Bitcoin ETF Trading Volume Surges Past $6 Billion Following Trump’s Victory

On November 6, the trading volume of BTC-ETF reached a peak of $6.1 billion, the highest since March 15, with BlackRock’s IBIT hitting a record $4.14 billion.

According to Bloomberg analyst Eric Balchunas, this figure surpassed the trading volume of companies like Berkshire, Netflix, or Visa. The expert anticipates that this high level of activity will translate into product inflows by Tuesday or Wednesday.

$IBIT just had its biggest volume day ever with $4.1b traded.. For context that’s more volume than stocks like Berkshire, Netflix or Visa saw today. It was also up 10%, its second best day since launching. Some of this will convert into inflows likely hitting Tue, Wed night pic.twitter.com/vy2zJBwaHd

— Eric Balchunas (@EricBalchunas) November 6, 2024

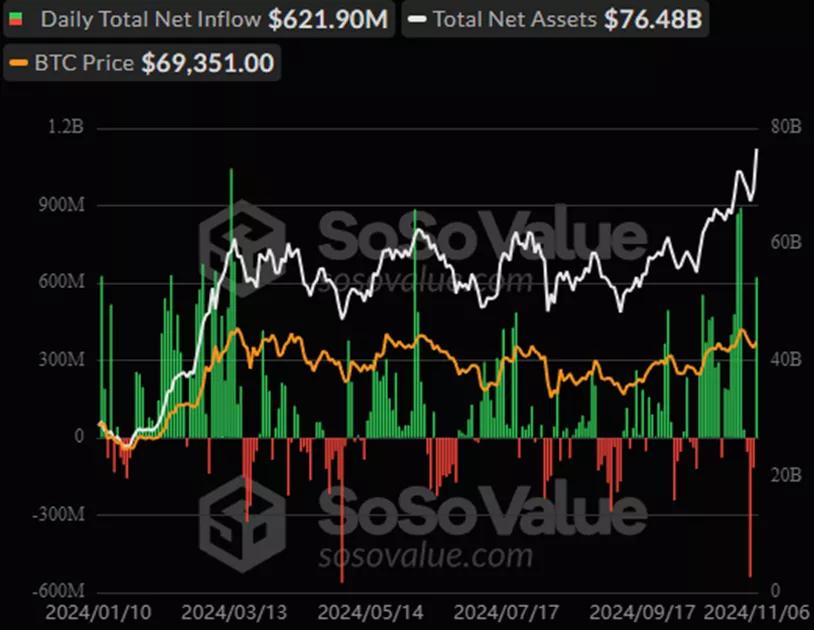

Overall, on November 6, the inflow into the sector amounted to $622 million.

This followed a negative streak of three days.

Cumulative inflows since the approval of BTC-ETF in January have increased to $24.1 billion.

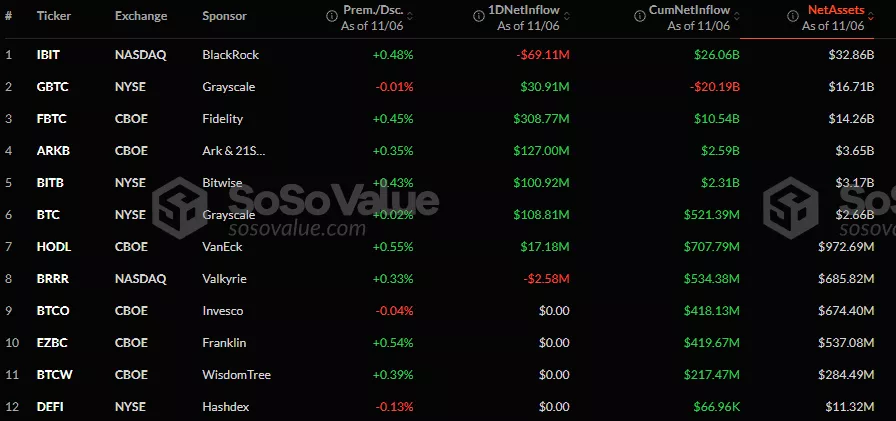

On November 6, investors withdrew $69.1 million from IBIT and $2.6 million from Valkyrie’s BRRR.

The inflows were distributed as follows:

- Fidelity’s FBTC — $308.8 million;

- ARK Invest and 21Shares’ ARKB — $127 million;

- Grayscale’s BTC — $108.8 million;

- Bitwise’s BITB — $100.9 million;

- Grayscale’s GBTC — $30.9 million;

- VanEck’s HODL — $17.2 million.

Earlier, the Michigan state pension fund disclosed the acquisition of 460,000 shares of Grayscale Ethereum Trust (ETHE) worth over $10 million and 460,000 shares of Grayscale Ethereum Mini Trust ETF (ETH) for approximately $1.1 million.

Previously, Syncracy Capital co-founder Daniel Chung, in light of Donald Trump’s victory in the U.S. presidential election, predicted the approval of a SOL-ETF as early as the first quarter of 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!