Betting on efficiency: how bitcoin miners are adapting to new realities

Since the announcement of ‘liberation’ tariffs, bitcoin fell sharply — as did the глобальные фондовые индексы. At one point, volatility in the S&P 500, the “barometer of the American economy,” even превзошла swings in the leading cryptocurrency.

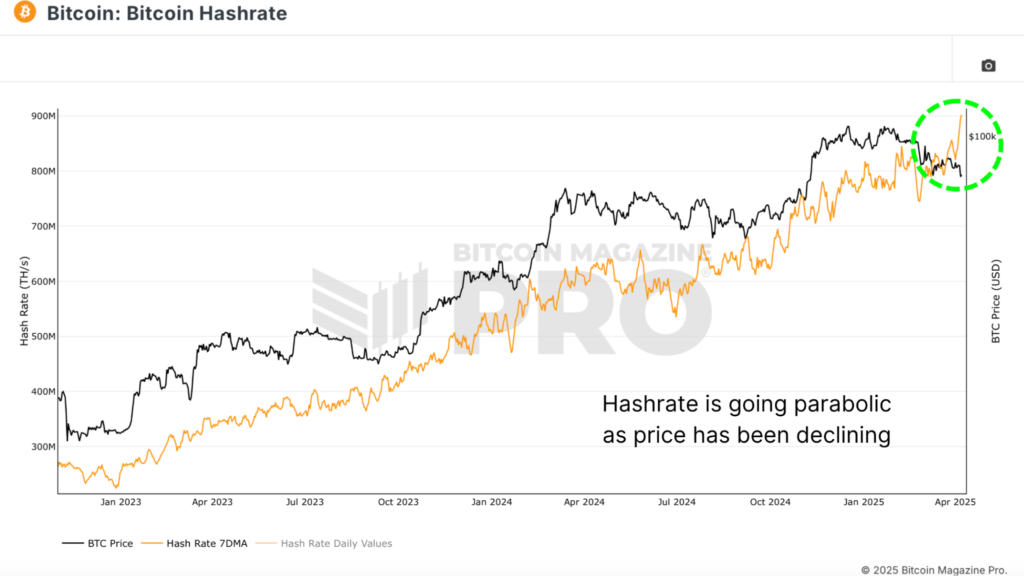

One might have expected miner capitulation amid uncertainty and declining profitability. Instead, hashrate is hitting records and network difficulty is rising. All this suggests market participants still believe in digital gold’s long-term potential.

Hashrate vs bitcoin’s price

Despite an uninspiring price trend, the network’s hashrate continues its “rocket ride” — the metric keeps setting all-time highs, shrugging off macro ructions and market turbulence.

The two usually move together: when price falls or flatlines, mining profitability drops and hashrate tends to stagnate or decline.

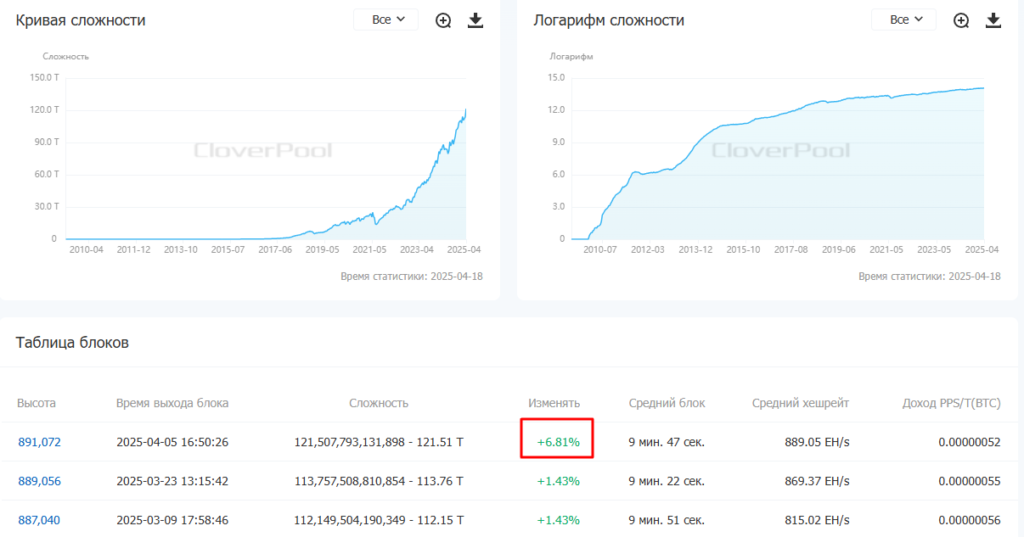

Difficulty, which is inextricably linked to hashrate, jumped by almost 7% on April 5.

