Bitcoin falls below $100,000

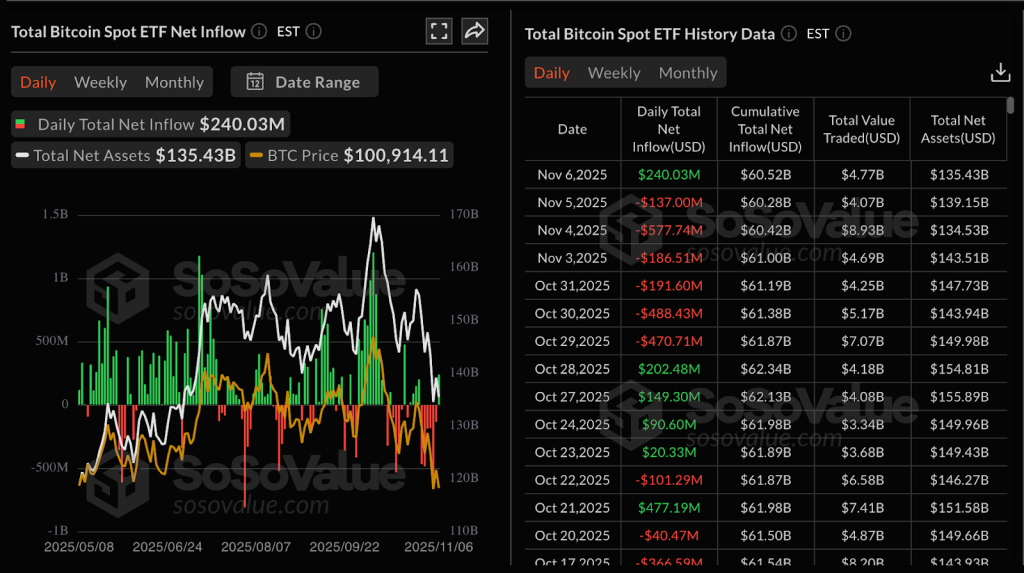

Spot BTC ETFs recorded inflows for the first time in eight days

On November 7 the price of the largest cryptocurrency slipped below the psychological $100,000 level — to about $99,900.

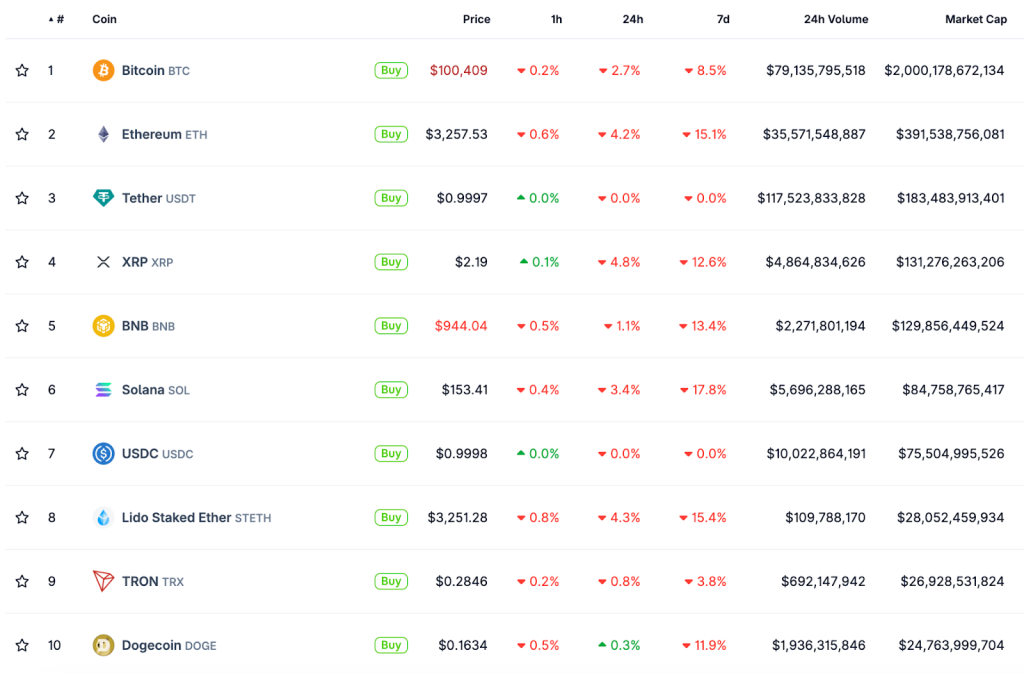

Over the past day bitcoin fell 2.9%, and 8.9% over the week. At the time of writing it trades at $100,110.

