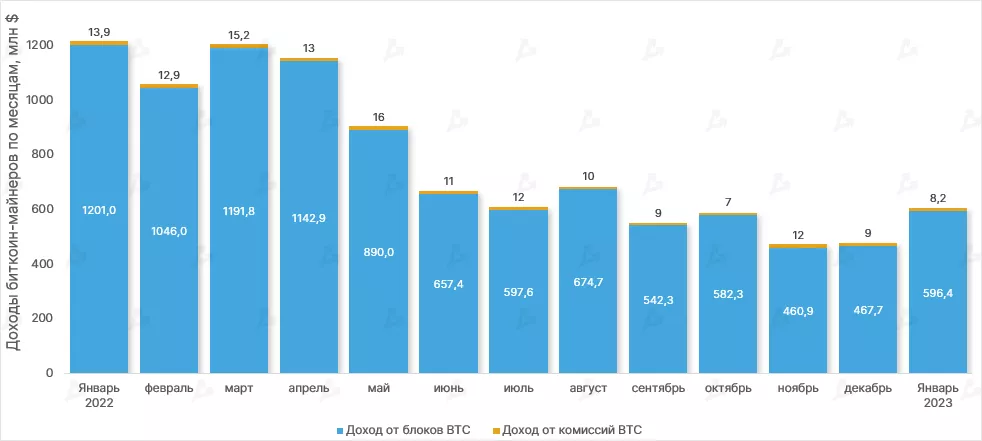

Bitcoin miners’ revenue rose 27% in January

Aggregate revenue of Bitcoin miners in January amounted to $604.6 million. The figure rose by 27% from December, according to an analytical report ForkLog.

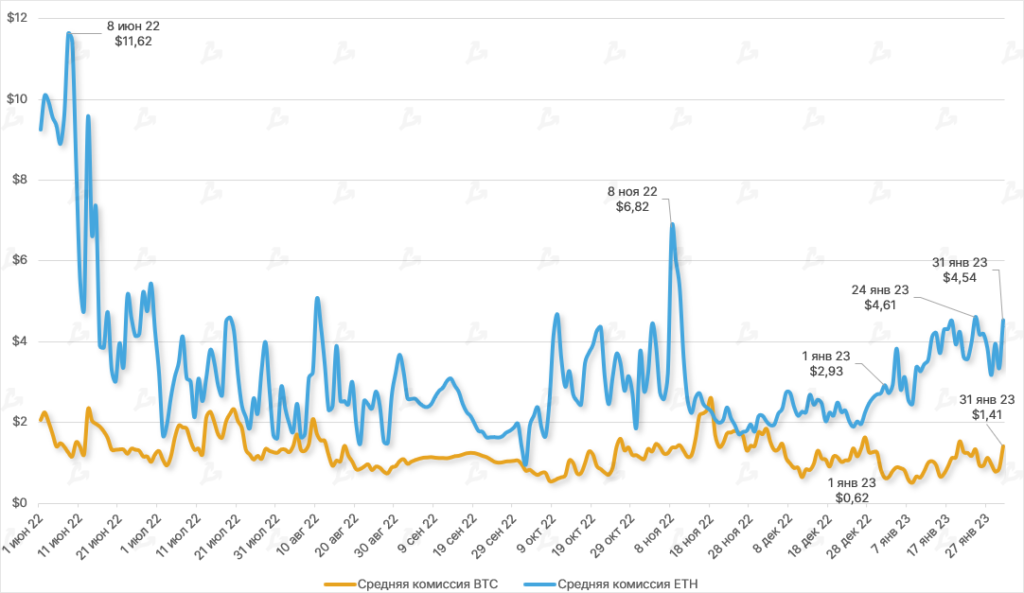

The average transaction fee for Bitcoin in January rose by 127%—from $0.62 to $1.41. Over the same period, the corresponding Ethereum metric rose by 55%—from $2.93 to $4.54.

The share of fees in revenue fell to 1.38% (2% in December).

