Bitcoin ETFs Break Eight-Day Outflow Streak

- The negative streak of outflows from spot Bitcoin ETFs ended on the ninth day.

- The number of institutional holders of exchange-traded funds based on the first cryptocurrency exceeded 1,000.

- Bloomberg predicted an increase in the share of large investors.

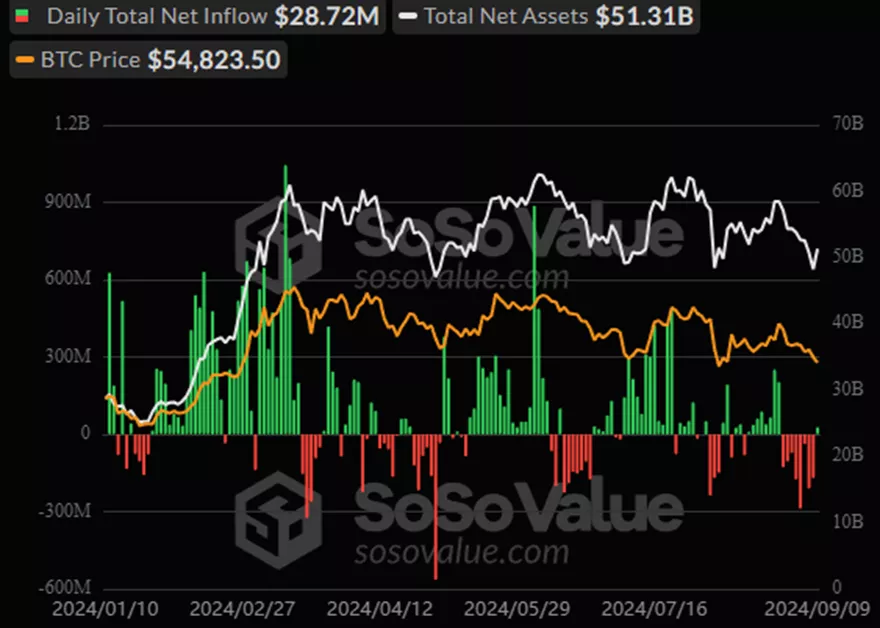

On September 9, inflows into spot Bitcoin ETFs amounted to $28.7 million, according to SoSoValue. Over the previous eight days, investors withdrew $1.2 billion from the products.

The negative streak was the longest since the listing of the instruments in January.

On September 9, the structure of inflows was as follows:

- FBTC by Fidelity — $28.6 million;

- BITB by Bitwise — $22 million;

- ARKB by Ark Invest and 21Shares — $6.8 million;

- BTCO by Invesco — $3.1 million.

Clients withdrew $22.8 million from GBTC by Grayscale and $9.1 million from IBIT by BlackRock.

Cumulative inflows since the approval of BTC-ETFs in January increased to $16.9 billion.

Investors in Profit

According to Bloomberg analyst Eric Balchunas, 99% of investors in the instruments remain in profit.

ALSO IMP PSA: if you cover bitcoin ETFs be careful of haters using assets to paint narrative. Assets can go down bcc price goes down, the TRUTH is net flows and they are at $16.8b YTD, which is just near there high water mark (and above the high end of our prediction $10-15b… pic.twitter.com/OiqIqdgwXr

— Eric Balchunas (@EricBalchunas) September 9, 2024

“I’m surprised at how X (not to mention the haters) goes wild when a tiny outflow appears. As we’ve said, this industry [develops] literally ‘two steps forward, one step back‘. Get used to it,” commented the specialist.

The expert noted that the number of institutional holders of spot Bitcoin ETF shares exceeded 1,000.

One more thing re the holders. Bitcoin ETFs collectively have over 1,000 institutional holders after just two 13F periods. That’s beyond unprecedented. $IBIT alone has 661 holders with 20% of its shares reported held by institutions and large advisors, likely headed to 40% in…

— Eric Balchunas (@EricBalchunas) September 9, 2024

“This is unprecedented. IBIT by BlackRock alone has 661 holders, 20% of whose shares are owned by institutions and large advisors. In my humble opinion, within the next 12 months, this share will reach 40%,” added Balchunas.

Ethereum-ETF

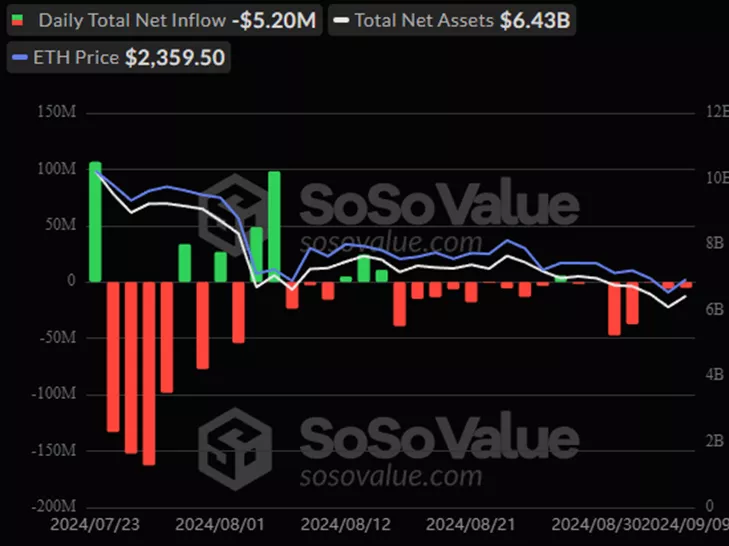

On September 9, outflows from spot Ethereum ETFs amounted to $5.2 million, according to SoSoValue. The negative trend continued for the fifth consecutive day.

Net outflows for the entire period increased to $573.5 million.

Cumulative outflows from the Grayscale Ethereum Trust (ETHE) rose to $2.69 billion. On September 9, the figure increased by $22.6 million.

Clients added $8 million to ETH by Grayscale, $7.6 million to FETH by Fidelity, and $1.85 million to ETHW by Bitwise.

Back in May, BlackRock’s head of digital assets, Robert Mitchnick, stated expectations of a new wave of inflows into products due to institutional participation.

In April, a similar forecast was presented by Bernstein analysts.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!