BIS reports strong central-bank interest in CBDCs

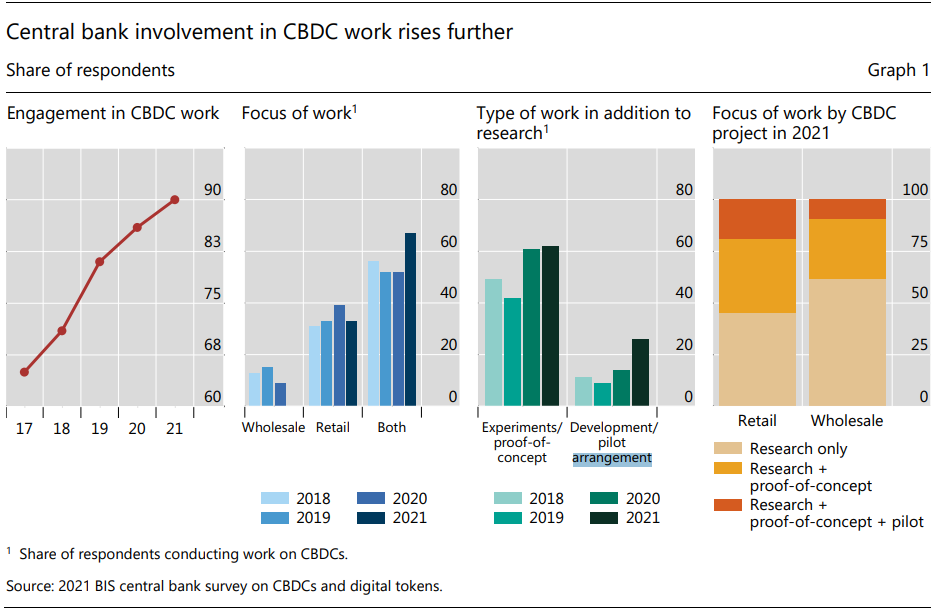

Nine out of ten central banks worldwide are studying CBDC, with most regulators favouring projects aimed at retail use cases, according to a BIS study.

Work on retail #CBDC in advanced economies focuses mainly on improving domestic payments efficiency, safety and financial stability; emerging market and developing economies also emphasise boosting financial inclusion https://t.co/aQhcWCT5g0 pic.twitter.com/GKz9pbNA8Q

— Bank for International Settlements (@BIS_org) May 6, 2022

In autumn 2021 BIS polled 81 central banks. The aim of the work was to study progress by monetary authorities in CBDC research, as well as their motives and plans regarding the deployment of these instruments.

According to the findings, more than half of respondents are developing their own digital currencies or “conducting concrete experiments.” About 20% say they are creating or testing retail CBDCs — roughly half as many institutions are working on a wholesale variant of the instrument.

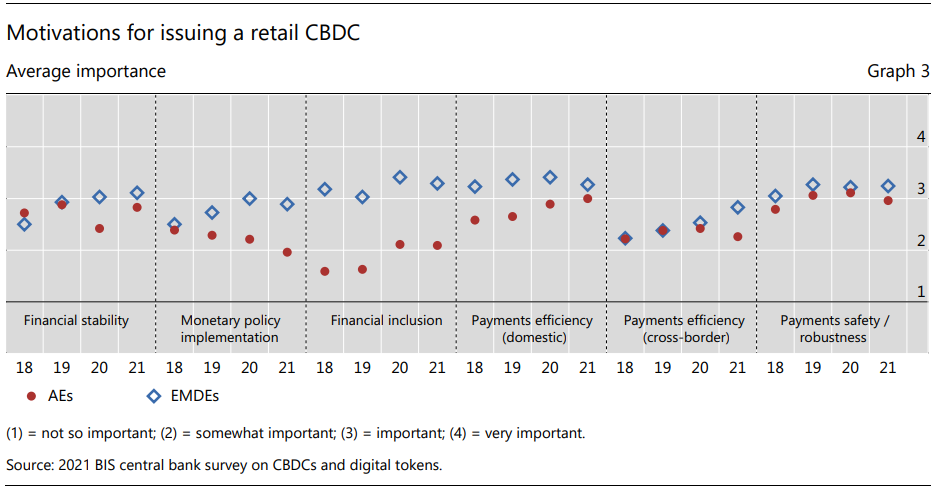

In BIS notes that regulators in advanced (AEs) and emerging (EMDEs) economies have different motivations for developing retail CBDCs. The former are more focused on boosting domestic payment efficiency and safety, as well as financial stability.

For the latter, these factors also matter, but increasing access to financial services and the efficiency of cross-border payments are more important.

The authors also noted that 70% of central banks study the potential impact of stablecoins on monetary and financial stability, and around a quarter of respondents are considering the use of cryptocurrencies.

In April, BIS said that the main motivation for developing-country central banks studying CBDC deployment was the improvement of payment-system efficiency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!