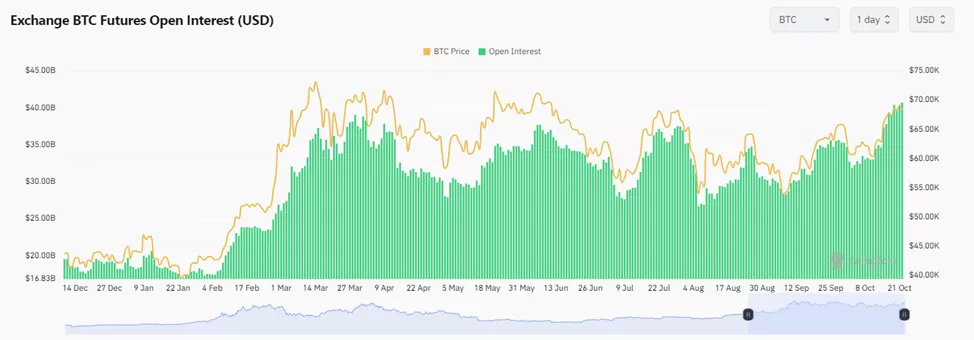

Bitcoin Futures Open Interest Reaches Record $40.6 Billion

On October 21, the total open interest (OI) in bitcoin futures reached a record $40.6 billion, surpassing the March figures at the ATH. This is according to data from Coinglass.

In terms of coins, the figure amounted to 592,000 BTC, the highest since December 2022. At that time, the leading cryptocurrency was valued at no more than $20,000 amid peak bearish sentiment.

40% of the total dollar value was attributed to contracts listed on the CME, popular among institutional investors ($11 billion).

“The breakthrough of the $68,000 mark was accompanied by an inflow of ~$2.4 billion into BTC-ETF over the last six sessions, as well as a corresponding jump in OI. This is a constructive signal for opening new long positions,” — commented SOFA.org’s Head of Analytics, Augustin Fan.

QCP Capital noted that macroeconomic factors in Japan and China, combined with the US elections, are contributing to the continued rise of bitcoin.

4/ Japan’s inflation dipped to 2.5% from 3.0%, and the BOJ is likely to keep rates low. Meanwhile, US equities are near all-time highs, and the USD/JPY rally continues. All signs point to strengthening risk-on sentiment as the US election nears.

— QCP (@QCPgroup) October 20, 2024

“US stocks are near historical highs, and the Japanese yen is on a new weakening cycle. Optimism will intensify as the US elections approach, leading to a rise in risk assets and supporting Uptober,” concluded the experts.

Earlier, BlackRock CEO Larry Fink opined that bitcoin will continue to rise regardless of who occupies the White House.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!