Bitcoin Options Indicate Potential Rise to $70,000

Investors have established a significant volume of open positions with an expiration price of $70,000 for call options maturing on March 8 and 29, reports The Block.

The illustration also indicates a rise in bets on the digital gold reaching $80,000 within the next three weeks.

Jag Kuner, head of derivatives at Bitfinex, highlighted this statistic. According to the expert, the preference for call options over put options signals a bullish market.

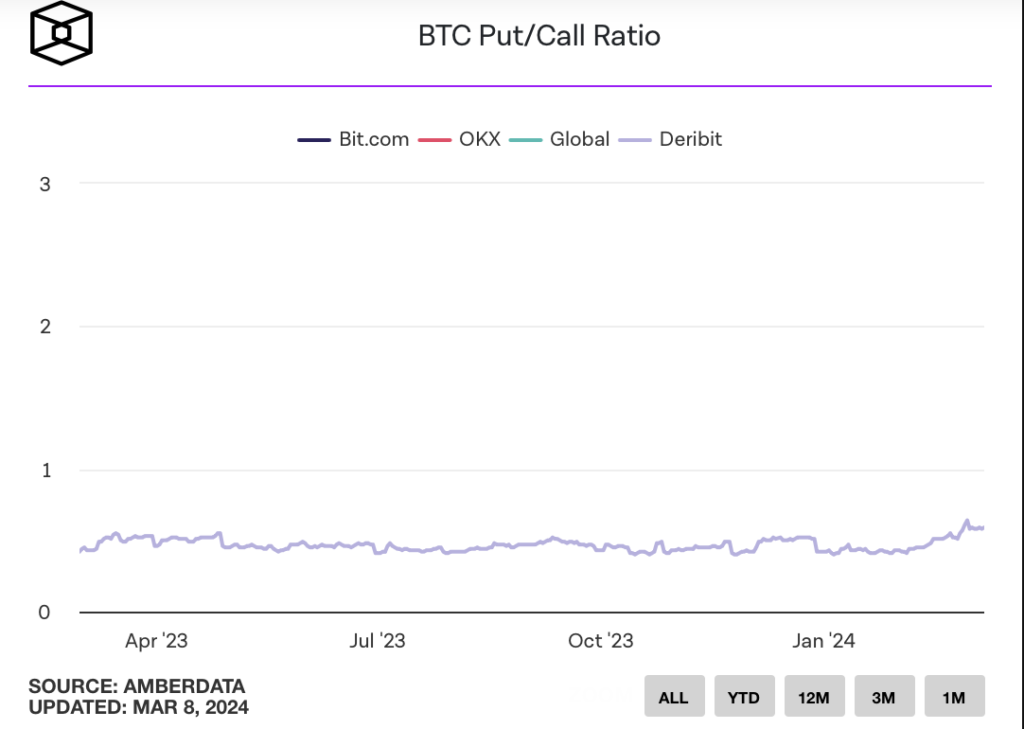

According to The Block, the average put-call ratio for bitcoin options across various platforms is 0.6. A value below 1 suggests bullish sentiment, while above 1 indicates bearish sentiment.

Kuner emphasized that for the first time in the past six months, the put-call ratio has dropped to such low levels and remains stable.

The head of derivatives at Bitfinex noted a decrease in implied volatility. This trend reflects expectations of reduced price fluctuations.

“A reduction in this parameter often leads to lower option premiums and allows market participants to reduce risk,” commented the expert.

Earlier, QCP Capital noted that a deleveraging decline after bitcoin reached a historical high subsequently led to aggressive buying of call options expiring in September-December.

In February, CIO of Bitwise, Matt Hougan, predicted that the price of digital gold would exceed $80,000 in the foreseeable future due to the success of ETFs.

JPMorgan pointed to the upcoming halving in April as a potential trigger for a sharp decline in the price of the leading cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!