Bitcoin Mining Costs Set to Surge Post-Halving, Expert Reveals

The cost of mining Bitcoin using the Antminer S19 XP is expected to rise from $40,000 to $80,000 following the halving, according to Ki Young Ju, CEO of CryptoQuant.

#Bitcoin mining costs are set to double by the end of the month after the halving, jumping from $40K to $80K for S19 XPs, commonly utilized by US miners.

Chart by @clayop pic.twitter.com/iElf2i7Kok

— Ki Young Ju (@ki_young_ju) April 8, 2024

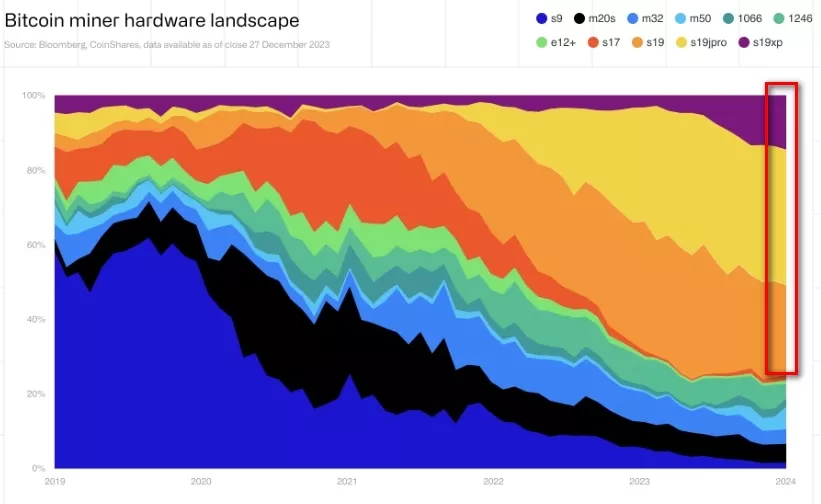

The expert noted that this model is widely used by American miners. It is the most energy-efficient in the S19 series, which still generates a significant portion of the hashrate, according to CoinShares.

The head of CryptoQuant emphasized that after the third halving in 2020, only the subsequent parabolic price increase of digital gold ensured profitable operations for miners.

Since the May 2020 halving, mining costs doubled, yet a parabolic bull run ensued, covering these costs and achieving profitability. pic.twitter.com/scE9iiXbOI

— Ki Young Ju (@ki_young_ju) April 8, 2024

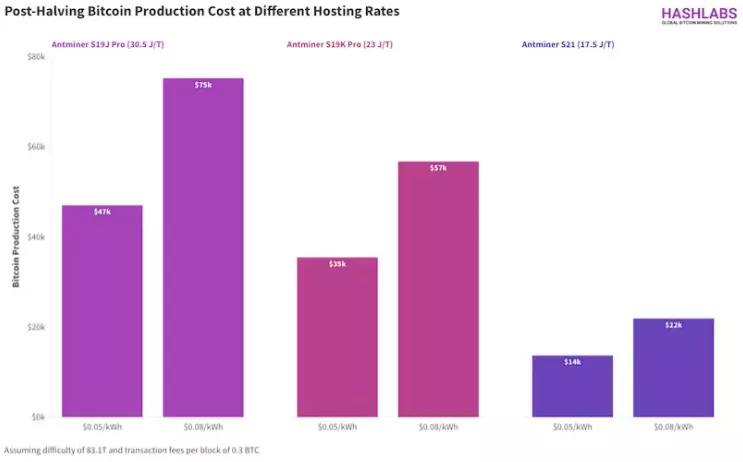

A similar assessment was provided by Hashlabs Mining co-founder Jaran Mellerud. According to his calculations, direct costs for mining Bitcoin with the Antminer S19J Pro in the US will reach $75,000 after the block reward is halved. This model is less efficient than the S19 XP but occupies a larger share of the equipment fleet.

“Many miners in the US may face cash flow issues post-halving and thus will be forced to conduct a large-scale upgrade of their equipment,” Mellerud predicted.

In this situation, transitioning to the S21 series becomes “a necessity rather than a choice,” he stated.

Bitmain announced the flagship device of this series in August 2023.

