Bitcoin Options Indicate Summer Lull, Says Expert

Traders dealing in bitcoin options are bracing for a summer lull in the market. This conclusion was drawn by Jag Kuner, head of derivatives at Bitfinex, as reported by The Block.

“Summer is usually a period of low volatility. Participants begin to build corresponding positions,” the specialist commented.

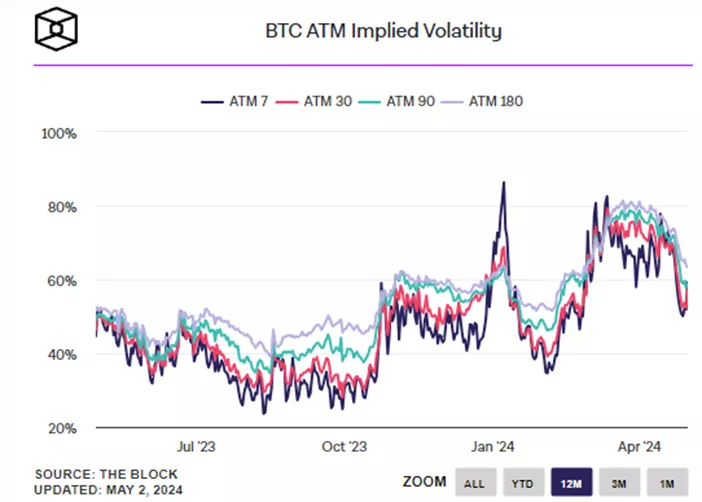

According to the expert, since mid-April, the implied volatility (IV) of “at the money” options has dropped from over 77% to less than 60% for weekly, monthly, and multi-month contracts.

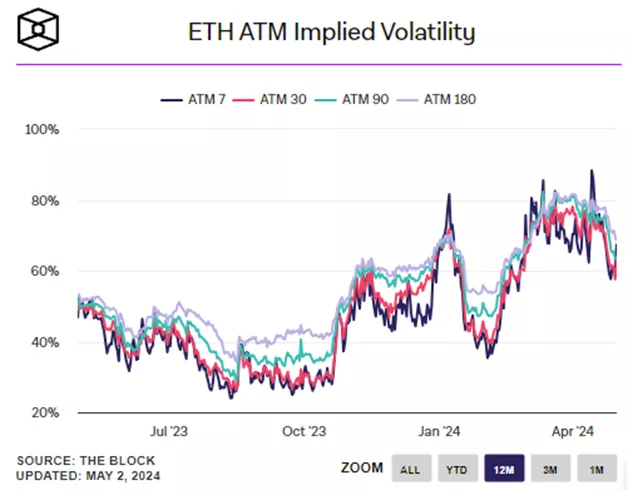

A similar trend has been observed in the implied volatility of Ethereum “at the money” options.

According to Bartosz Lipinski, CEO of Cube.Exchange, this situation reflects a wait-and-see approach until the status of the second-largest cryptocurrency by market capitalization in the US becomes clearer.

“Usually, when there is uncertainty, traders move away from risk into cash and stay on the sidelines,” he explained.

The expert pointed out the likelihood of increased price fluctuations in the summer amid low liquidity.

“Summer can be a relatively calm period […] but just remember 2017, the DeFi summer, and the last major bull market to see what can happen,” he added.

Earlier, trader Gordon Grant noted a decline in confidence in the growth of bitcoin and Ethereum by the end of the year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!