Binance Holds $31 Billion in Stablecoins, Attracts Major Investors

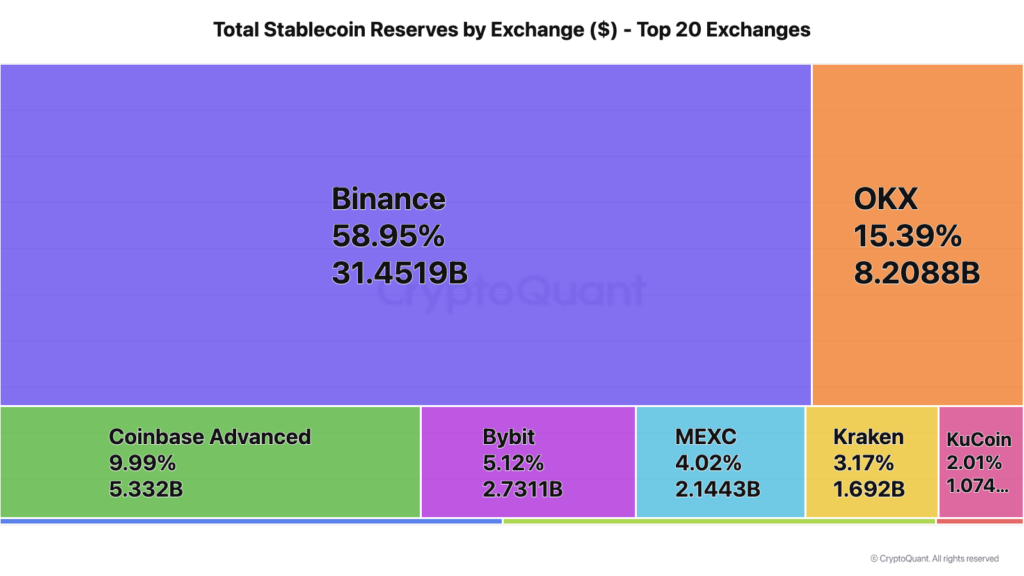

Cryptocurrency exchange Binance has consolidated $31 billion in reserves in stablecoins Tether (USDT) and USDC, accounting for nearly 59% of the total volume of “stablecoins” on the top 20 trading platforms, according to analysts at CryptoQuant.

In May 2025, Binance recorded stablecoin inflows amounting to $31 billion. Since the beginning of the year, the inflow of USDT and USDC has reached $180 billion.

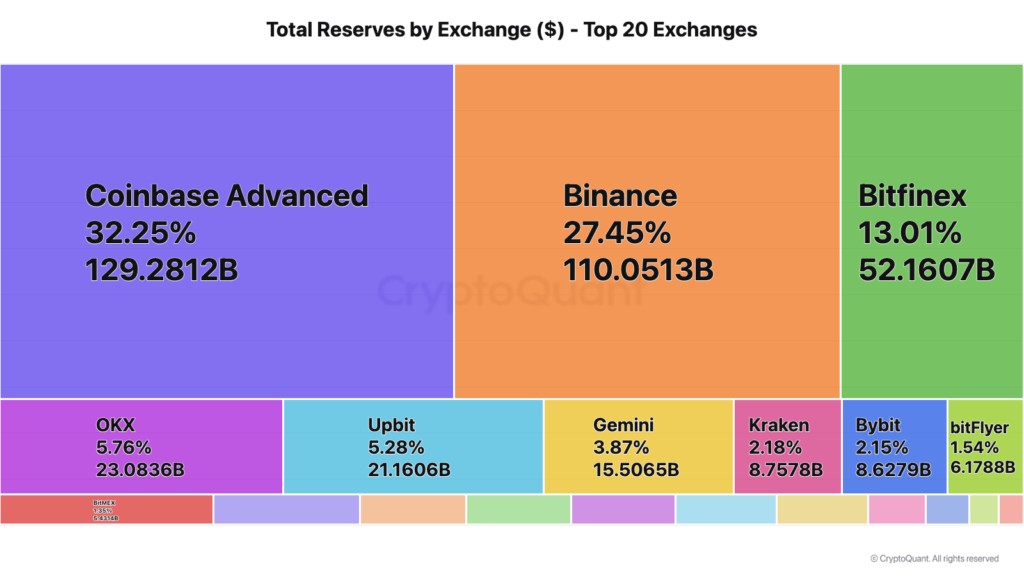

“Binance continues to show the highest average Bitcoin inflow, indicating the attraction of major players. The average deposit on Binance jumped to 7 BTC on May 22, when the first cryptocurrency reached a new all-time high of $112,000. Average deposits on other major exchanges were lower: Bitfinex (5 BTC), OKX (1.23 BTC), Kraken (0.7 BTC), and Coinbase (0.8 BTC),” claim CryptoQuant analysts.

In terms of total reserves, Binance ranks second with $110 billion in assets in Bitcoin, Ethereum, USDT, and USDC. Coinbase leads with $129 billion.

Analysts note that Binance publishes up-to-date reserve data (Proof-of-Reserves) with wallet addresses in real-time, whereas Coinbase relies on traditional financial audits.

Earlier, former Binance head Changpeng Zhao warned of the risks associated with the widespread creation of corporate reserves based on the first cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!