Bitcoin hits a record above $124,000

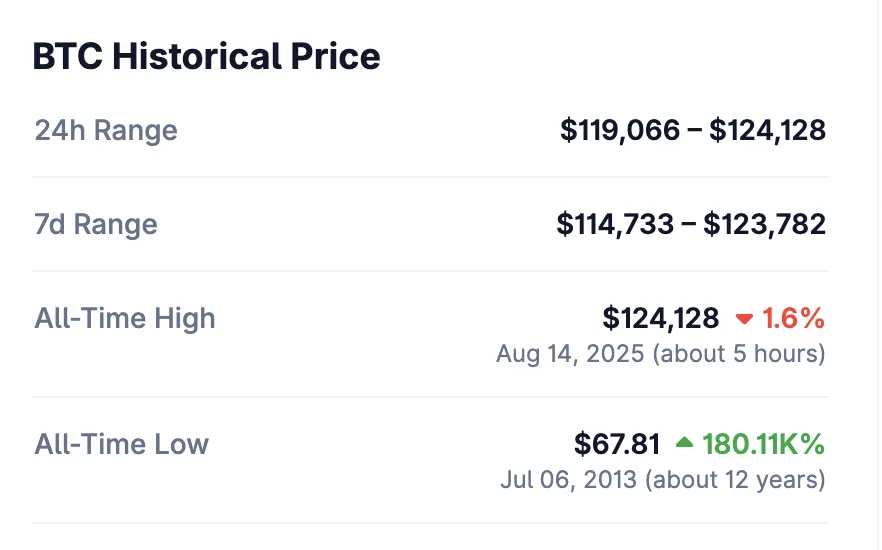

On August 14, bitcoin hit $124,128, setting a new price record (ATH).

After setting an all-time high, bitcoin slipped back below $121,000.

Bitcoin broke below $120,000, falling to $119,388.

The pullback coincided with the release of the US producer-price index (PPI). The print rose to 3.3% versus 2.5% expected.

At the time of writing, the leading cryptocurrency had eased to $121,862, 1.6% off its ATH.

Amid the surge, bitcoin’s market capitalisation reached $2.4 trillion, entering the world’s five largest assets. On this measure, the cryptocurrency briefly overtook Google.

BREAKING: #BITCOIN JUST SURPASSED GOOGLE TO BECOME THE 5th LARGEST ASSET IN THE WORLD

THIS IS WILD!!! pic.twitter.com/yphRAka7j9

— Vivek Sen (@Vivek4real_) August 13, 2025

Ether came within less than $100 of a new record. The cryptoasset trades at $4,737 — 3% below the all-time high of $4,878 set on November 10, 2021.

Total crypto-market capitalisation reached $4.23 trillion, up 2.9% over the past 24 hours, according to CoinGecko.

Bitcoin’s dominance index stands at 57.5%; Ethereum’s at 13.5%.

