Beyond the Wild West: why VCs are leaving crypto—and crypto is leaving VCs

In the year now ending, analysts observed a marked rollback in venture funding for cryptocurrency projects to levels reminiscent of 2017. There is, however, a silver lining: some initiatives are trying to revive a spirit of independence from VC—at least in their declarations.

Oleg Cash Coin explains why for ForkLog readers.

Not so long ago

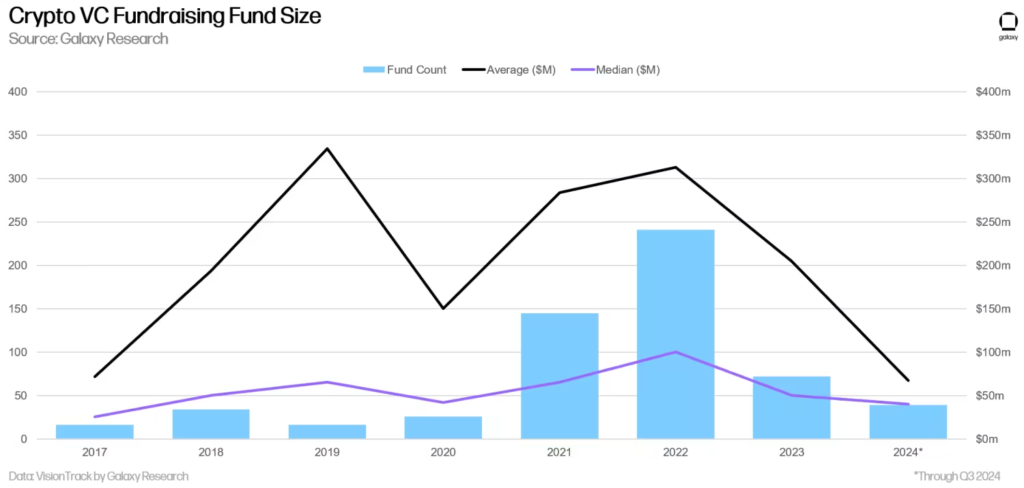

The investment landscape in 2024 differed little from the previous year, save for the last three months, when venture activity multiplied. From October the mood changed, though in terms of capital raised from the VC segment the market still lags far behind 2021–2022.

The chart shows clearly the diminished role of venture firms. According to Galaxy’s data, the median size of new crypto funds fell to its lowest since 2017—$40m.

With 2024 drawing to a close, it is set to be the weakest fundraising year since 2020. Only about 40 new funds raised $1.95bn, well below the frenzy of 2021–2022. Notably, the largest share of capital went to companies and projects founded in 2021 and 2022. By comparison, in the lacklustre 2023 those figures were reached in Q3 alone.

In previous bull cycles there was a steady correlation between the volume of venture investment and rising crypto prices. Over the past two years that link has weakened: a stronger market has not lifted the VC segment as it did before. Several factors may explain this.

As the United States remains the dominant venue for capital allocation, regulatory uncertainty after FTX’s collapse, alongside broader access to exchange-traded products, may have caused a bottleneck.

Today many find it safer to enter crypto via shares of public blockchain firms and crypto funds or ETFs; the market offers ample liquidity.

Private projects and startups may have receded into the past for large pools of capital. The “Wild West of ICOs” likely moved into the respectable offices of specialist funds and the corporate arms of big crypto companies.

Users to blame

The slide in the number and size of deals coincided with the rise of high-FDV tokens with scant circulating supply.

Binance Research’s report shows how the trend toward “sensible” tokenomics started to fade right after FTX’s collapse. This may reflect reduced competition in token issuance in 2022–2024 compared with the previous bull cycle.

Plainly, tokenomics in which 95% or more of a project’s tokens unlock in later years weighs on prices.

Investors quickly concluded such projects lack long-term prospects. Lately they seem to prefer those with the highest possible MC/FDV.

By that measure, memes typically lead. Their MC/FDV is almost always 1, removing the risk of post-unlock selling by early investors who bought in private rounds at prices many times below market. Meme coins have returned to ordinary users the chance to compete on equal terms, even with modest means.

The trend has been embraced by venture investors and entire companies, which in 2024 set up specialised units to invest in meme coins. Binance, Avalanche, TRON and TON all launched such efforts. So did traditional organisations.

Bitwise’s chief investment officer Matt Hougan voiced open support for such products:

«I would prefer that meme coins be invested in via ETFs, rather than through FTX».

Indeed: why buy high-risk assets with a payoff measured in years when one can enter the meme-coin market and see returns in a month—or even a week?

Where the money is going

One revelation of 2024 was the Bitcoin ecosystem, which began experimenting with DeFi. According to data from DeFi Llama, roughly 30 such startups raised about $650m—over 60% of what investors provided in 2022 and 2023.

Outside Bitcoin, venture capital has been most active in AI and developer tooling; in the second half of 2024 these categories together accounted for more than 50% of investments.

CryptoRank’s figures are echoed by Galaxy analysts, who recorded a fivefold jump in AI investment in Q3 2024.

It seems few large firms now lack AI applications in their investment plans. Some of them, like Coinbase Ventures, bet on infrastructure projects; others, such as VanEck and a16z, foresee the rise of AI agents and their evolution into economic actors—naturally bringing million-dollar profits to beneficiaries.

Even so, 2024 saw the return of community projects striving to do without VC. Setting memes aside, a notable late-year event was the launch of Hyperliquid’s token (HYPE), which became the largest airdrop in crypto history.

Needless to say, no venture firm was publicly involved. The team states:

«Hyperliquid Labs is self-funded and does not raise external capital».

The project chose an unusual path for 2024, releasing about 30% of tokens from the maximum supply at the TGE.

In short, the crypto market—especially in 2024—has tilted toward highly liquid, regulated investment avenues. And token success has increasingly been defined by limited public VC involvement at the earliest stages.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!