Bitcoin Faces Potential Drop to $60,000 if $65,800 Support Breaks, Says CryptoQuant

Bitcoin has neared the aggregate breakeven level for speculators (~$65,800). This mark will act as support, and if breached, could trigger a correction down to $60,000, according to analysts at CryptoQuant, reports The Block.

Experts believe that traders closing arbitrage deals have intensified downward pressure on the price of the leading cryptocurrency.

Currently, the market “lacks bullish momentum,” leading to quotes falling below the key level of $65,800. Nevertheless, experts noted that the pressure on the price may be limited.

Traders are hesitant to replenish their coin reserves, demand growth from whales remains weak, and the volume of stablecoins is increasing at the slowest pace since November 2023.

Jag Kuner, head of derivatives at Bitfinex, confirmed CryptoQuant’s data regarding the derivatives market situation.

“As funding rates have turned negative, inflows into ETFs, which were part of basis trading, have dried up,” he explained.

The specialist reported a $1.2 billion drop in open interest in bitcoin futures on the CME over the past ten days.

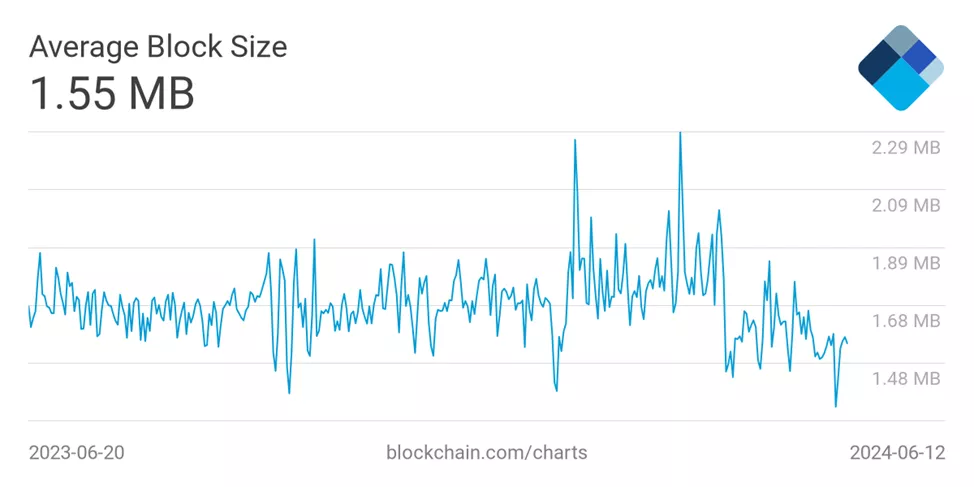

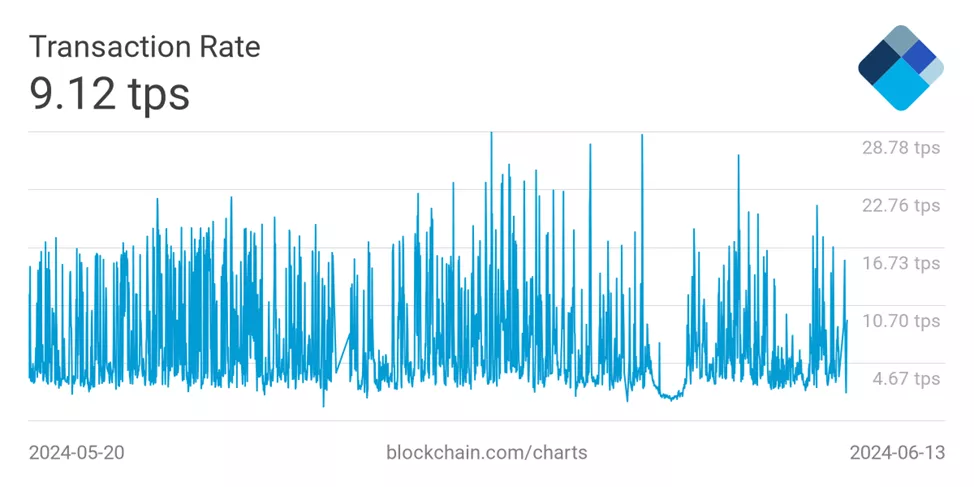

Amid weakening market activity, there is also a decline in the average block size and TPS.

The first indicator reached an annual low on June 7. The second, after peaking above 28 TPS, has fallen to the current 9.12 TPS.

Earlier, Glassnode indicated that a decisive price movement in either direction is necessary to exit range-bound trading.

Previously, analysts concluded that operations on the price difference between spot and derivatives markets are restraining buyer pressure in BTC-ETF.

Earlier, Bernstein predicted bitcoin could reach $200,000 by the end of 2025, driven by expectations of “unprecedented demand for spot exchange-traded funds.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!