Bitcoin climbs back above $90,000 amid precious‑metals rally and a weaker dollar

Bitcoin reclaimed $90,000 as precious metals rallied and the dollar weakened.

On December 29, the price of the leading cryptocurrency cleared $90,000. Ether followed the market bellwether, rising above $3,000.

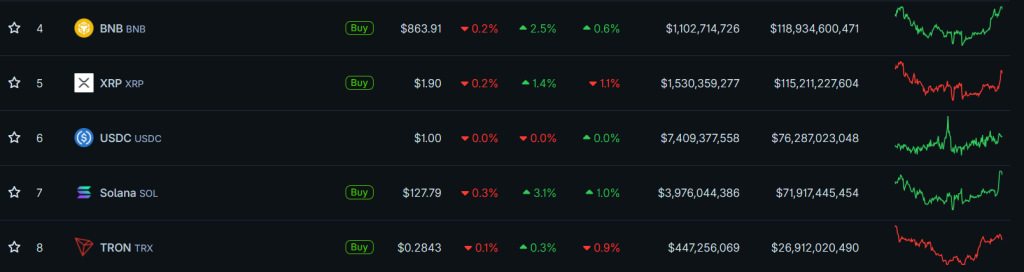

At the time of writing, the digital gold is trading at $89,996 and ether at $3,037.

ReserveOne Inc.’s chief investment officer Sebastian Bea linked the current impulse to retail participation. In his view, the upswing is being driven by short-term traders adding positions in the futures market.

The rebound in leading assets turned the top ten cryptocurrencies by market value green. Altcoins are posting gains, clawing back recent declines.

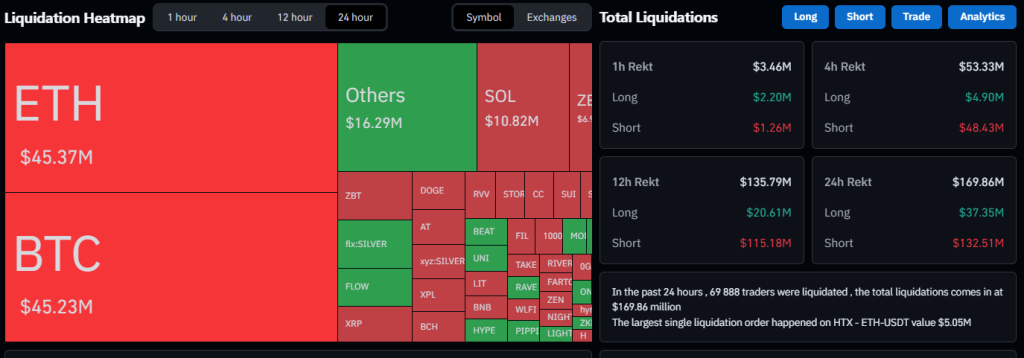

The sharp leg higher triggered a wave of liquidations totalling $169.86 million, $45.37 million of which were in ether.

Despite the bounce in prices, market sentiment remains subdued. A popular indicator has signalled “extreme fear” for 16 straight days.

Crypto investor and blogger Lark Davis noted that bitcoin is just 3% below its yearly open. A so‑called post‑halving annual candle has never closed red.

3 days till the Bitcoin yearly candle closes$BTC has never closed a post-halving year candle as red in its history

Right now Bitcoin is down 3% from its yearly open at $93,400

Can Bitcoin push above the yearly open in the next 3 days? pic.twitter.com/0rbF85OkCQ

— Lark Davis (@LarkDavis) December 29, 2025

Silver and gold

On December 28, silver reached an all‑time high, coming close to $84. Gold also set a record, rising to $4,530.

The Kobeissi Letter highlighted extreme silver volatility over the weekend. The price action resembled crypto: a sharp spike followed by a rapid drop.

Absolute insanity in silver right now:

At 6:20 PM ET, just 20 minutes after futures opened, silver prices surged to a record high of $83.75, up +6%.

By 7:30 PM ET, silver prices fell to a low of $75.15, erasing -10% of its value in 70 minutes.

Buckle up for a crazy week. pic.twitter.com/DmS0qMvwC4

— The Kobeissi Letter (@KobeissiLetter) December 29, 2025

“Absolute insanity in silver. At 6:20 PM ET, just 20 minutes after futures opened, the price jumped to a record $83.75 (+6%). By 7:30 PM ET, quotes fell to a low of $75.15, losing 10% of value in 70 minutes,” the analysts noted.

Analysts linked the metals rally to an upcoming change of leadership at the the Fed in 2026. Markets expect the new chair to be aligned with U.S. President Donald Trump’s policy and to move toward rate cuts.

Prices are also supported by strong industrial demand and hedging of inflation risks (the so‑called “devaluation” trade in the dollar).

Bitcoin vs precious metals: the long view

Despite the current lull in cryptocurrencies, over longer horizons digital assets have far outpaced metals.

Analyst Adam Livingston calculated that since 2015 bitcoin has risen 27,701%. Over the same period, silver gained just 405% and gold 283%.

Bitcoin vs. Silver vs. Gold since January 1st, 2015:

Silver: 405%

Gold: 283%

Bitcoin: 27,701%Even ignoring the first 6 years of Bitcoin’s existence for the crybabies who whine about the timeframe comparison…

…gold and silver drastically underperform the APEX ASSET.… pic.twitter.com/vdAnatqRKG

— Adam Livingston (@AdamBLiv) December 27, 2025

Noted crypto critic Peter Schiff disagreed, proposing a four‑year, not ten‑year, comparison. In his view, “Bitcoin’s time has passed.”

Now do the last four years only. Times have changed. Bitcoin’s time has passed.

— Peter Schiff (@PeterSchiff) December 27, 2025

Matt Golliher, co‑founder of Orange Horizon Wealth, joined the discussion. He pointed to a fundamental issue in commodities: when prices rise, mining at previously uneconomic deposits becomes profitable. The resulting increase in supply pushes prices back down—a mechanism bitcoin lacks, thanks to its fixed issuance.

Good reminder for 2025:

The long-term price of any commodity tends to converge with its marginal cost of production.

When the price increases, production of it increases, inflating the supply faster and bringing the price back down.

Unless, of course, it has a fixed supply…

— Matt Golliher (@MattGolliher) December 27, 2025

Amid debate over the best store of value, the U.S. dollar is set to end 2025 with its worst performance in almost a decade. Host Ethan Ralph noted an almost 10% drop in the U.S. Dollar Index (DXY).

Friendly reminder that the US Dollar is having it’s worst performance in almost a decade. pic.twitter.com/DGqluGGTqZ

— Ethan Ralph (@TheRalphRetort) December 23, 2025

“The decline in the dollar and the Fed’s inflationary policy will serve as a positive catalyst for gold, silver and bitcoin,” — argues former BitMEX CEO Arthur Hayes.

Earlier, Bitwise chief investment officer Matt Hougan believes that over the next ten years bitcoin will continue to deliver high returns, though large year‑to‑year swings are unlikely.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!