Bitcoin Correction Attributed to ETF Approval Sell-off, Say Analysts

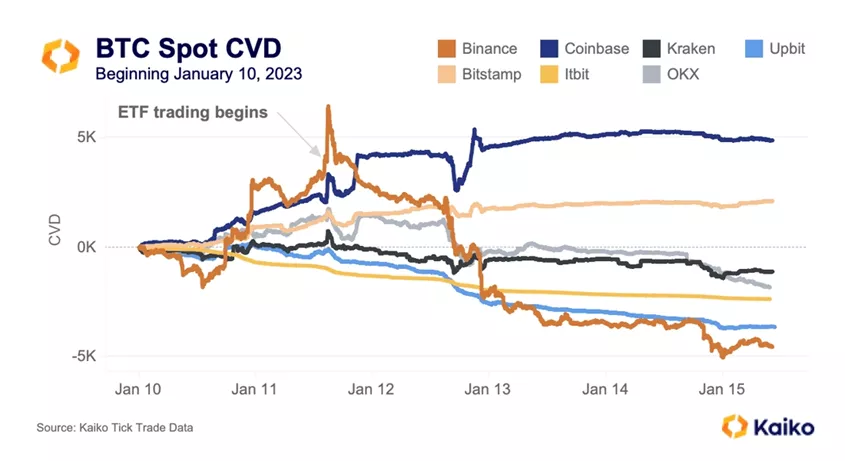

Cumulative Volume Delta (CVD) of digital gold on leading platforms turned negative following news of spot Bitcoin ETF approval, according to Kaiko.

Analysts pointed to a “sell the news” scenario. They noted that an hour before the US market opened, net purchases on Binance reached nearly 3000 BTC, but the buyers’ advantage was short-lived.

Positive CVD remained only on Coinbase and the institution-focused platform Bitstamp. Its competitor, Itbit, recorded net sales, as did retail-favored exchanges Binance, OKX, and Kraken.

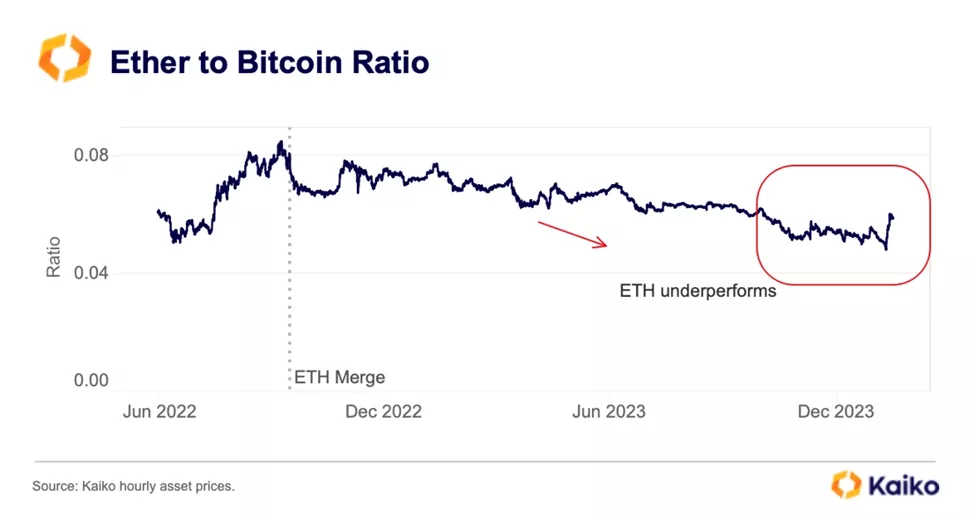

Ethereum and ERC20 tokens have become attractive to investors due to speculation regarding future approval of spot Ethereum ETFs, according to specialists. They noted that after falling to annual lows, the ETH/BTC ratio surged.

“Given the more uncertain regulatory status of Ethereum, ETFs based on it may face a somewhat more challenging approval path,” experts predicted.

