Bitcoin clings to a ‘delicate’ $105,000 as analysts sketch the road ahead

Despite a drop to $100,000, the leading cryptocurrency managed to settle around $105,000, though analysts see its current state as unstable.

According to Kronos Research analyst Dominic John, bitcoin’s trading metrics indicate strength, but “the structure remains fragile.”

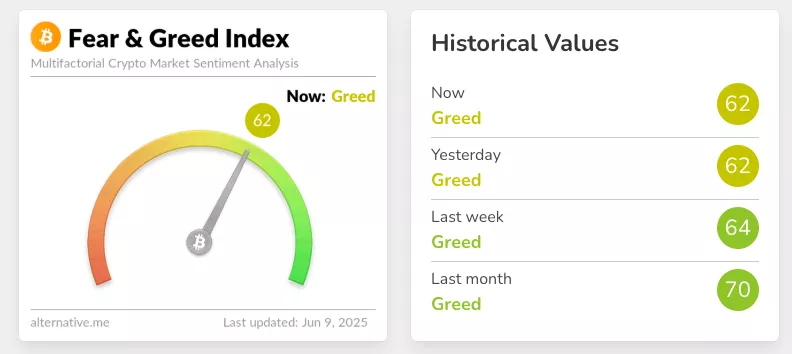

“With the fear and greed index at 55 [at the time of writing the figure is 62], sentiment has balanced; markets are in wait-and-see mode, now looking for a macro trigger or confirmation of the trend,” he noted.

HashKey Eco Labs CEO Kay Lu also said that digital gold is trading in a “delicate” range around key support levels, where indecisive investors could panic and sell on a single piece of negative news.

Key factors will be the US consumer price index (June 11) and the producer price index (June 12). The releases could hint at the next steps by the Fed.

According to the FedWatch Tool from CME Group, traders currently expect the policy rate to remain at 4.25-4.50% with a probability of 99.9%.

“It is possible that no substantial market moves will occur before [the Federal Reserve meeting], unless trade talks in the United States make progress or run into obstacles,” emphasised BTSE COO Jeff May.

A more optimistic view

CryptoQuant technical analyst Carmelo Alemán also questioned whether the bullish thesis for this cycle still holds after the clash between US President Donald Trump and billionaire Elon Musk:

“However, these doubts quickly dissipate when analysing on-chain indicators, which show clear bullish signals.”

Among the positives, Alemán highlighted the decline in bitcoin reserves on centralised exchanges. Over the past week they fell by 2.88% — from 2.43m BTC to 2.36m BTC.

In his view, this dynamic suggests reduced selling pressure and reflects investors’ conviction in bitcoin as a store of value.

Meanwhile, the realised capitalisation of the first cryptocurrency continues to hit records: the metric reached a new all-time high of $934.88bn.

“This confirms steady bitcoin purchases and increased capital inflows, reinforcing long-term confidence,” Alemán explained.

In addition, there is continuous growth in UTXO — more coins are being held across various volume and age bands of addresses.

According to Alemán, this points to:

- balanced distribution across investor types;

- steady growth in confidence;

- reduced willingness to sell.

“These trends are not isolated from each other. Taken together, they reflect a structural shift in behaviour, where long-term confidence prevails over short-term speculation,” the researcher concluded.

Analyst and MN Trading founder Michaël van de Poppe saw bitcoin preparing for a new high.

#Bitcoin prepares itself for the next rally towards a new ATH.

If the markets corrects to $103K, that’s a tremendous opportunity to get yourself some more Bitcoin.

Above $106K is an elevator towards a new ATH and likely $120k+ in Q3. pic.twitter.com/tpgyRJCCPq

— Michaël van de Poppe (@CryptoMichNL) June 8, 2025

“If the market corrects to $103,000, that will be a great opportunity to buy some more coins. Above $106,000 is an elevator to a new ATH and, likely, above $120,000 in the third quarter,” he added.

Earlier, Bitfinex analysts predicted a new bitcoin high of $125,000 in July.

However, CryptoQuant did not rule out a return of the leading cryptocurrency to $96,700, which corresponds to the average purchase price of short-term investors.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!