Bitcoin Outshines Gold: Expert Notes Capital Shift to Cryptocurrency ETFs

Since the start of 2024, gold ETFs have seen an outflow of $2.39 billion, while inflows into funds based on the leading cryptocurrency have reached $3.89 billion. These figures were presented by Bloomberg analyst Eric Balchunas.

Meanwhile it’s a pretty bad scene right now in the gold ETFs category… via @SirYappityyapp in our just published weekly flow note pic.twitter.com/C0T17JZpiA

— Eric Balchunas (@EricBalchunas) February 14, 2024

The illustration shows that only three out of the 14 most popular precious metal-based products—VanEck Merk Gold Shares, FT Vest Gold Strategy Target Income ETF, and Proshares UltraShort Gold—can boast positive dynamics.

The specialist questioned the capital rotation into the leading cryptocurrency. He attributed the trend to FOMO in the stock market in light of recent macroeconomic data.

To be sure I don’t think these are ppl migrating to btc ETFs (maybe a tiny bit) but rather just us equity fomo altho that could reverse given the new eco data

— Eric Balchunas (@EricBalchunas) February 14, 2024

The decline in investor interest can also be attributed to the drop in the asset’s price (-3.2% since the beginning of the year). Meanwhile, digital gold has appreciated by 23.5% over the same period.

Against this backdrop, Bitcoin ETFs are attracting increased attention. BlackRock’s IBIT and Fidelity’s FBTC have entered the top 20 weekly fund inflows across all types of exchange-traded funds.

Bitcoin Munger noted the absence of gold ETFs in the rankings.

Incredible to see not just one but 2 #bitcoin ETFs with top flows in the last week.

You know what is not present in the top 20? Gold.

The disruption of gold by Bitcoin is going to come a lot faster than goldbugs think. pic.twitter.com/HydWjKLuuT

— Bitcoin Munger (@bitcoinmunger) February 13, 2024

“The disruption of the ‘eternal value’ by Bitcoin will happen much faster than goldbugs think,” he suggested.

Co-founder and CTO of Casa, Jameson Lopp, recalled one of the prominent figures in this category—Peter Schiff. He decided to inquire about his well-being, adding ETF dynamics to the post.

Can someone do a wellness check on @PeterSchiff? pic.twitter.com/mUc2xGwK2j

— Jameson Lopp (@lopp) February 14, 2024

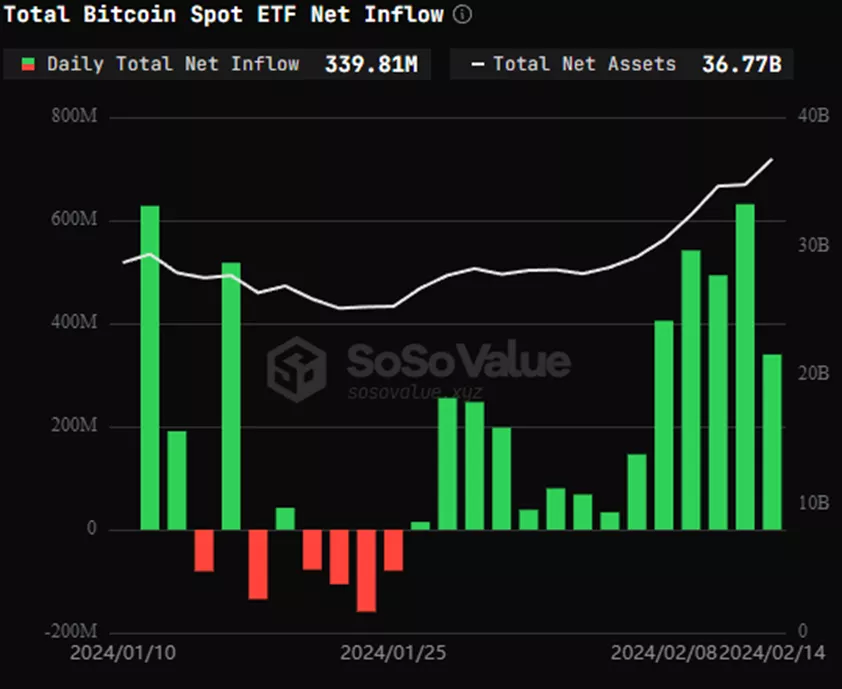

According to SoSoValue, on February 14, the cumulative net inflow into funds based on the leading cryptocurrency continued for the 14th consecutive trading day, reaching $4.23 billion.

According to SoSoValue, on February 14th, the total net inflow for Bitcoin spot ETFs was $339 million, marking fourteen consecutive trading days of net inflows. Grayscale ETF GBTC experienced a net outflow of $131 million in a single day, while Invesco’s Bitcoin ETF BTCO saw a… pic.twitter.com/nu7H2pPKph

— Wu Blockchain (@WuBlockchain) February 15, 2024

According to Blockworks, Bitwise’s Chief Investment Officer Matt Hougan predicted a “secondary acceleration” of inflows into spot Bitcoin ETFs in a few months.

The specialist referred to the need for clients of RIA to free up some capital to invest in the new asset, which will take some time.

Analysts at JPMorgan have pointed out higher liquidity metrics for ETFs from BlackRock and Fidelity compared to GBTC.

Earlier, ARK Invest assessed the potential rise in the price of the leading cryptocurrency to $120,000-2,300,000 by 2030.

Experts cited drivers such as the approval of spot Bitcoin ETFs, halving, institutional adoption, and further reduction of regulatory uncertainty.

In January, Standard Chartered predicted digital gold at $200,000 following ETF approval.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!