The metric adjusts automatically to maintain a stable block interval and rises only in response to a notable increase in network computing power.

Miners, it seems, are going all-in: they are adding capacity and investing in infrastructure even though today’s price hardly promises a quick payback.

At first glance, the strategy looks irrational. Yet it may reflect firm conviction in bitcoin’s long-term potential and strong rewards for those securing the network.

A bet on the future

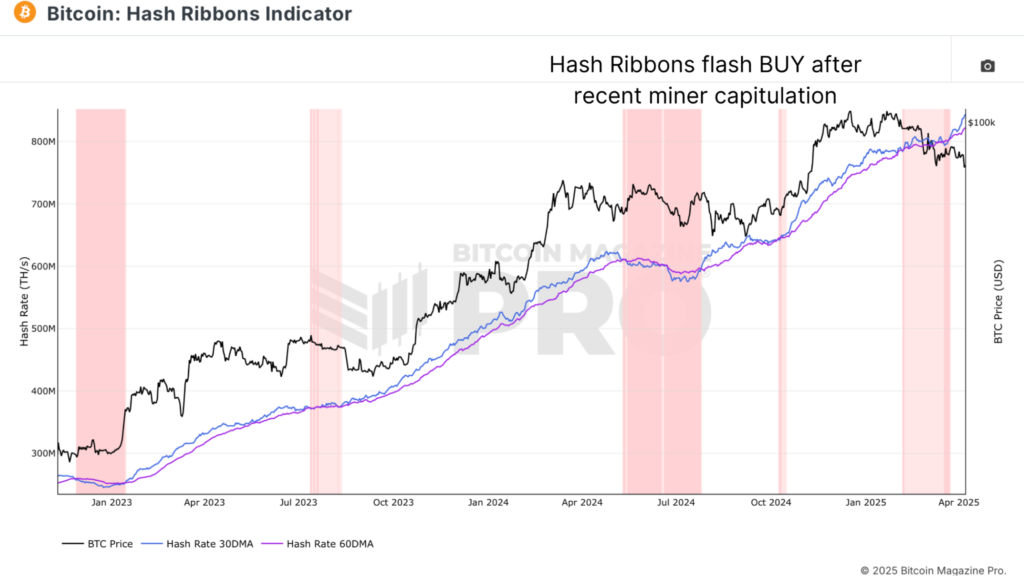

Recently the “difficulty ribbon” indicator flashed a buy signal for bitcoin, adding intrigue to the market backdrop.

A rising 30-day moving average (blue) crossing above the 60-day (purple) signals the end of miner capitulation and a revival in their “vitality”. Visually, the chart background switches from red to white.

“Historically, such crossovers have often marked turning points for bitcoin’s price,” — пояснил Bitcoin Magazine Pro lead analyst Matt Crosby.

He finds today’s setup especially notable: the clear breakaway of the faster moving average is not just a sign of miner recovery but a “big bet on the future”.

Not so simple

Many read a rising hashrate as a bullish signal, but “the reality is far more complex,” noted Bitcoin Magazine Pro and Blockware Solutions analyst Mitchell Askew.

