- \n

- Bipartisan backing for the bill to expand KYC requirements across industry participants is growing.

- If enacted, the measure would extend to wallet providers, miners and validators.

- Critics see the initiative as a direct attack on technological progress and liberal values.

\n

\n

\n

\n

\n\n

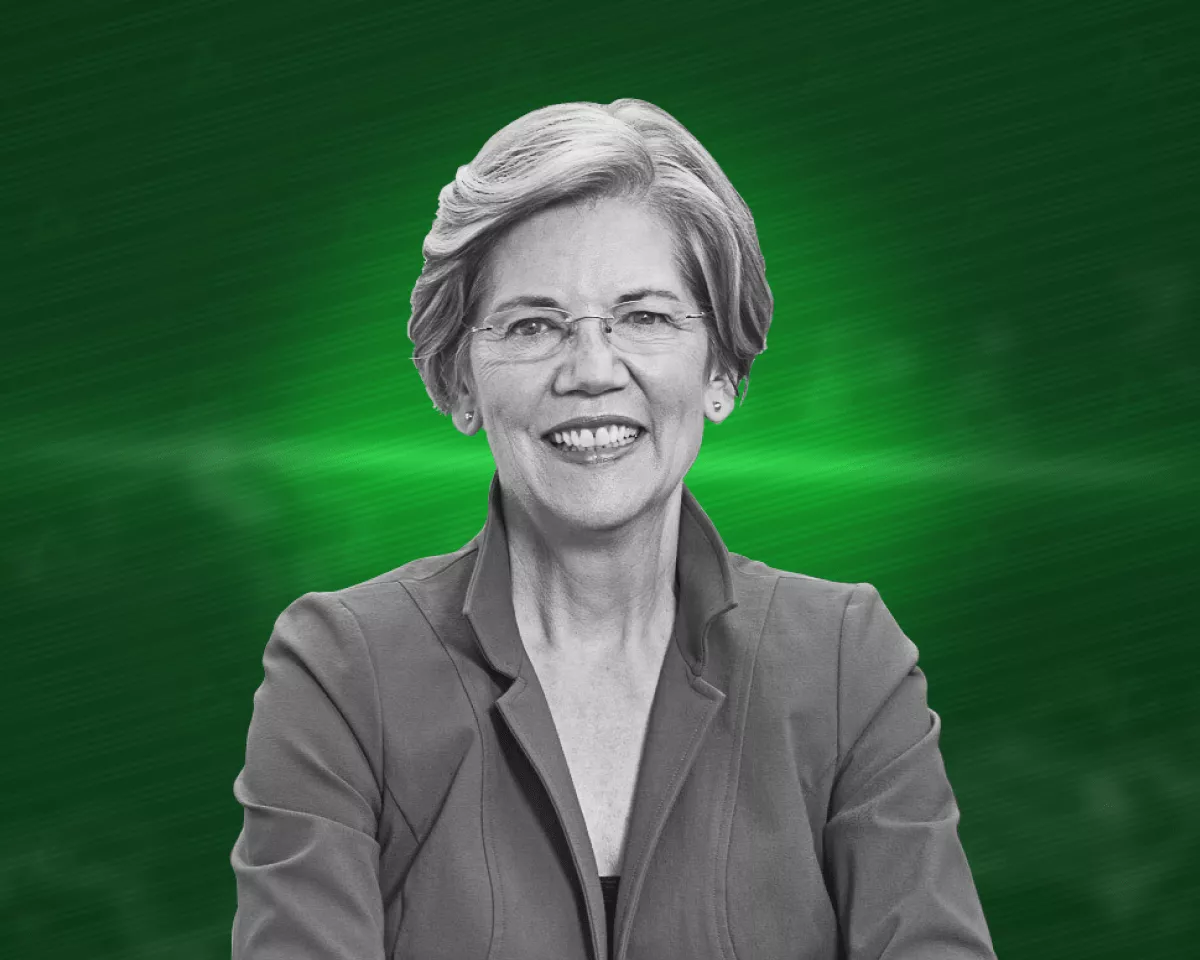

Five senators backed the bill proposed by their colleague Elizabeth Warren, which would introduce Know Your Customer (KYC) procedures for \u201ccrypto wallets, miners, validators and other network participants\u201d.

