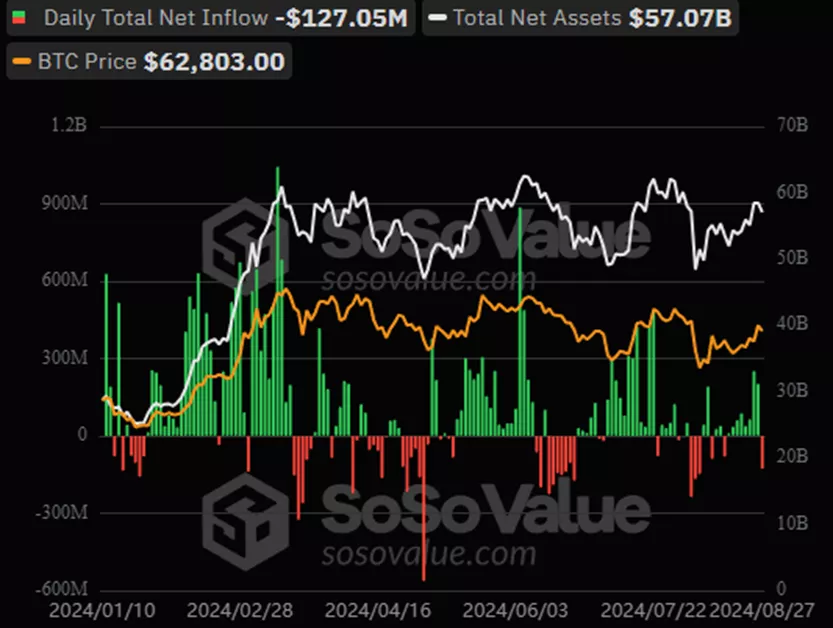

Bitcoin ETF Inflows Halt on Ninth Day

On August 27, outflows from spot Bitcoin ETFs amounted to $127.1 million, according to SoSoValue. In the preceding eight days, these products had seen inflows of $756 million.

Investors withdrew $102 million from ARKB by ARK Invest & 21 Shares, $18.3 million from GBTC by Grayscale, and $6.8 million from BITB by Bitwise.

Other instruments showed no change.

Cumulative inflows since the approval of BTC-ETFs in January have decreased to $18 billion.

Ethereum-ETF

On August 27, outflows from spot Ethereum ETFs totaled $3.5 million, according to SoSoValue. This negative trend continued for the ninth consecutive day.

Net withdrawals over the entire period increased to $481.3 million.

Total outflows from the Grayscale Ethereum Trust (ETHE) rose to $2.55 billion, with an increase of $9.2 million on August 27.

On the last reporting day, clients added $3.9 million to FETH by Fidelity and $1.9 million to ETHW by Bitwise.

There were no changes in other exchange-traded funds.

Glassnode has warned of the cryptocurrency market entering a phase of increased volatility.

Previously, trader and analyst Rekt Capital pointed to a potential Bitcoin reversal if a successful retest of the upper boundary of the descending channel leads to a return to a growth trajectory.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!