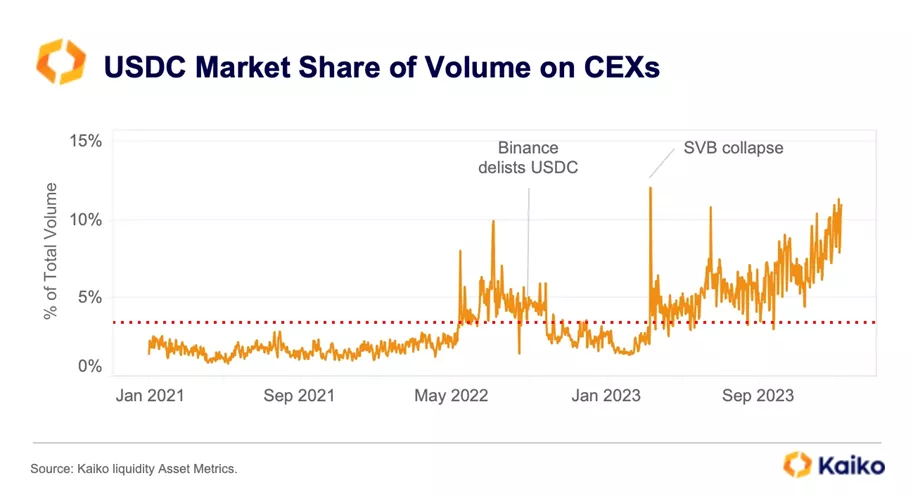

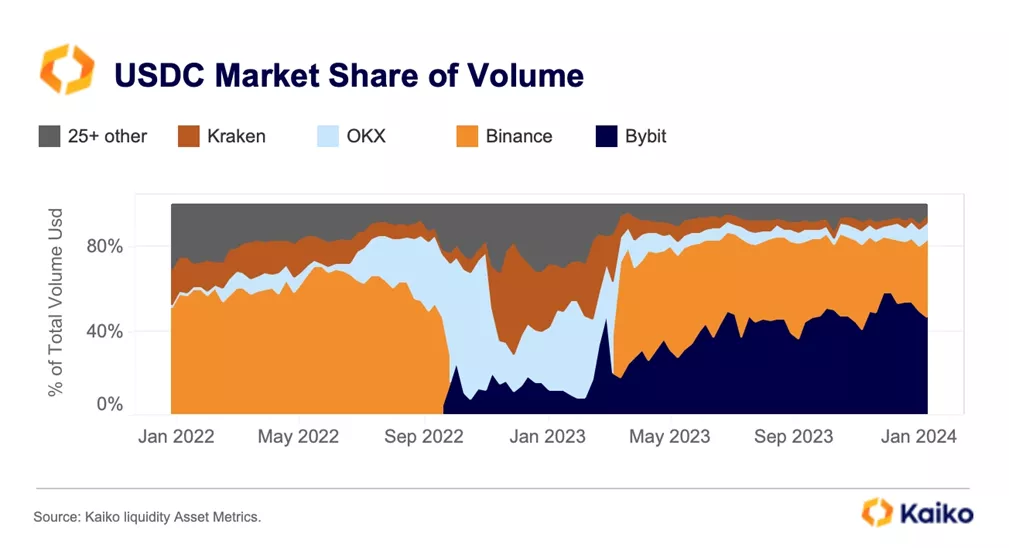

In the context of Circle’s application for an IPO, Kaiko highlighted the market position of the firm’s supported USDC. Despite the banking crisis last spring, the stablecoin managed to double its share in trading on CEX to levels not seen since 2021.

According to analysts, one of the drivers was Bybit’s introduction of zero fees for USDC trading pairs in February. By total volume, the platform took the lead, surpassing Binance.

Earlier, analysts at TD Cowen expressed doubts about the imminent approval of spot Ethereum ETFs.

Previously, analysts at 10x Research pointed to the risks of a Bitcoin correction to $38,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!