Bitcoin Nears Record High of $94,000 Amid BTC-ETF Options Launch

On the evening of November 19, the price of the leading cryptocurrency reached a new all-time high, surpassing $93,900. The excitement surrounding the launch of options trading on BlackRock’s spot Bitcoin ETF may have been the catalyst.

At the time of writing, the asset is trading at $92,400. The daily decline rate has decreased to 0.2%.

Bloomberg analyst James Seyffart noted that on the debut day, market participants opened 289,000 calls and 65,000 puts on the BTC-ETF, totaling $1.9 billion. The ratio of 4.4 to 1 explains the price’s drive towards the ATH, he pointed out.

UPDATE: Final tally of $IBIT‘s 1st day of options is just shy of $1.9 billion in notional exposure traded via 354k contracts. 289k were Calls & 65k were Puts. That’s a ratio of 4.4:1. These options were almost certainly part of the move to the new #Bitcoin all time highs today pic.twitter.com/IN3s9hajJ2

— James Seyffart (@JSeyff) November 19, 2024

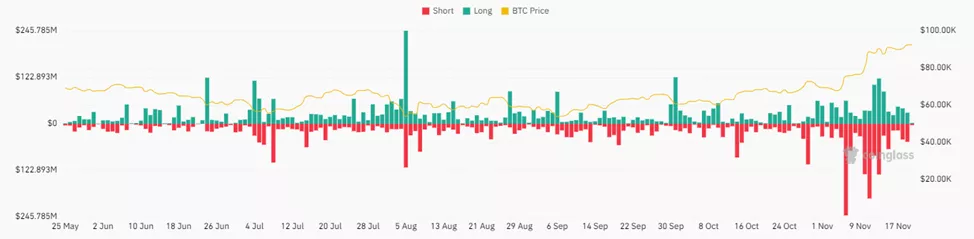

The rise in prices may have been amplified by the liquidation of short positions. Over the past day, their volume amounted to $47.6 million, according to Coinglass.

Earlier in the day, information emerged about MicroStrategy’s plans to issue five-year senior convertible bonds worth $1.75 billion to purchase bitcoins.

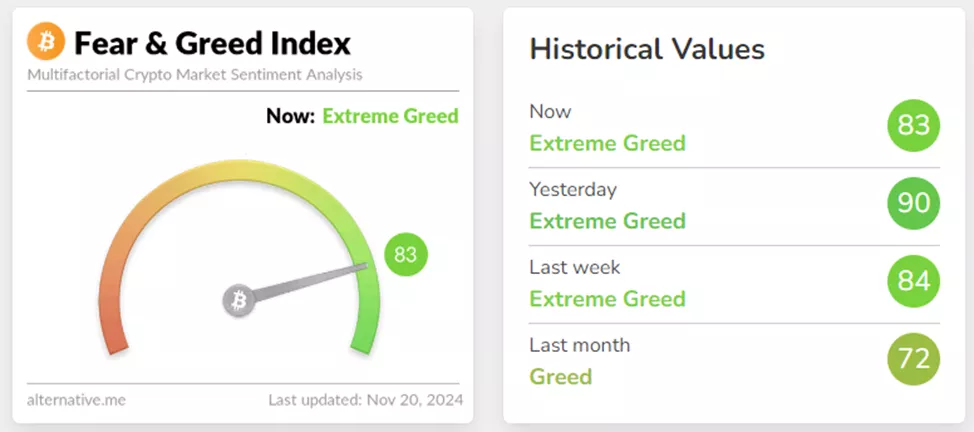

The cryptocurrency fear and greed index reached a level of 83, indicating a state of extreme greed among market participants.

Analyst Jesse Colombo highlighted Bitcoin’s breakout from a triangle pattern on the four-hour timeframe. If this breakout holds, the expert anticipates further movement towards $100,000.

Bitcoin is now breaking out of its triangle/pennant pattern on the 4-hour intraday chart.

Assuming this breakout holds, it should run to $100,000+ fairly quickly.$BTC $IBIT pic.twitter.com/kx5GzNDh3U

— Jesse Colombo (@TheBubbleBubble) November 19, 2024

Previously, Bernstein identified catalysts for Bitcoin’s rise to $200,000 by 2025.

Similarly, BCA Research has set the same target for Bitcoin in the current cycle.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!