According to trader Ardi, after losing $100,000 the next key support sits at $98,000.

$BTC falls below $100K again 🚨

Engulfing 4H candle sends Bitcoin to test the $100K support.

Needs to hold above, otherwise likely flushe into ~$98K critical support. pic.twitter.com/LD5vzzzuvz

— Ardi (@ArdiNSC) November 7, 2025

Earlier, CryptoQuant contributors from XWIN Research noted a local bottom for digital gold around $100,000, citing the MVRV indicator. They named $99,000–$101,000 as the reference range.

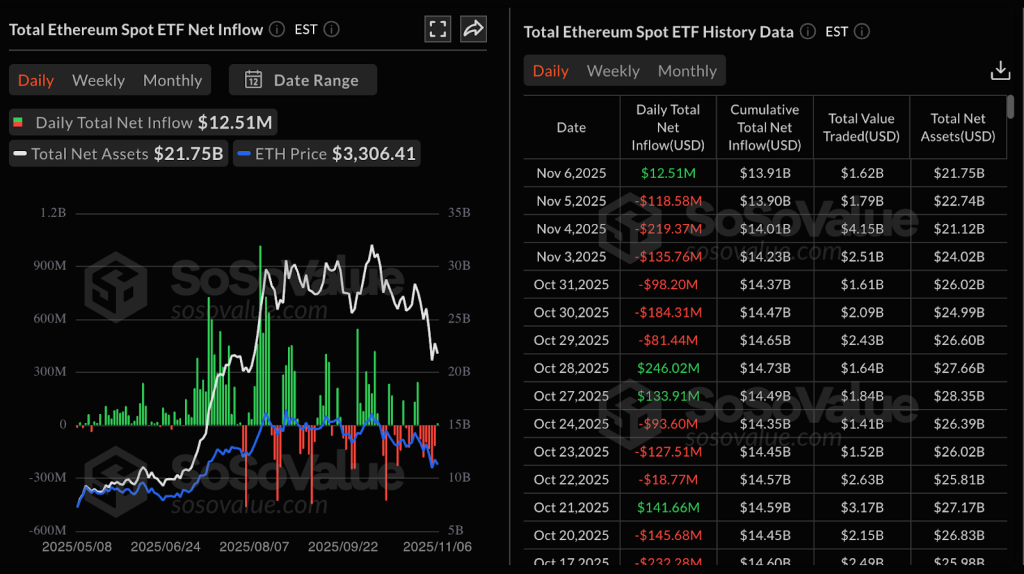

Ethereum’s price has fallen 4.6% over the past day and 15.7% over seven days. At the time of writing, the second‑largest cryptocurrency trades around $3,200.

Almost all top‑10 cryptocurrencies by market capitalisation declined. The exception was the memecoin Dogecoin, up 0.3%.

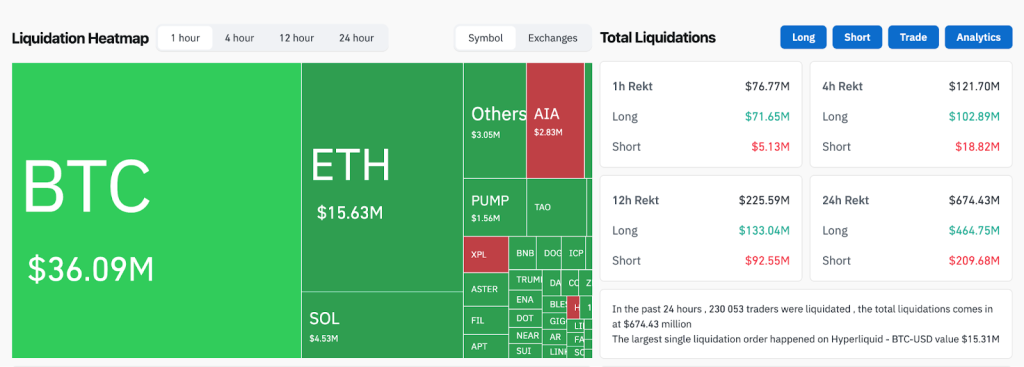

Amid the correction, $76.8 million in positions were liquidated over the past hour. The 24‑hour tally reached $674.3 million.

