Bitcoin ETFs Attract $355 Million Amid Liquidity Improvement

Bitwise filed for 11 altcoin-based exchange-traded funds.

On December 30th, spot exchange-traded funds based on the leading cryptocurrency recorded a net capital inflow of $355 million, breaking a seven-day negative trend.

The leader was IBIT from BlackRock, which accounted for $143.7 million. It was followed by ARKB from Ark Invest ($109.5 million) and FBTC from Fidelity ($78.5 million). Even GBTC from Grayscale, which often sees outflows due to high fees, attracted $4.2 million.

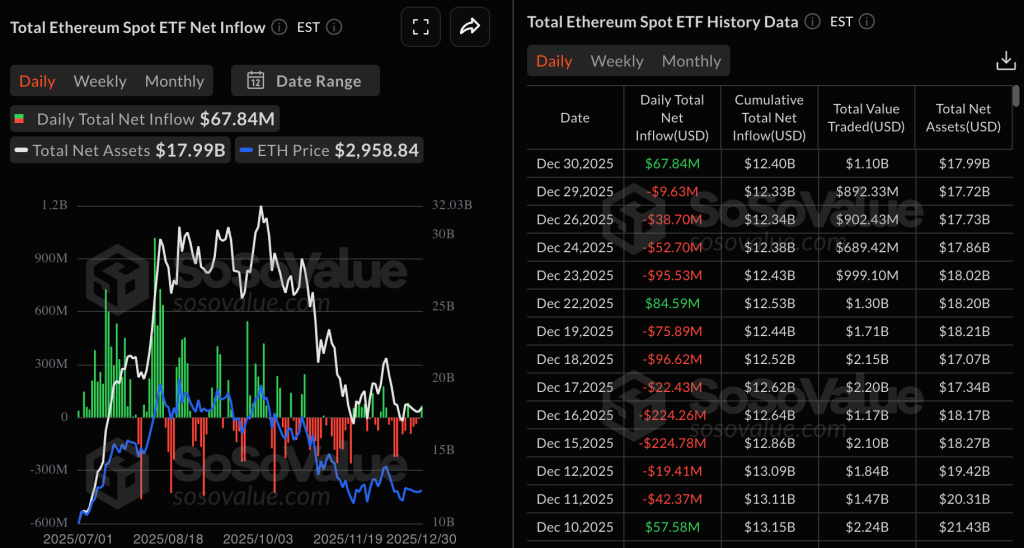

Ethereum-ETF saw an inflow of $67.8 million, with the majority going to ETHE from Grayscale — $50.1 million.

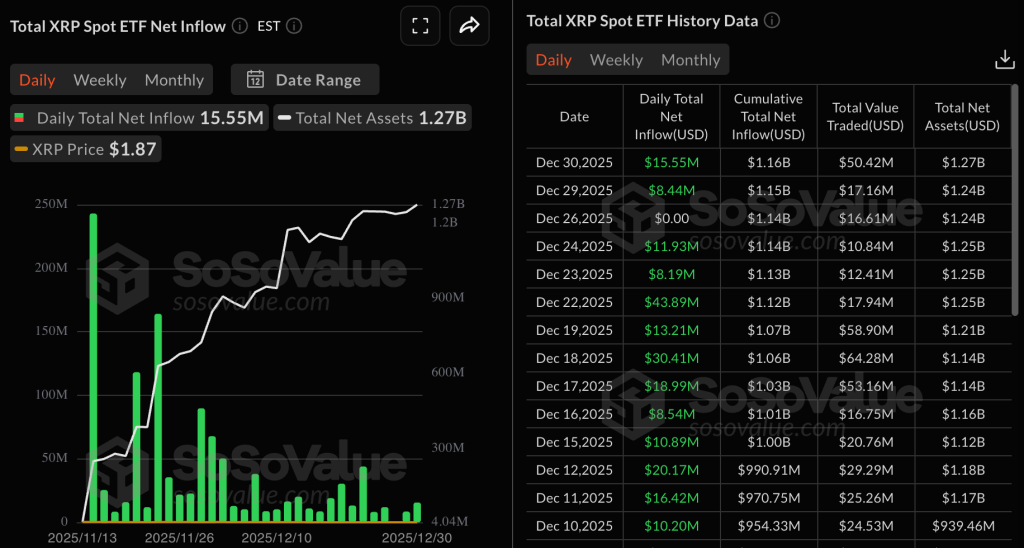

Spot XRP-ETFs received $15.5 million — inflows have continued for 30 consecutive days. Since launch, these instruments have accumulated $1.1 billion.

Investor interest also remains strong in products based on Solana. In the latest trading session, they attracted $5.2 million.

Liquidity Growth

Analysts attribute the trend reversal to improved global liquidity. Former BitMEX CEO Arthur Hayes noted that the dollar supply hit a low in November and is beginning to rise.

$ liq likely bottomed in Nov and is inching higher. It’s time for crypto to pump up the jam. pic.twitter.com/XANf5xqEuo

— Arthur Hayes (@CryptoHayes) December 31, 2025

According to him, the current conditions are favorable for a new surge in the crypto market.

An expert known as Mister Crypto agreed, stating that global liquidity indicators are “going up.” This indicates an increase in the money supply in major economies.

Global Liquidity is going vertical.

Bitcoin will follow! pic.twitter.com/dKZcX52b82

— Mister Crypto (@misterrcrypto) December 31, 2025

“We are now on the bullish side of the liquidity cycle,” he added.

New Applications from Bitwise

Bitwise has filed an application with the SEC to launch 11 “strategic” exchange-traded funds, each focused on a specific token. The list includes:

According to the description, up to 60% of the portfolio may be allocated to direct token holdings, while the remaining 40% could be in ETP securities. These must either directly hold a specific coin or provide synthetic access to it.

This mixed architecture distinguishes the new ETFs from Bitwise’s previous products. Previously, the company offered crypto industry stock funds (such as a basket including Coinbase shares), composite indices of several assets, or instruments built solely on perpetual contracts.

Earlier in December, one of the world’s largest asset managers, Vanguard Group, opened access to Bitcoin ETFs for its clients.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!