Bitcoin Dips Below $83,000 Amid Trump’s Tariff Announcement on EU Goods

On the night of February 27, the price of the leading cryptocurrency fell below $83,000, only to later recover to $86,000. The catalyst was Donald Trump’s announcement of 25% tariffs on imports from the EU.

“The European Union was created to take advantage of the United States. And that goal has been well executed,” he stated.

The US President announced that tariffs on goods from Canada and Mexico would take effect on April 2, although they were initially planned for March 3.

Following Trump’s statements, companies in the S&P 500 lost $500 billion in market capitalization.

The trade war is back:

Minutes after President Trump announced 25% tariffs on the EU, the S&P 500 erased $500+ BILLION of market cap.

Meanwhile, Bitcoin just broke below $84,000 for the first time since November 11th.

What’s next? Let us explain.

(a thread) pic.twitter.com/dE5gFOULOP

— The Kobeissi Letter (@KobeissiLetter) February 26, 2025

At the time of writing, digital gold is trading at $86,090. The rate of decline over the past 24 hours stands at 3.1%. Among leading altcoins, the drop ranges from 1.1% (Solana) to 5.7% (Ethereum).

Hedge Funds Turn Bearish

Presto Research linked the sharp decline in Bitcoin in recent days to hedge funds unwinding positions focused on arbitrage of the “basis spread.” This is evidenced by a record outflow of $1 billion from BTC-ETF.

The spread arises from the difference between longs in exchange-traded funds and shorts on CME futures.

If the price of the underlying asset falls, the premium on derivatives decreases, prompting ETF sales and increasing pressure on derivative prices. This intensifies negative dynamics in the spot market, creating a feedback loop where more funds rush to “cash out,” according to 10x Research.

“Basis on CME and Binance, when annualized, show no signs of recovery yet. A potential source of relief is the funding rate, which has started to decline following weak macroeconomic data,” explained Presto Research.

SignalPlus co-founder and CEO Chris Yu noted the weakening implied volatility of Bitcoin during price declines, indicating a retreat of speculators from expectations of near-term growth.

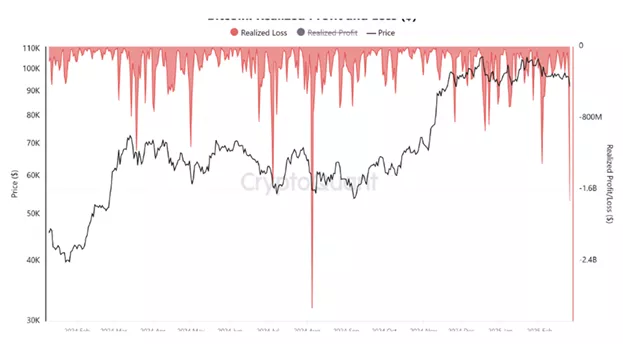

CryptoQuant reported that the $1.7 billion capitulation on February 25 was the largest since August 5, 2024. Users closed positions at a loss equivalent to 79,000 BTC, specialists calculated.

“While it cannot be said with certainty that new lows are not ahead, current levels already present opportunities rarely seen in the medium-term structure,” analysts wrote.

The cryptocurrency fear and greed index has fallen to 10 points, the lowest since June 2022, indicating a zone of extreme panic.

According to Binance CEO Richard Teng, the dip in digital assets is temporary and will not last long.

Earlier, Eric Trump, son of US President Donald Trump, urged accumulating Bitcoin during the dip. On February 4, he also recommended buying ETH following a major correction.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!