Bitcoin miners’ fee income sinks to a 12-month low

The figure fell to $300,000 per day

Transaction-fee takings for miners of the first cryptocurrency have fallen to a 12-month low, according to The Block.

The figure has dropped to $300,000 a day — 1% of miners’ total revenue. Most income is generated by the block reward of 3.125 BTC (~$287 million at the current rate).

Sharp spikes in fees were seen in 2023 and 2024 amid the popularity of protocols such as Ordinals and Runes. They revived interest in the BTCFi ecosystem.

On-chain data show that the network’s primary use remains money transfers. That limits the scope for generating high transaction fees.

Bitcoin’s economic model envisages that by 2140, when coin issuance ceases, miners will earn solely from fees. That makes ever more pressing the question of whether the blockchain can sustain sufficient income to support network security.

Bitcoin slides as fees fall

According to a report by Hashrate Index, between 10 and 17 November miners earned 3,127 BTC (~$313 million) in block rewards.

Transaction fees totalled 22 BTC (~$2.1 million) — 0.69% of overall takings.

The price of the digital gold fell 12.8% — from $105,700 to around $90,000. At the time of writing the asset trades at $92,300, up 0.5% on the day. Over the week, it has slumped by more than 11%.

Dollar-denominated hashprice fell 10.8% — from $42.88 to $38.25 per PH/s/day. In BTC terms it rose 2.6% — from 0.00040660 BTC to 0.00041712 BTC per PH/s/day.

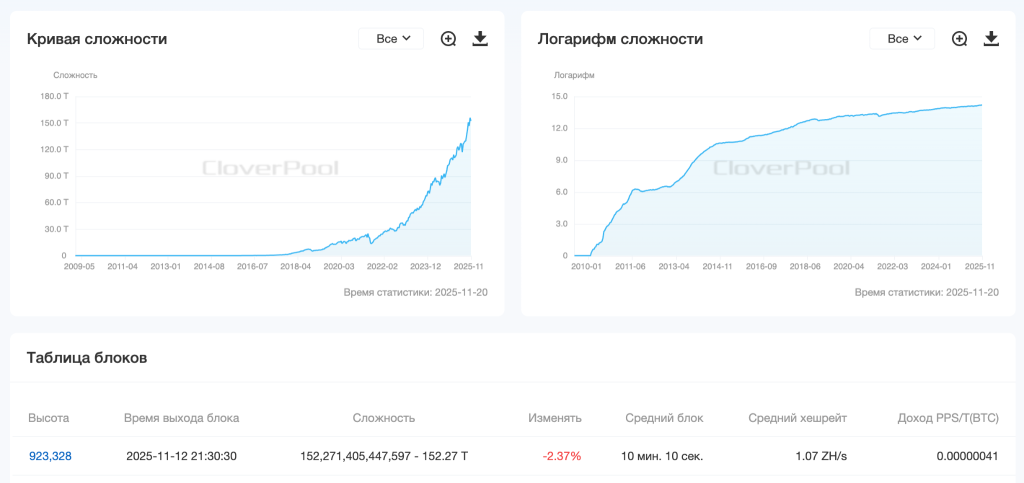

Hashrate (7 DMA) increased by 6.7% — from 1,056 EH/s to 1,127 EH/s. The 30-day SMA currently stands at 1,107 EH/s.

The latest difficulty adjustment occurred on 12 November. The metric fell 2.37% to 152.27 T.

Bitcoin miners’ shares rally on Nvidia results

Shares in public mining companies rose after the release of Nvidia’s strong quarterly report. The firm reported record revenue of $57 billion.

Cipher Mining climbed by more than 13%, IREN by 10%. Bitfarms, TeraWulf and CleanSpark also gained. The shares of the largest miner by market value — MARA — jumped 4%.

Renewed interest in crypto miners is linked to their diversification strategy into artificial intelligence. In late October, Crusoe raised $1.375 billion to develop AI infrastructure for OpenAI, and in early November IREN signed a $9.7 billion contract with Microsoft.

Earlier, MARA CEO Fred Thiel predicted tough times for miners amid rising competition and declining profitability.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!