Bitcoin ETF Holdings Near 1 Million Coins

Issuers of spot Bitcoin ETFs have acquired 976,873 BTC ($66.2 billion), equivalent to nearly 5% of the available supply. This was highlighted by Nate Geraci, president of The ETF Store.

Spot bitcoin ETFs now about 23,000 away from holding 1,000,000 btc…

Or almost 5% of btc final total supply.

via @apollosats pic.twitter.com/QnrOPr6vPX

— Nate Geraci (@NateGeraci) October 28, 2024

To reach the seven-figure mark in the next five working days, a net inflow of approximately $314 million is required, assuming prices remain stable at the time of writing.

Analyst Alessandro Ottaviani described the achievement of an ATH for the leading cryptocurrency as “inevitable” given the current accumulation pace of $3.13 billion over the past two weeks.

In the last two weeks we had $3B net inflow from the Bitcoin Spot ETFs.

If this pace continues through November, ATH will be inevitabile

— Alessandro Ottaviani (@AlexOttaBTC) October 27, 2024

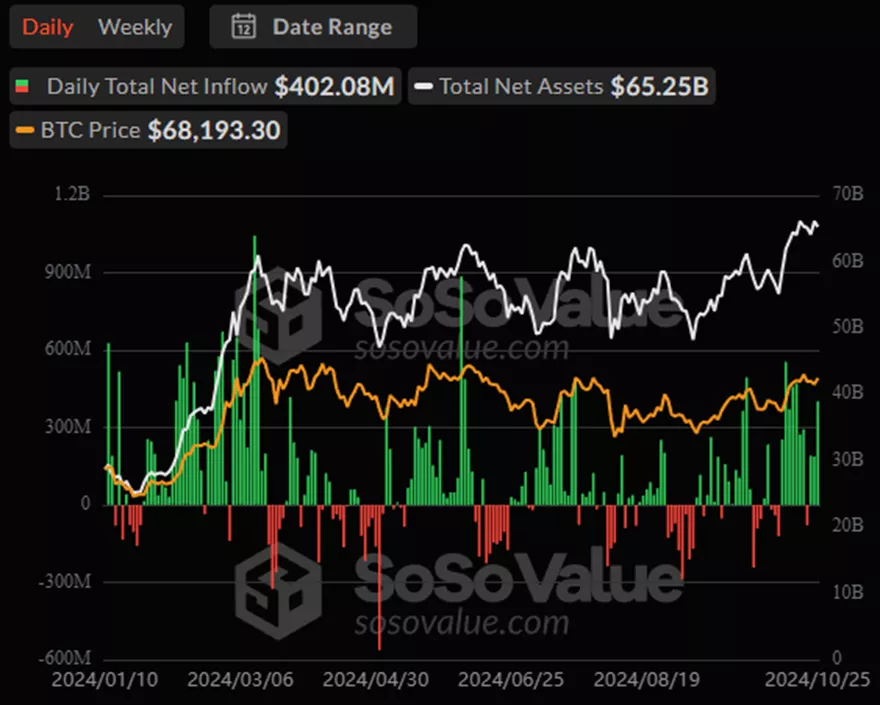

On October 25, inflows into BTC-ETFs amounted to $402.1 million, with a total of $21.93 billion since the approval of the products.

CIO of ZX Squared Capital, Si K. Jeng, in a conversation with Cointelegraph, predicted a positive trend for the asset regardless of the winner in the U.S. presidential election.

His colleague from Apollo Capital, Henrik Andersson, noted that the “biggest decisive factor” would be the victory of Republican candidate Donald Trump:

“If he becomes head of state […] Bitcoin will rise to $100,000 by the end of the year.”

Other drivers mentioned include the anticipated reduction of the key rate by the Fed and Russia lifting its ban on mining the leading cryptocurrency.

Market participants in Bitcoin options have prepared for a “bullish” scenario following the U.S. presidential election and the Federal Reserve meeting by increasing OI on November calls with strike prices above $80,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!