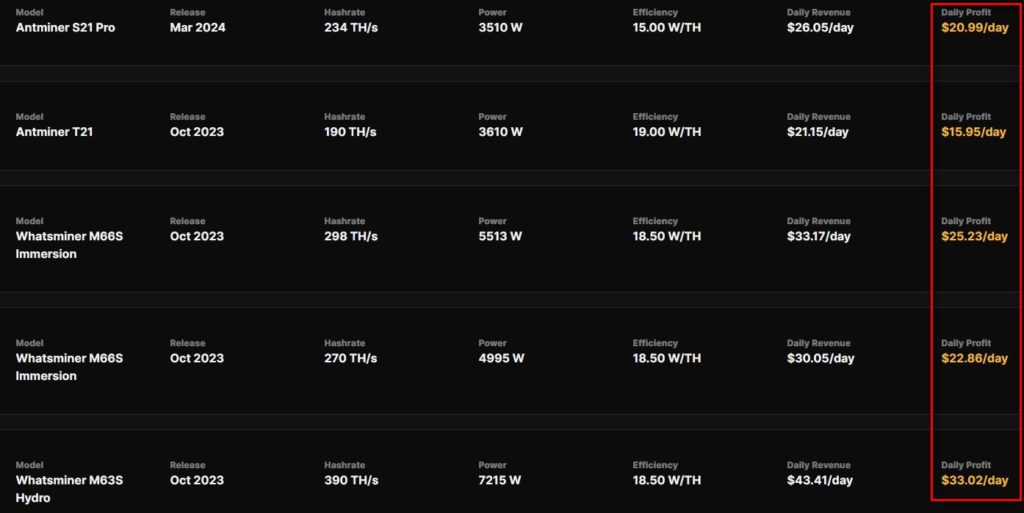

In October, the company released the Antminer T21 model with slightly lower power. In the same month, the main competitor, MicroBT, introduced a new generation of miners.

These series provide the highest daily profit metrics, according to Hashrate Index.

“While switching to the latest rigs allows operations to continue even under high costs, it is unlikely to be a viable long-term strategy. The need for constant equipment upgrades, often before previous investments have paid off, underscores the instability of this approach,” Mellerud warned.

In his view, various methods should be employed to enhance competitiveness, including:

- reducing operational expenses;

- improving the efficiency of outdated miners through software solutions;

- seeking opportunities for additional revenue, such as utilizing excess heat.

Mellerud also suggests that post-halving, the trend of expanding mining geography in search of “cheap electricity” will intensify. He noted that companies are already actively exploring emerging markets in Africa, Latin America, and Asia.

Bitfarms operates in Argentina and Paraguay, with Marathon also entering the latter, while Bitdeer expands its capacity in Bhutan, the expert cited as examples. According to Bloomberg, Chinese miners are relocating to Ethiopia.

Will the Halving Seriously Impact Hashrate and Price?

According to research by Galaxy Digital experts, 15-20% of Bitcoin network’s computational power will become unprofitable and may be shut down post-halving.

Top managers of mining companies agreed with the inevitable decline in hashrate overall but found it difficult to predict the scale.

In Mellerud’s opinion, the reduction will be moderate, ranging from 5-10%. His former colleagues at Hashrate Index provided an even lower estimate of 3-7%.

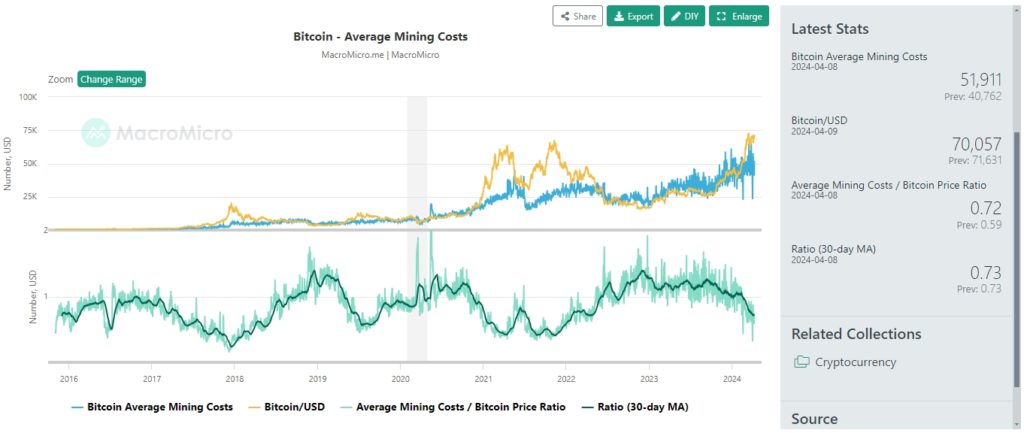

The Hashlabs Mining co-founder justified the forecast with the current high average profitability of Bitcoin mining compared to its price. According to MacroMicro, the figures are $51,911 and $70,057, respectively.

The expert also noted that approximately 70% of the operational equipment was commissioned before January 2022. As a result, it has operated for several months under much harsher economic conditions than those expected post-halving, he emphasized.

Mellerud does not anticipate a significant impact of the block reward reduction on Bitcoin’s price. The event will not trigger a bull market contrary to the popular narrative, the expert believes. He argues that the halving will slightly reduce the coin’s supply, and demand will remain the decisive factor.

According to Ki Young Ju, on-chain indicators suggest a favorable opportunity to buy Bitcoin, as the atmosphere resembles the previous halving.

Same vibe as the previous #Bitcoin halving. https://t.co/Iez8vXkPvw

— Ki Young Ju (@ki_young_ju) April 8, 2024

However, after the 2020 halving, miners shifted to net sales of mined coins. A significant price increase began only months later, with the next peak reached in November 2021.

Former BitMEX CEO Arthur Hayes suggested that Bitcoin might fall before and after the halving, which serves as a bullish catalyst in the medium term.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!