Bitcoin falls below $21,000 after Powell remarks

The Fed is taking decisive and swift steps to balance demand with supply and to keep inflation expectations anchored. Such a policy will require keeping interest rates high for some time, its chairman Jerome Powell said.

The Fed chair explained that the longer inflation remains high, the greater the likelihood that it will become anchored at elevated levels. To bring it down, a sustained period of economic growth below trend may be required, he added.

“The successful disinflation [by former Fed Chair Volcker] in the early 1980s required a lengthy period of extremely restrictive monetary policy. Our aim is to avoid such an outcome by acting decisively now,” Powell said.

The size of the rate increase in September will depend on the data. However, softer price pressures in the latest reports are not enough, the Fed chair warned. He suggested that at some point the central bank could slow the pace of monetary tightening.

Powell’s remarks were slightly more hawkish, but overall echoed his тезисы пресс-конференции following the заседания в июле.

The market had priced in slightly more aggressive rhetoric. Along with the latest macro data, the odds of a softer rate hike in September rose from 36% to 43.5% on the last day.

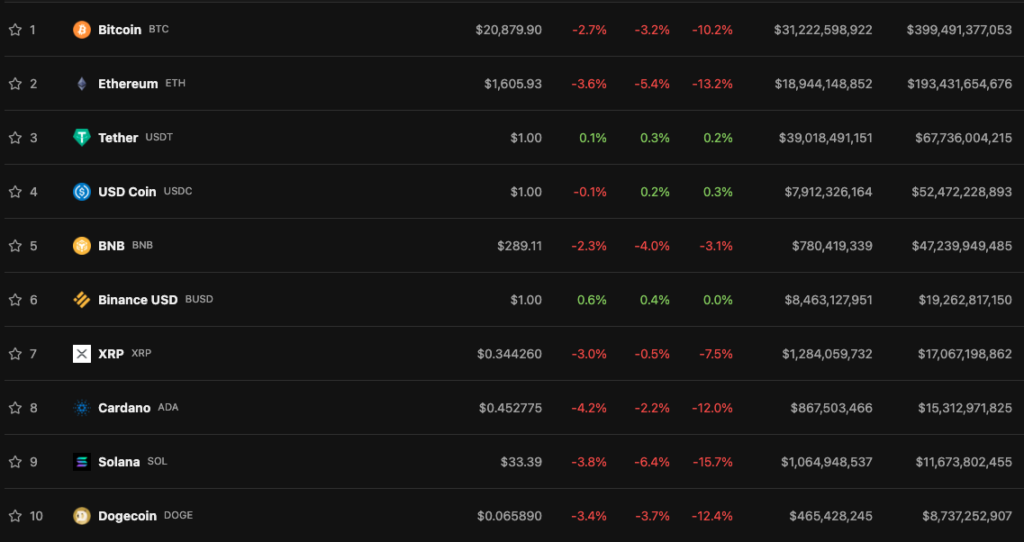

The cryptocurrency market reacted negatively to Powell’s remarks. In the last 24 hours, Bitcoin fell about 3.5% (CoinGecko) and sank below $21,000. As of writing, the digital gold trades above $20,800.

All top-10 crypto assets moved into the red zone, with the exception of stablecoins USDT, USDC and BUSD.

Recall that Galaxy Digital CEO Mike Novogratz спрогнозировал Bitcoin would stay in the $20,000–$30,000 range.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!