Bitcoin Faces Uncertainty Amid Mt.Gox Compensation Distribution

- Bitcoin is experiencing uncertainty due to the distribution of Mt.Gox compensations.

- Ethereum may find itself in a favorable position following the approval of spot ETFs.

- Meme tokens continue to attract traders’ attention.

The price of Bitcoin is being held back by uncertainty surrounding the potential distribution of assets from the Mt.Gox exchange. This is reported by The Block, citing a report from QCP Capital.

In late May, the platform, which went bankrupt in 2014, began moving its first cryptocurrency worth over $9 billion for the first time in five years. Mt.Gox is expected to compensate clients by October 31.

This situation could benefit Ethereum ahead of the launch of spot ETFs, experts suggest. On May 23, the US Securities and Exchange Commission approved 19b-4 applications from potential product issuers. Companies are now awaiting the regulator’s approval of the S-1 form.

“As the market consolidates within a range and eagerly anticipates the launch of spot ETFs on Ether, ‘accumulators’ remain attractive, allowing traders to consistently accumulate ETH at a discount,” noted QCP Capital.

Is a Sell-Off Possible?

Analysts at Bitfinex share concerns regarding the upcoming payments to affected Mt.Gox users.

“If creditors decide to quickly liquidate their assets, the market could face an increase in Bitcoin supply. This scenario is likely to lead to a sharp price drop due to the sudden influx of sell orders. Such an event could trigger a cascade of further liquidations as panic spreads among other holders,” they suggested.

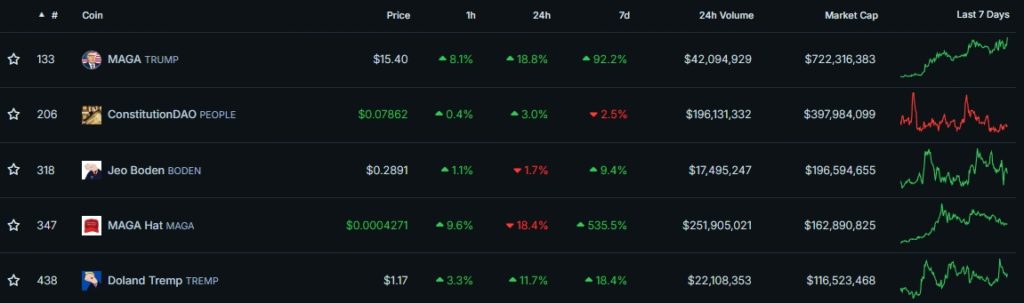

Meanwhile, amid the trading of major cryptocurrencies within a relatively narrow range, investors’ attention has shifted to more volatile meme coins, noted QCP Capital specialists.

“Traders are shifting their focus to high-beta meme tokens like Shiba Inu, Dogecoin, and Pepe, which are showing double-digit growth within the 10-20% range and rank in the top 10 by open interest volume,” wrote the analysts.

The most significant growth over the past seven days has been demonstrated by assets in the PolitiFi category, according to CoinGecko. However, the outcome of the legal proceedings against Donald Trump has shaken the positions of “political” meme coins associated with his name.

According to MN Trading founder Michaël van de Poppe, the altcoin market is generally in a consolidation phase before a “big breakout.”

The #Altcoin market capitalization is technically consolidating before a big breakout is happening. pic.twitter.com/XS0NBoZrpW

— Michaël van de Poppe (@CryptoMichNL) May 31, 2024

Former owner and head of the Mt.Gox exchange, Mark Karpeles, does not expect mass sales of the distributed Bitcoins by the platform’s clients.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!