks have almost always outpaced Bitcoin in growth during bull markets. As we are in the middle of the current cycle, each “window of weakness” for digital gold miners is seen as an opportunity to buy their shares, according to the experts.

They assert that the segment is dominated by retail investors, while institutions largely avoid investments in “Bitcoin proxies” due to ongoing skepticism about cryptocurrencies.

However, amid the asset’s rise to new highs, analysts expect institutional interest in industry-related company stocks to awaken. Miners are expected to be the primary beneficiaries of capital inflow, Chhugani and Sapra believe.

They particularly focus on shares of Riot Platforms and CleanSpark. According to the experts, despite the halving, investments in these companies will yield 60-70% gross profit if Bitcoin’s price remains at its current level or higher.

“Any reduction in mining capacity following the halving of block rewards (we estimate 10-15% will close) will lead to both Riot and CleanSpark increasing their relative market share,” the analysts suggest.

Galaxy Digital specialists previously predicted that as a result of the halving, approximately 15-20% of Bitcoin’s computing power will become unprofitable.

Bernstein experts believe that growing activity in the ecosystem of the first cryptocurrency, driven by developments in L2 solutions, DeFi, and NFT projects, will increase the share of fees in miners’ revenue from the current 5% to a stable 15%.

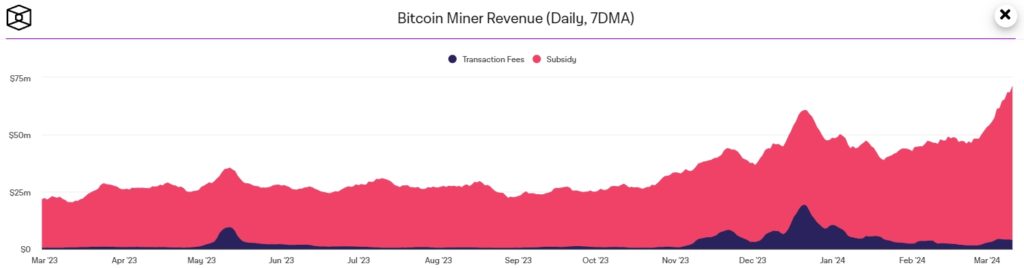

Meanwhile, on March 11, the daily revenue of Bitcoin miners reached a record $71.12 million (smoothed by a seven-day moving average), according to The Block.

Transaction fees amounted to only $3.73 million in total. This figure is significantly lower than the December highs reached during the Ordinals boom.

Bernstein Analysts More Confident in Bitcoin’s Path to $150,000

Chhugani and Sapra anticipate a further surge in the price of the leading cryptocurrency post-halving. They are even more convinced of their forecast of reaching $150,000 by the end of 2024.

Their initial assessment was based on expectations of a $10 billion inflow into spot Bitcoin ETFs this year and another $5 billion next year.

However, the figure has already exceeded $9.5 billion, with an average daily inflow rate of about $370 million. This suggests that the experts’ forecast for 2025 will be surpassed within 166 days.

Chhugani and Sapra believe that Bitcoin fund issuers have yet to truly “tap into” traditional capital pools such as pension and sovereign funds, private banks, and other institutions.

“These are still early days for Bitcoin’s integration into traditional asset portfolios,” the analysts assert.

Earlier, Tom Lee, co-founder of the analytical firm Fundstrat, predicted a similar target for digital gold — $150,000 this year.

Author of the bestseller “Rich Dad, Poor Dad” and entrepreneur Robert Kiyosaki has raised his forecast to $300,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!