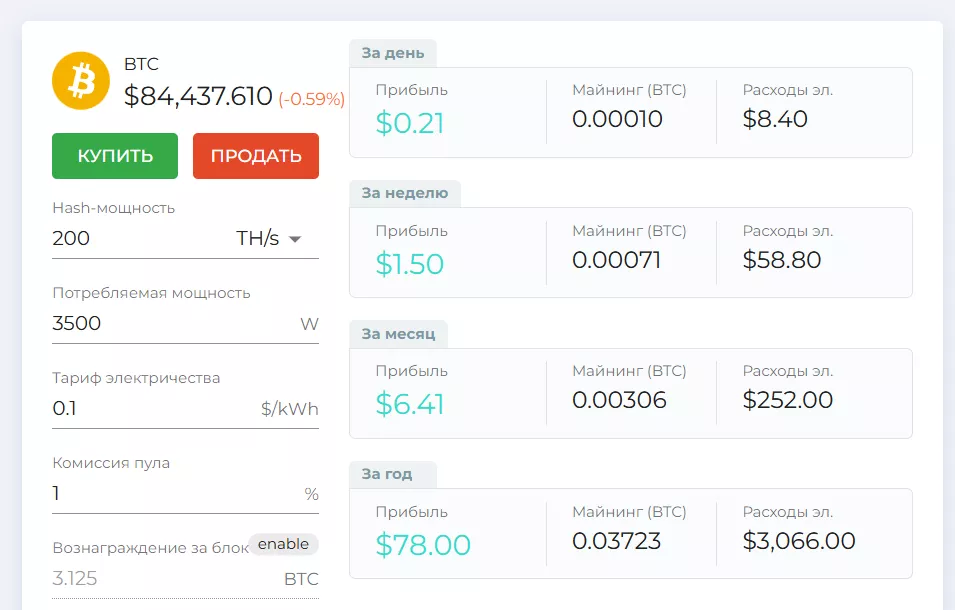

“In the short term, growth in the metric can be bearish as it intensifies competition among miners and forces them to sell more bitcoin to cover power costs. Over the long run, however, a higher hashrate reflects greater investment in infrastructure and improved network security,” the expert explained.

CoinDesk senior analyst James Van Straten is also concerned by the rise in hashrate and difficulty against subdued on-chain activity and relatively low prices.

“For miners to remain profitable and cover operating and capital expenses, you need a high bitcoin price, full blocks and high transaction fees,” he stressed.

Van Straten likened bitcoin’s blockchain to “a powerful train hurtling down the tracks, but without passengers”.

“I hope bitcoiners realize this space is more than just podcasts, X audio rooms and ‘up only’ on the digital-gold narrative. If we don’t get people using bitcoin for real commerce, the game is over,” said former Nasdaq board member Nicholas Gregory.

A more optimistic view was offered by CryptoQuant contributor Yonsei_dent. In his view, sustained growth in hashrate and difficulty amid falling price points to powerful fundamentals — chiefly the asset’s intrinsic value and network security.

According to Hashrate Index, хешпрайс is stagnating near a ~$40 per PH/s per day low. The current reading is $44.3.

To Yonsei_dent, rising technical metrics may look negative because they raise mining costs, but they ultimately reinforce bitcoin’s constructive outlook. He cited CryptoQuant CEO Ki Young Ju who, analysing hashrate trends, allowed for a potential surge in the leading cryptocurrency’s market capitalisation to $5trn.

The tariff backdrop

What is stoking miners’ urgency in a less-than-friendly environment? Crosby argues one driver — especially in the US — is a rush to front-run the impact of forthcoming “liberation” tariffs.

“Bitmain — the largest maker of mining hardware — could be hit. Amid changes in trade policy, ASIC prices could rise by 30–50%, and in the worst case more than double,” the specialist suggested.

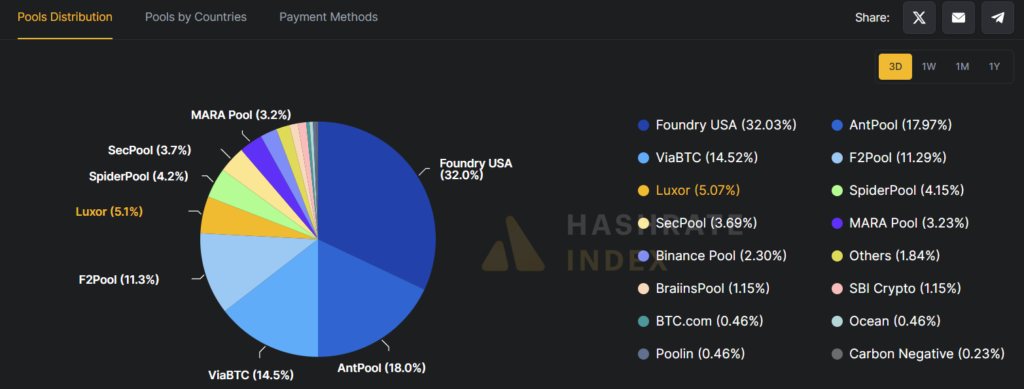

More than 40% of bitcoin’s hashrate is concentrated in US giants such as Foundry USA, MARA Pool and Luxor.

“That leaves miners especially exposed to higher costs: even small increases can hit profitability hard. This may explain why capacity is being added now — while hardware remains (relatively) available and cheap,” Crosby noted.

A shot in the foot?

Many industry experts expect the “liberation” tariffs announced on April 2 to hit US bitcoin miners.

Most mining rigs enter the country from Malaysia (a new tariff of 24%), Thailand (36%) and Indonesia (32%), noted Blockware Solutions founder and CEO Mason Jappa.

“Rigs already delivered to the US will become more expensive,” he said.

BitMars general manager Summer Man added China (54%) to the list. She stressed that all factories of Bitmain, the largest maker of bitcoin-mining equipment, would be affected.