\n\n

Joining the coalition behind the July bill to crack down on money laundering in digital assets were Raphael Warnock, Lafonza Butler, Chris Van Hollen, John Hickenlooper and Ben Ray Luján. Three of them are members of the Banking Committee.

\n\n

In September, nine more lawmakers backed it, including the chairs of the Senate Committee on Homeland Security and Governmental Affairs and the Judiciary Committee.

\n\n

Favorable assessments came from the Banking Policy Institute, the Massachusetts Bankers Association, Transparency International USA, Global Financial Integrity, the National Association of County Prosecutors, the sheriffs of the nation\’s largest counties, the National Center for Consumer Rights Protection and the National Consumer League.

\n\n

According to Warren, the bill aims to prevent illicit use of crypto assets for money laundering, drug trafficking, sanctions evasion and financing of terrorism.

\n\n

Rationale for the Initiative

\n\n

- \n

- Expanding the Bank Secrecy Act (BSA) to include KYC requirements for wallet providers, miners, validators and other network participants who could contribute to crypto-related illicit transactions;

- Closing gaps regarding \u201cnon-custodial\u201d wallets that enable bypassing KYC checks and sanctions compliance, with instructions for FinCEN to develop and implement the corresponding legislation;

- FinCEN\u2019s proposed guidance for financial institutions on reducing risks associated with transactions in which digital assets pass through mixers and other anonymity-enhancing technologies;

- Strengthening BSA compliance oversight with a directive for the Treasury Department, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to implement KYC/AML compliance checks for supervised entities;

- Extending BSA rules on reporting foreign accounts to cryptocurrencies, obliging participants in offshore deals over $10 000 in digital assets to file a report with the IRS;

- Reducing the risks of illicit funding through crypto ATMs, with FinCEN instructed to ensure that owners and operators of the equipment regularly provide and update the physical addresses of devices they own or operate, as well as verify the identity of customers and counterparties.

\n

\n

\n

\n

\n

\n

\n\n

Criticism of the Initiative

\n\n

Warren\’s proposal has drawn criticism from the community and experts.

\n\n

Alex Thorn, head of corporate research at Galaxy Research, called the bill an \u201ceffective ban\u201d on Bitcoin and cryptocurrencies. In his words, decentralized software \u201cis not capable of performing centralized KYC functions.\u201d

\n\n

requiring non-custodial open-source software to perform bank-like compliance is *the big attack* bitcoin’s enemies have always threatened. it’s impossible for bitcoin core, for example, to comply with this, so it amounts to an effective ban of bitcoin in the USA.

— Alex Thorn (@intangiblecoins) December 11, 2023

\n“While the bill is pitched as a solution to potential money laundering and terrorist financing, it is in fact a retreat from liberal values and a shift toward surveillance and control valued by authoritarian actors,” Agrawal explained.

\n\n

Niraj Agrawal, the Coin Center communications director, described the initiative as a \u201cdirect attack on technological progress and personal privacy.\u201d

\n\n

The Digital Asset Anti-Money Laundering Act is a direct attack on technological progress and also a direct attack on our personal privacy and autonomy.

Make no mistake, while proposed as a solution to potential money laundering and terrorist financing, the bill is in fact a… pic.twitter.com/8oID1wECGL

— Neeraj K. Agrawal (@NeerajKA) December 11, 2023

\n“While the bill is pitched as a solution to potential money laundering and terrorist financing, it is in fact a retreat from liberal values and a shift toward surveillance and control valued by authoritarian actors,” Agrawal explained.

\n\n

The expert pledged to work to prevent the bill from passing.

\n\n

GovTrack notes that, of Warren\’s 330 bills proposed over 11 years in the Senate, only one has been enacted, and another ten became part of other laws that have since taken effect.

\n\n

Most of the time, members of Congress undertake actions such as proposing amendments to regulatory texts and serving on committees.

\n\n

In December 2022, Warren, along with colleague Roger W. Marshall, introduced a bill tightening AML requirements for the use of digital assets.

\n\n

In March 2023, the senator called on authorities to take action against \u201cfake audits\u201d of cryptocurrency firms.