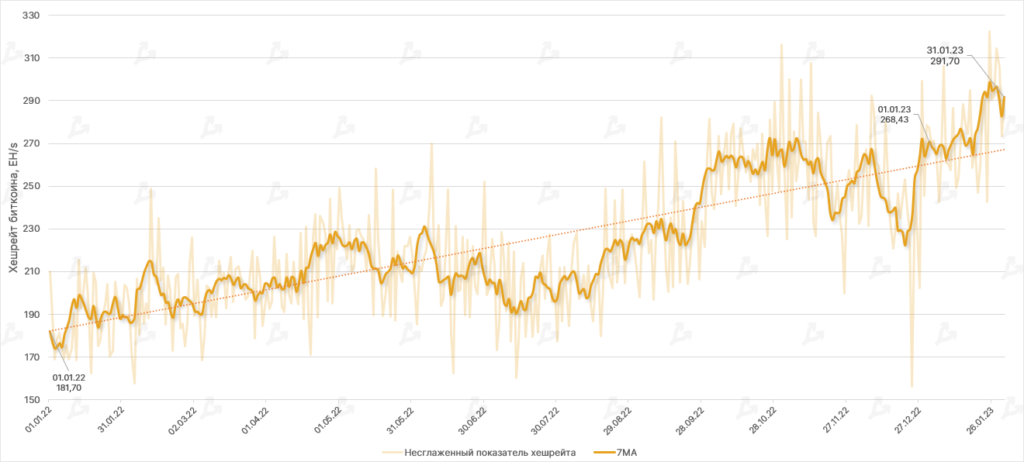

Against the backdrop of price recovery, Bitcoin’s hashrate in January rose by 8.6%, approaching the 300 EH/s threshold.

The overall trend of the metric remains persistently upward, indicating market participants’ confidence in Bitcoin’s long-term prospects.

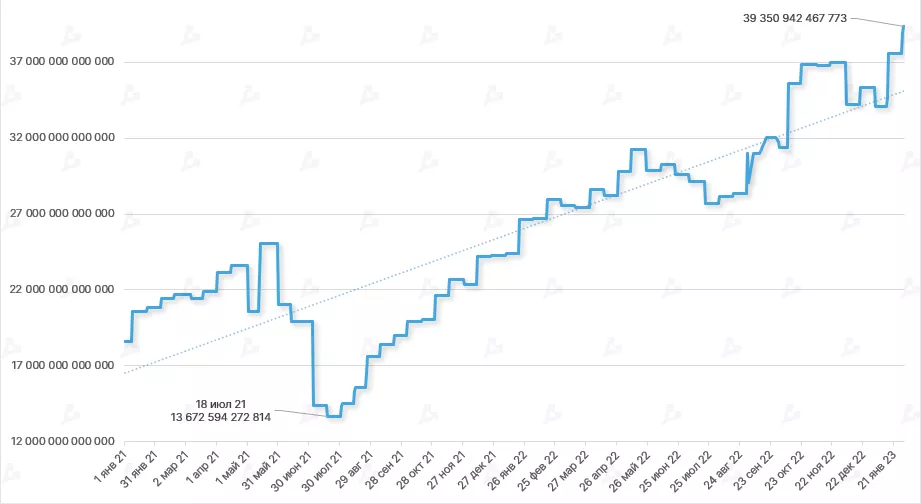

The mining difficulty, closely linked to the hashrate, again hit a new historical high — at 39.35 T.

An increase in the metric reduces mining profitability and caps miners’ revenue growth, but on the other hand stimulates investment in high-performance and energy-efficient equipment.

Hashprice for Bitcoin is gradually recovering. The indicator has already reached October 2022 levels, preceding the November market crash.

The share of the largest pool — Foundry USA — nearly reached one third of the total Bitcoin hashrate (32.3%). A month earlier the figure stood at 26.7%. Accordingly, the gap to the nearest competitor — AntPool (19.7%) — widened.

Earlier in January, Marathon Digital sold 1,500 BTC to cover part of its expenses. The firm holds a total of 11,418 BTC.

In February, the U.S. mining company TeraWulf announced a $32 million equity raise via a stock placement. The initiative aligns with a legally binding agreement with creditors on debt restructuring.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!