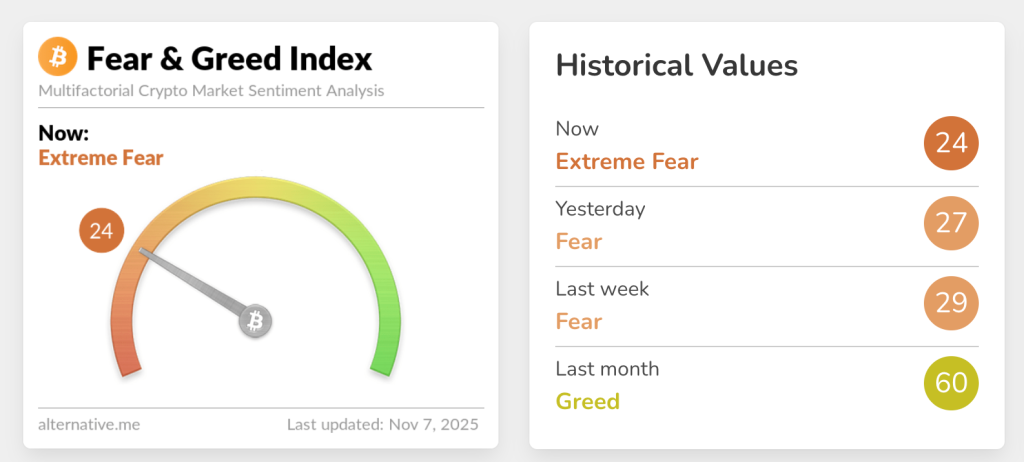

The crypto fear and greed index stands at 24 — an “extreme fear” zone.

ETF inflows resume

Bitcoin’s price is falling despite the return of inflows into funds based on the asset. In the latest session, spot BTC-ETF took in $240 million after six days of outflows.

The bulk went to BlackRock’s IBIT — $112 million. Also “in the plus” were FBTC from Fidelity ($61 million) and ARKB from Ark & 21 Shares ($60 million).

Ethereum‑focused products received $12 million. BlackRock’s ETHA led with $8 million.

FETH from Fidelity and ETHW from Bitwise attracted $4 million and $3 million, respectively.

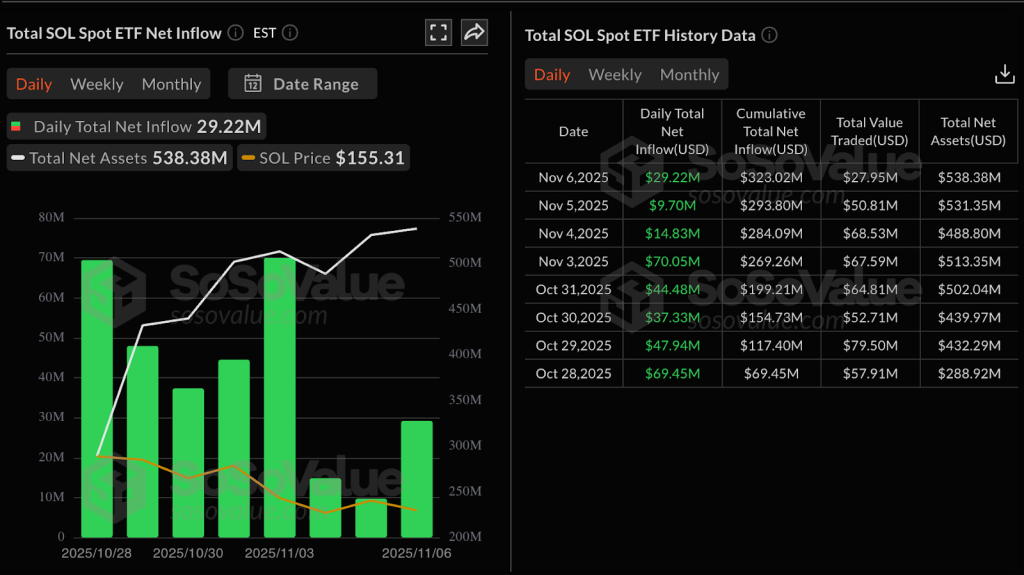

Inflows into spot Solana ETFs have continued for an eighth straight day — $29 million in the most recent session. Since launch, these instruments have taken in $323 million.

The segment is currently represented by two players — BSOL from Bitwise and GSOL from Grayscale.

JPMorgan analysts forecast bitcoin’s rise to $170,000.

A trader under the nickname Ash Crypto spotted a “bear trap” in Ethereum’s dynamics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!