Bitcoin Options Traders Bet on Post-Election Surge to $80,000

Bitcoin options market participants have positioned for a bullish scenario following the U.S. presidential election and the Federal Reserve’s FOMC meeting, increasing OI in November calls with strike prices above $80,000, according to The Block.

The first event is scheduled for November 5, followed by the second three days later.

The probability of the Federal Reserve easing monetary policy by 25 basis points is estimated at 87%, while the victory of the Republican candidate Donald Trump, perceived as more crypto-friendly, is estimated at 63.5%.

On Deribit, over 3,100 calls with strike prices ranging from $80,000 to $82,000, expiring on November 29, were opened, totaling $212 million.

For puts, the OI stands at $82 million. The recent acceleration in this metric suggests hedging of long positions, according to Andre Dragos, head of research at Bitwise in Europe.

Bitcoin ETFs

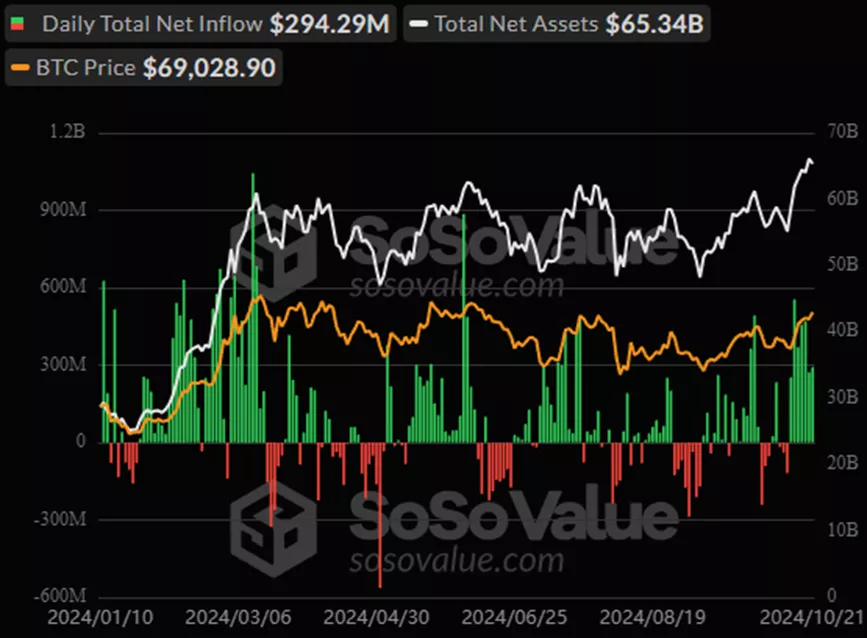

On October 21, inflows into spot Bitcoin ETFs amounted to $294.3 million, with a seven-day total of $2.67 billion.

The inflow on the last day was driven by BlackRock’s IBIT ($329 million), while changes in five other products ranged from -$22.1 million to $5.9 million, with no changes in six others.

Total inflows into instruments since trading began in January have increased to $21.2 billion.

“While institutional support remains strong, the slowdown in inflows suggests the potential for further momentum weakening if capital does not return to the market,” commented Valentin Fournier from BRN.

According to the specialist, technical indicators also point to a similar scenario, implying Bitcoin’s consolidation before a renewed upward attempt.

“Once the price stabilizes above $68,000, we will enter a calmer phase with subdued volatility, potentially leading to renewed acceleration. We remain optimistic in the medium term and do not anticipate a trend reversal,” the expert explained.

Bitcoin futures open interest has reached a record $40.6 billion.

Inflows into cryptocurrency investment funds from October 13 to 19 reached a July high of $2.2 billion, compared to $407 million the previous week.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!