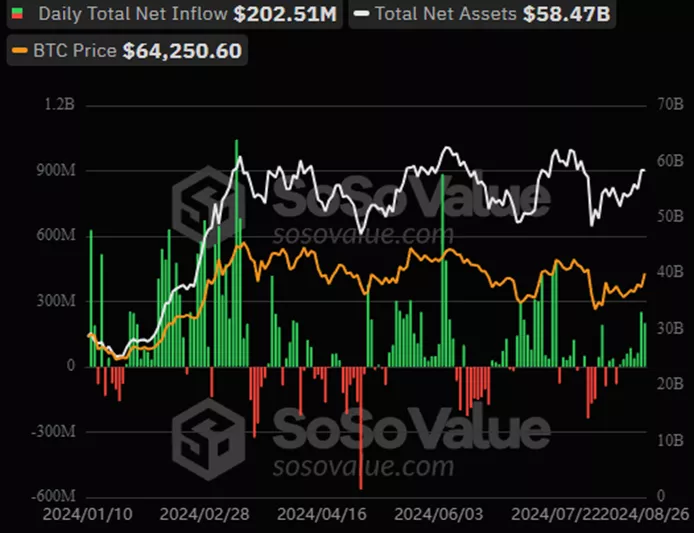

Bitcoin ETF Inflows Continue for Eighth Consecutive Day

On August 26, inflows into spot Bitcoin ETFs reached $202.5 million, according to SoSoValue. The total for the past eight days amounted to $756 million.

Clients added $224.1 million to BlackRock’s IBIT, $5.5 million to Franklin Templeton’s EZBC, and $5.1 million to WisdomTree’s BTCW.

There was an outflow of $16.6 million from Bitwise’s BITB, $8.3 million from Fidelity’s FBTC, and $7.2 million from VanEck’s HODL.

No changes were observed in Grayscale’s GBTC, ARK Invest & 21 Shares’ ARKB, Valkyrie’s BRRR, and Invesco’s BTCO.

Cumulative inflows since the approval of BTC-ETFs in January have increased to $18.1 billion.

Ethereum-ETF

On August 26, outflows from spot Ethereum ETFs amounted to $13.2 million, according to SoSoValue. The negative trend continued for the eighth consecutive day.

The net withdrawal over the entire period increased to $477.9 million.

The cumulative outflow from Grayscale Ethereum Trust (ETHE) rose to $2.54 billion, with an increase of $9.5 million on August 26.

On the last reporting day, clients withdrew $2.7 million from Fidelity’s FETH and $1 million from Franklin Templeton’s EZET.

No changes were observed in other products.

CoinShares linked the increased demand for Bitcoin funds to a speech by Fed Chairman Jerome Powell at the Jackson Hole symposium, where he confirmed the possibility of a rate cut in September.

Earlier, QCP Capital predicted that the price of the first cryptocurrency would move sideways between $62,000 and $67,000 due to a lack of growth signals in the options market until October.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!