Bitcoin ETF Approval Diminishes Likelihood of Sell-Offs, Say Experts

Following a wave of long position liquidations, the anticipated sell-off after the expected approval of spot Bitcoin ETFs by the SEC is now less certain. Analysts at K33 Research have reached this conclusion.

They believe the cascade of forced long closures has “sharply improved market conditions.”

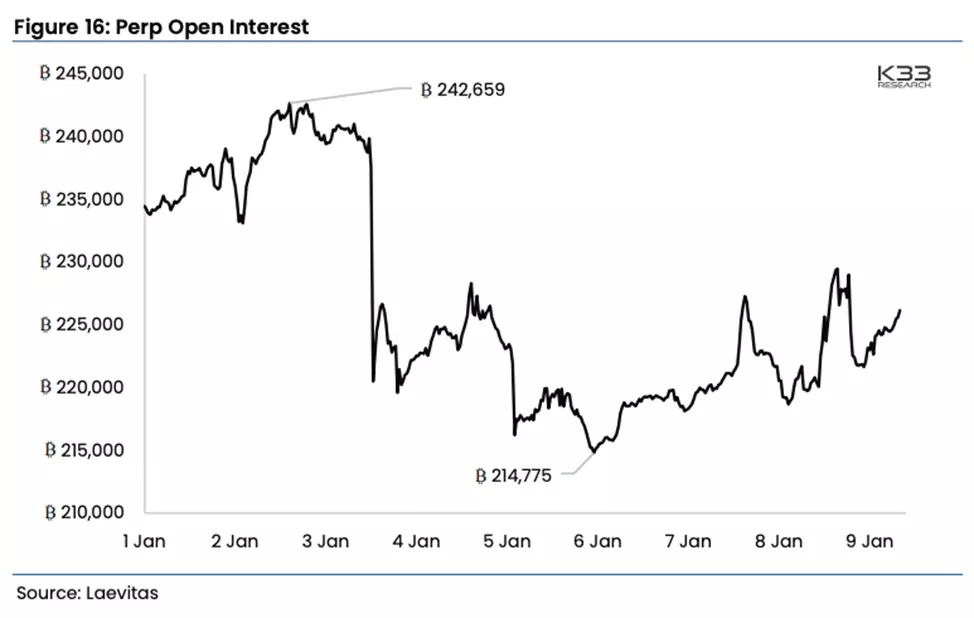

According to their observations, from January 2 to 6, open interest (OI) in perpetual contracts decreased by 12%, and funding rates shifted to a neutral state.

These parameters remained stable thereafter, indicating much less market excitement compared to the previous week, the analysts added.

“After the reduction in leverage, the market has become more resilient to profit-taking from the ETF announcement,” the specialists explained.

K33 Research noted a rise in OI on the CME to a record 131,620 BTC.

“Premiums remain high (~20%), but in a much healthier upward trend than what we observed at the start of the year. Like OI, this indicator is likely to decrease significantly after the ETF approval. The transition from futures to spot ETFs will lead to long closures on the CME,” the analysts predicted.

Experts agreed with the consensus forecast of a positive SEC verdict on the product on January 10. They warned of subsequent volatility following the event.

“We expect an increase in volumes […], as well as a rapid adjustment of traders’ risk profiles,” the specialists indicated.

Experts also touched on the “fee war” among firms applying to launch the instrument.

According to The Block, Bitwise leads this list, offering zero fees for the first six months or until the first $1 billion in assets is reached, after which the parameter increases to 0.2%.

ARK Invest and 21Shares offer a slightly lower fee of 0.25% (previously 0.8%). VanEck and Fidelity also offer a 0.25% fee. BlackRock is ready to charge 0.2% for the first 12 months or until AUM reaches $5 billion.

Other applicants offer fees ranging from 0.29% to 0.8%. Grayscale, which hopes to convert its Bitcoin trust into an exchange-traded fund, charges 1.5%.

K33 explained that low fees may be based on the desire to quickly attract a large share of the potential multi-billion dollar inflow.

“There are two positive effects […]. First, it is more attractive to invest with low management fees. Second, it reduces the selling pressure on the first cryptocurrency, as issuers liquidate fewer coins to cover costs,” the analysts explained.

In the early hours of January 10, the SEC’s account on the X platform was compromised to publish a fake message about the approval of spot Bitcoin ETFs.

Earlier, Standard Chartered predicted that the price of digital gold could rise to $200,000 by 2025 due to the registration of the product.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!