Bitcoin ETFs Acquire $6.52 Billion in BTC, Challenging GBTC

As of January 29, nine spot Bitcoin ETFs launched since January 11 hold 150,846 BTC ($6.52 billion), according to K33 Research.

January 30

150,000 BTC is held by the new ETFs — in less than three weeks!

Significant slowdown of GBTC outflows led yesterday to see the strongest daily U.S. spot flows since January 17.

BlackRock needed 13 trading days for its AUM to surpass all Canadian BTC ETFs combined. pic.twitter.com/C7Tb9fNsd5

— Vetle Lunde (@VetleLunde) January 30, 2024

On January 22, the AUM of the nine funds was 108,908 BTC, and on January 16, it was 47,652 BTC.

Over 13 trading days, net inflows into these instruments exceeded $1 billion. Positive inflows were recorded for the second consecutive day after four days of outflows.

The volume of coins held by Coinbase’s IBIT exceeded the AUM of all Canadian product issuers (CI Galaxy Bitcoin ETF and Purpose Bitcoin ETF) — 56,621 BTC ($2.45 billion) compared to 55,016 BTC ($2.38 billion).

Fidelity’s FBTC also approached this level with 51,064 BTC ($2.21 billion).

Over 13 days, 126,482 BTC (~$5.5 billion) were withdrawn from Grayscale’s GBTC.

The outflow on January 29 amounted to $191.7 million — the lowest since the launch. As a result, the net inflow into the sector as a whole that day reached $255.6 million.

Here is the flow data in BTC terms pic.twitter.com/Bk9QFelvSi

— BitMEX Research (@BitMEXResearch) January 30, 2024

These figures were confirmed by the data aggregator SoSoValue.

According to SoSoValue, the situation began to reverse. On January 29, the Bitcoin spot ETF had a total net inflow of US$255 million, and Grayscale GBTC had a single-day net outflow of US$191 million. The other nine ETFs except Grayscale saw a total net inflow of $446 million.…

— Wu Blockchain (@WuBlockchain) January 30, 2024

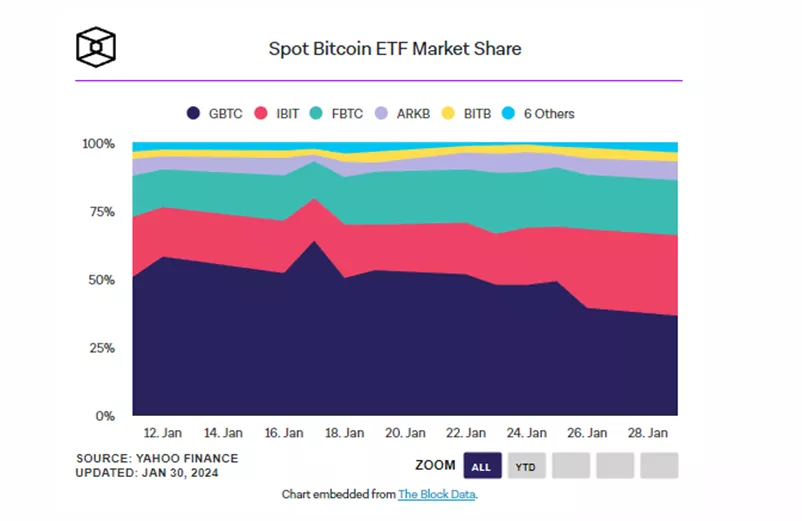

According to The Block, GBTC’s market share fell from a peak of 63.9% (January 17) to the current 36%.

On January 29, Google allowed the advertising of spot Bitcoin ETFs.

Earlier, CoinShares analysts explained the drop in Bitcoin’s price following the product’s launch by noting that issuers primarily purchased digital gold before January 11.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!