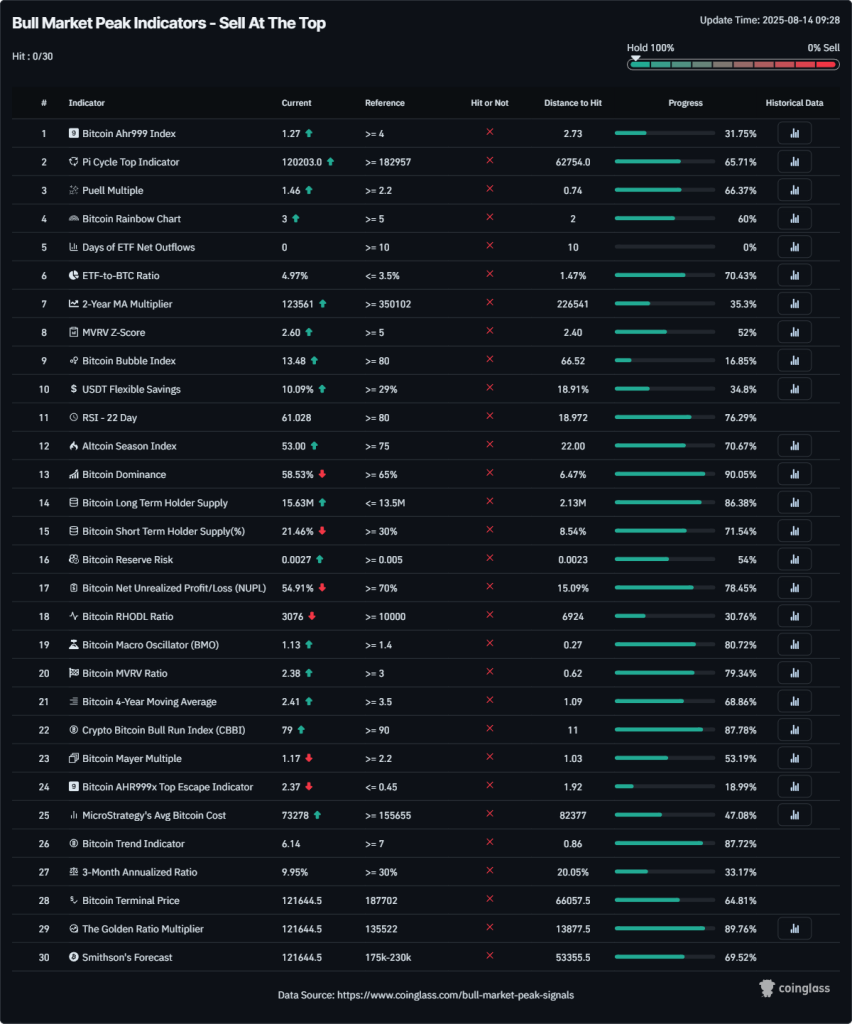

None of the CoinGlass indicators for a bull-market peak is yet signalling overheating or the wisdom of taking profits.

In the past 24 hours, positions of 113,822 traders worth $454 million were liquidated.

CoinGlass data show short positions worth $2 billion at risk. Short sellers would lose funds if bitcoin reached $125,500.

Further gains ahead?

According to Presto Research analyst Min Jun, the rally to a new ATH was driven by rising expectations of a rate cut by the Fed in September.

“The CME FedWatch Tool now puts the probability at 93.7%,” she told The Block.

Optimism intensified after publication of the latest US consumer-price index. The July reading came in at 2.7%, below the 2.8% consensus.

However, Fed easing is not guaranteed, Jun noted. Earlier, chairman Jerome Powell said the central bank focuses on annual inflation. Hence a rise in the core measure could spark concern despite a slowdown in the headline CPI.

“Bitcoin’s price will likely remain highly sensitive to any news — positive or negative — related to the September rate decision,” the expert added.

BTC Markets crypto analyst Rachel Lucas said the bitcoin price is rising thanks to a “perfect storm” of institutional demand from ETFs and corporate treasuries.

“Over the past month, bitcoin ETFs have attracted more than $3.6 billion, while corporate and government treasuries have accumulated 3.64 million BTC. That is more than 17% of the total supply. If you add strategic long-term investments, we see structural demand meeting limited supply,” she said.

She said the sustained uptrend could persist through year-end, though consolidation in the $120,000–125,000 range is possible.

“But the combination of scarce supply and deep structural demand will support further growth through the end of the year. Long-term holders are confident in the asset; bitcoin and Ethereum are increasingly seen as core assets in investment portfolios,” Lucas concluded.

JAN3 CEO Samson Mow also predicted further gains for bitcoin, but warned of a potential pullback.

There will be more Bitcoin ATHs but I think we will see a pullback because alts are running too hot now. Once the altcoin mania passes, Bitcoin will take off. This is just how it’s always been. https://t.co/OZn3mTtgkC

— Samson Mow (@Excellion) August 13, 2025

“We will see several more new bitcoin ATHs, but I think a pullback will follow — altcoins are overheated now. Once the alt mania passes, the first cryptocurrency will take off again. That’s how it has always been,” he wrote.

On August 13, Capriole Investments founder Charles Edwards forecast a new leg higher for bitcoin.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!