По оценке analysts at The Mining Pod, the China-based company controls about 80% of the global ASIC-miner market. Its closest competitor and “countryman”, MicroBT, holds around 7%, with both firms’ production concentrated in the same jurisdictions.

Both companies earlier said they would launch manufacturing lines in the US. Yet ничего не известно about the true scale of those plans. Moreover, chips for the rigs still arrive from abroad.

According to Lauren Lin, head of hardware at service firm Luxor Technology, some suppliers are scrambling to “catch the last train”, rushing large ASIC shipments from Asia to the US.

Hardware accounts for a substantial share of miners’ costs, and a rise of more than 20% in purchase prices will materially affect profitability, she added.

Synteq Digital CEO Taras Kulik believes the announced tariffs “will stifle further sector development”.

Hashlabs head Jaran Mellerud forecast a short-term spike in mining-rig imports amid a temporary “tariff reprieve”.

Before mutual tariffs took effect, US President Donald Trump announced a 90-day delay, leaving in place a base rate of 10%.

Mellerud called that levy “material, but not fatal”.

“By paying 10% more for rigs than overseas competitors, US miners are at a disadvantage. That is not enough to make crypto mining in the US unprofitable, but it raises capex and weighs on the viability of new investments over the long term,” he conceded.

For these reasons, miners will hurry to bring equipment into the US to get ahead of possible future price rises, the expert added.

Earlier, Mellerud estimated the impact of the tariffs announced by Trump on US bitcoin miners. He expects equipment costs to rise by 24%. The payback period for Bitmain’s latest-generation Antminer S21 would extend to 23 months, versus 18 months for firms outside the US.

“The US share of the global bitcoin-mining industry is likely to decline because of the tariffs. The country will remain a major player, but its dominance will wane, leading to a broader global distribution of hashrate,” Mellerud concluded.

Mining goes on

“Bitcoin mining has never been this unprofitable per terahash,” Crosby noted.

In his experience, toward the end of bear markets hashprice typically starts to rise: competition eases and weaker participants exit.

“But this time is very different. Despite low profitability, miners are not only staying online, they are adding computing power. That points to two likely scenarios: either they are trying to accelerate the accumulation of digital gold as margins narrow, or — more optimistically — they are confident in bitcoin’s future profitability and are buying the dip,” the expert said.

As ever, new, more power-efficient and capable rigs are arriving. Bitdeer has tested its SEAL03 bitcoin-mining chip, demonstrating energy efficiency of 9.7 J/TH. That matches Bitmain’s flagship Antminer S21XP Hydro.

The firm plans to unveil a next-generation chip with 5 J/TH energy use.

A fly in the ointment

In the first quarter, sales by smaller miners climbed, Coin Metrics noted.

After the halving that took place in April 2024, larger miners were better positioned: they could upgrade to more efficient machines and deploy them in regions with cheaper power. Some big firms, such as Core Scientific, diversified into the high-margin market for AI compute.

TheMinerMag analysts found selling pressure from public mining firms — March saw the highest coin sales since October 2024.

Fifteen major players “offloaded” more than 40% of their March production in aggregate. HIVE, Bitfarms and Ionic Digital all exceeded 100%.

Analysts attribute the March shift toward selling to weaker mining revenues with hashprice stuck near lows and rising uncertainty from trade wars.

CryptoQuant author Axel Adler Jr also linked the current uptick in miner selling to economic pressure from trade tariffs. In his words, this does not look like “capitulation or panic”.

Miners are holding up well. Even with the recent price drop, their sentiment is on the rise -a clear sign they still believe in Bitcoin’s long-term potential.

The current wave of selling looks more like a response to economic pressure from trade tariffs than any sign of… pic.twitter.com/t5nVkcKv6Y

— Axel ?? Adler Jr (@AxelAdlerJr) April 17, 2025

“Miners are holding up well. Even despite the recent price drop, their sentiment is improving — a clear sign they still believe in bitcoin’s long-term potential,” the analyst noted.

Conclusions

Despite an uninspiring price trend, bitcoin’s hashrate keeps rising, setting new records in the face of macro instability and market volatility.

The sharp turn in US trade policy matters: steep tariffs on imported mining hardware could materially raise ASIC costs. American miners and large pools risk higher expenses, which helps explain the push to add capacity while equipment is still (relatively) affordable.

Selling pressure tied to uncertainty around the “liberation” tariffs remains a factor. Yet many experts do not see this as capitulation or panic. On the contrary, a rising hashrate alongside a stagnant price signals ongoing innovation and confidence in bitcoin’s long-term prospects.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!